Margin loan continues hit new record

|

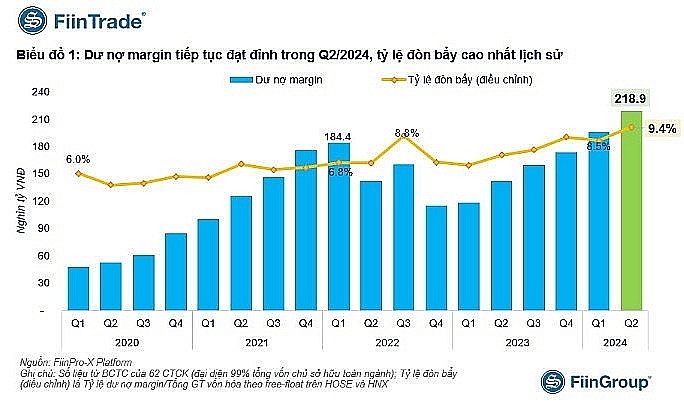

| Level of margin loan over the years according to FiinTrade statistics |

Nearly VND 220 thousand billion of loan

According to FiinTrade, a securities data analysis platform, margin loan balances at 62 securities companies (representing 99% of industry-wide equity capital) reached nearly VND 218.9 trillion (US$9.4 billion) as of June 30, 2024. This represents a 53.4% increase from the same period in 2023 and an 11.5% increase from the end of Q1 2024.

FiinTrade analysts note that this is the highest margin loan balance on record.

Interestingly, margin loan balances increased at a slower pace or even declined for securities companies with a large retail investor base, including VPS Securities, VPBank Securities, and MBS. In contrast, margin loan balances surged for companies catering to organizational customers including4 HCM .

FiinTrade's report also highlights that the leverage ratio (margin/total market capitalization) unexpectedly jumped to 9.4% at the end of Q2 2024, up from 8.5% in the previous quarter. This was driven by a slight decrease in market capitalization (calculated as the percentage of freely tradable shares to total outstanding shares) of VND 1.4 trillion (US$60 million) while margin loan balances surged by VND 22.6 trillion (US$1 billion).

The ratio of margin loan balances to average daily trading value edged up slightly to 10.4 times, but remained below levels observed during periods of high liquidity (11-12.6 times). This is primarily due to the modest improvement in liquidity, which remained largely flat in Q2.

The ratio of margin loan balances to total equity capital has increased for six consecutive quarters, reaching 0.88 times as of June 30, 2024. This is still significantly lower than the 1.2 times ratio recorded at the end of Q1 2022. This indicates that there is still considerable room for expansion in margin lending activities if only considering equity capital size.

However, meeting the margin loan balance/total equity capital ratio is just a necessary condition and a sufficient condition for securities companies to expand margin loan. According to financial statements, securities companies' equity capital is also allocated to other business segments, including proprietary trading (stocks, bonds, securities, etc.). Therefore, in reality, the headroom for equity capital to support margin lending is not substantial.

Notably, investor deposits declined for the first time after four quarters of strong growth, despite a continued increase in the number of new retail investor accounts. Specifically, investor deposits reached VND 94.1 trillion (US$4 billion) at the end of Q2 2024, down from around VND 104 trillion (US$4.5 billion) at the end of Q1 2024.

In Q2 2024, retail investors net bought VND 39.6 trillion (US$1.7 billion) on the HoSE, far exceeding the increase in margin loan balances during the same quarter (VND 22.6 trillion). Retail investors' net buying list was primarily composed of industry-leading or large-cap stocks that were under net selling pressure from foreign investors, concentrated in the Vingroup, banking, and securities sectors.

Thousand billion revenue from borrowing

Securities companies in Vietnam are reaping the benefits of a surge in margin loan balances, with revenue from lending activities soaring in the first half of 2024. TCBS Securities (TCBS) stands out as a prime example, reporting lending and receivables revenue of VND 637 billion (US$27.6 million) in Q2 2024 and VND 1,210 billion (US$52.5 million) in the first half of the year, representing increases of 60% and 80%, respectively, compared to the same period in 2023.

This impressive growth is attributed to TCBS's substantial margin loan balance, which reached VND 24,694 billion (US$1.07 billion) as of June 30, 2024, a 49% increase from the end of 2023. In particular, margin loan is VND 24,198 billion.

Rong Viet Securities also experienced strong growth in lending revenue, with VND 96 billion (US$4.1 million) in Q2 2024, up 31%, and VND 185 billion (US$8.0 million) in the first six months, up 26%. Rong Viet's margin loan balance stood at VND 3,138 billion (US$13.6 million) at the end of June 2024, a 13% increase from the end of 2023.

SSI Securities (SSI) continued its impressive performance in margin lending, generating lending and receivables revenue of nearly VND 513 billion (US$22.3 million) in Q2 2024, a 42.5% increase from the same period in the previous year. SSI's margin loan balance reached VND 19,600 billion (US$85.5 million), up 16% from Q1 2024 and 33.5% from the end of 2023, driven by positive market movements.

SSI further fueled its margin lending business by introducing attractive interest rate programs, such as "M7 - Interest Rate Only 7.99%" and "Full Year Dragon - Margin Interest Refund Up to VND 50 million," to help clients optimize their profits. For the first half of the year, SSI's margin lending revenue totaled VND 960 billion (US$42 million), up 38% from the same period in the previous year.

The trend of robust lending revenue growth extends across the securities industry. Other notable performers include FPTS Securities (VND 274 billion, up 29%), VCBS (VND 311 billion, up 61%), HSC (VND 725 billion, up 60%), and ACBS (VND 280 billion, up 110%).

Related News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Diversify and innovate securities products to attract foreign investors

15:30 | 20/10/2024 Finance

Important step to soon upgrade stock market

10:21 | 03/10/2024 Finance

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

More News

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance