Dealing with bad debts: time for ending!

|

Effective

According to the report of the Vietnam Asset Management Company (VAMC), from its establishment to the end of 31/12/2017, VAMC has purchased 26,221 debts from more than 16,200 clients at 42 credit institutions, in which the total outstanding debt was 307,932 billion VND, the debt purchasing price was 277,755 billion VND. Regarding the debt purchasing at market price, VAMC has signed contracts with 5 CIs to buy debt at market price for 6 customers with the total purchasing price of over VND 3,100 billion, reaching 100% of the plan for debt purchasing approved by SBV. Regarding debt recovery, in 2017, VAMC has cooperated with credit institutions to recover 30,700 billion VND, exceeding the 2017 plan for debt recovery allocated by the State Bank (22,000 billion), up 2.700 billion in comparison with 2016.

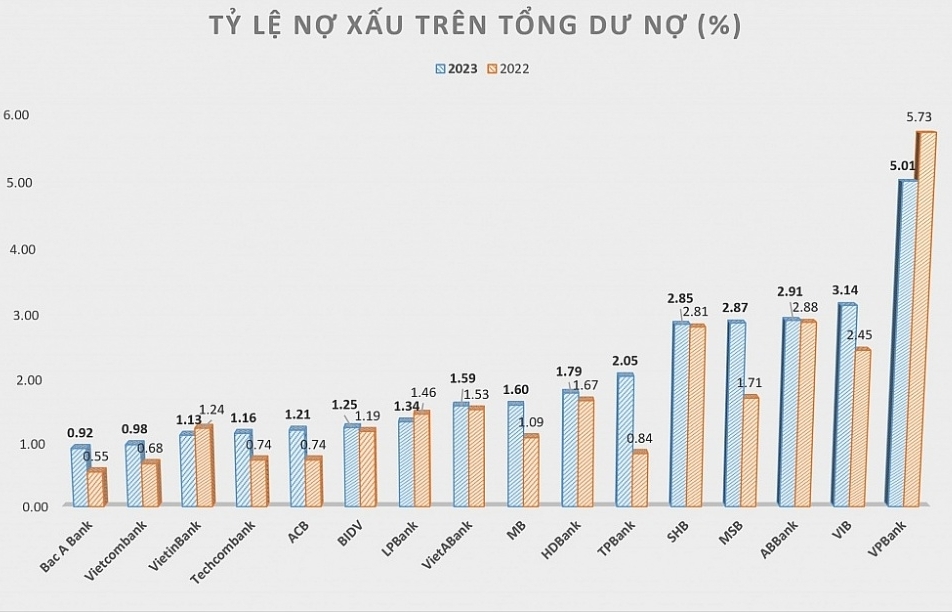

Thanks to these positive results, the NPLs ratio has now fallen to the accepted level. In the document of the latest question and answer (Q&A) session from the Prime Minister, according to the accumulated results from 2012 to the end of September 2017, the total handled bad debts was 685.3 trillion dong, bringing the bad debts to reach to 158.9 trillion, accounting for 2.34% by the end of September 2017. However, the risk of bad debts and implicit debts becoming bad debts is high (estimated at VND 558 trillion, accounting for 8.62% of the total credit outstanding balance, down from 10.08% at the end of 2016).

Therefore, experts have advised that the economic and legal policies should create favorable conditions for more effective treatment of bad debts. Recognizing this problem, the legal basis for the bad debt treatment of credit institutions in general and VAMC in particular so far is basically complete and synchronized. The National Assembly has issued Resolution No. 42/2017/QH14 on piloting settlement of bad debts to credit institutions; The Government has approved the project "Restructuring system of credit institutions in combination with NPL resolution in the 2016-2020 periods” (Decision 1058 / QD-TTg dated 19/7/2017).

According to the representative of VAMC, they have successfully carried out the debt purchasing at market price; recovery and seizure of security assets, debt auction and achieved positive results. In addition, Resolution 42 has increased the pro-activeness of credit institutions. Therefore, after a short time, 99.94% NPLs were handled by credit institutions themselves in accordance with the provisions of Resolution 42 and current legal documents, only 0.06% of NPLs were sold to VAMC.

Definitely resolve

Also in the document of the question and answer (Q&A) session, the Prime Minister has affirmed that the Government will offer many solutions to promote the economy which will contribute to control new arising bad debts to create a good business environment, create favorable conditions for enterprises and people to restore their production and business, bank loan repayments, in order to effectively deal with bad debt gradually. Therefore, with the close guidance of the Politburo, close monitoring of the National Assembly, the Government believes that in the period 2016-2020, the current bad debt situation will be definitely resolved.

Obviously, the confidence of the Prime Minister is quite well founded when the economy in general and the financial system in particular recently has many advantages. In addition to the impacts from operating policies, the CIs themselves are also active and have the conditions to control the bad debt ratio to the lowest level.

According to a report by the National Financial Supervisory Commission in 2017, the net income of credit institutions is estimated to increase 44.5% compared to 2016. ROA (return on total assets) and ROE (return on common equity) is estimated at 0.69% and 10.2% respectively (0.56% and 8.5% respectively in 2016). The Commission estimates that this rate in Vietnam has improved significantly, while almost all other countries have only slightly improved or continued to decline from 2012. Therefore, 2017 financial reports from many banks show that the profit figures are up to trillions, but bad debts have declined significantly. It is expected that in 2018, the profitability of the CI system will continue to be positive.

According to the National Financial Supervisory Commission, the cost of credit loss provision in 2017 has increased by 20.2% compared to 2016; As a result, the excess of credit loss provision has increased sharply, around 24.7% compared to the end of 2016. This is one of the favorable conditions for effectively preventing and handling NPLs.

However, a financial banking expert – Dr. Can Van Luc stated that it is necessary to create the legal basis and conditions for effective development of the debts trading market. Many domestic and foreign investors are very interested in our bad debts market; however, the underdevelopment of financial intermediaries has made it difficult for these investors to access the market. Vietnam has a lack of credit rating agencies and professional brokers.

Experts believe that the risks of bad debts are unavoidable and it is impossible to reach a 0% bad debts ratio because it is always hidden in the credits. Therefore, how to manage and deal with bad debts effectively and reasonably is the matter to be dealt with. In Vietnam, besides the important solutions such as completing legal framework, comprehensively building the debts purchasing market to attract more financial resources,... it must be synchronized with other solutions for strengthening and standardizing the accounting and financial system as well as facilitating production and business activities.

Related News

Accumulating bad debt ratio put pressure on banks

09:53 | 11/03/2024 Import-Export

The bad debt ratio has increased, putting pressure on banks

08:42 | 03/03/2024 Finance

Credit quality suffer from objective factors declining bad debt handling effectiveness

00:00 | 28/10/2023 Finance

The WB highlights a series of challenges, the banking system must enhance resilience

13:57 | 25/08/2023 Finance

Latest News

Strictly monitor market fluctuations to appropriately adjust prices

14:46 | 27/04/2024 Finance

Closely monitoring market fluctuations to consider appropriate time to adjust prices

09:30 | 26/04/2024 Finance

How does the Land Development Fund work effectively?

09:19 | 26/04/2024 Finance

Vietnam seeks to remove obstacles in upgrade of securities market

13:50 | 25/04/2024 Finance

More News

Price stability from supply increase and transparency in trading in gold market

09:42 | 25/04/2024 Finance

SBV takes more actions to stabilise foreign exchange rates

13:43 | 24/04/2024 Finance

Proposal to exclude criminal liability for tax officials when businesses provide false information to refund VAT

10:35 | 24/04/2024 Finance

Corporate bond maturity in 2024 remains high: MoF

13:51 | 23/04/2024 Finance

Support clearance procedures for imported gold for bidding

09:33 | 23/04/2024 Finance

The exchange rate will gradually cool down from the end of the second quarter of 2024, while interest rates will remain low

09:32 | 23/04/2024 Finance

Majority of credit institutions forecast profit growth in 2024

15:16 | 22/04/2024 Finance

Central bank plans to auction gold bars on April 22

18:00 | 21/04/2024 Finance

Old loans must endure higher interest rates temporarily: central bank

15:44 | 19/04/2024 Finance

Your care

Strictly monitor market fluctuations to appropriately adjust prices

14:46 | 27/04/2024 Finance

Closely monitoring market fluctuations to consider appropriate time to adjust prices

09:30 | 26/04/2024 Finance

How does the Land Development Fund work effectively?

09:19 | 26/04/2024 Finance

Vietnam seeks to remove obstacles in upgrade of securities market

13:50 | 25/04/2024 Finance

Price stability from supply increase and transparency in trading in gold market

09:42 | 25/04/2024 Finance