The exchange rate will gradually cool down from the end of the second quarter of 2024, while interest rates will remain low

| Proactive in dealing with exchange rate pressure | |

| The SBV is ready to actively use tools to ensure exchange rate stability |

|

| The seminar "Vietnam's financial market in 2023 and prospects for 2024". Photo: HD |

Bank profits will be more optimistic, increasing by 10-15%

Information at the seminar "Vietnam's financial market in 2023 and prospects for 2024" held on April 16, from the research group of the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), the Asian Development Bank (ADB) and the National Financial Supervisory Commission (NFSC), forecasted that Vietnam's GDP growth in 2024 could reach 6-6.5% (base scenario) with stronger recovery growth drivers in 2023, inflation increasing by about 3.4-3.8%, within the target of 4-4.5%.

According to Vu Nhu Thang, Deputy Chairman in charge of NFSC, the economy in 2024 has more prospects than 2023 thanks to the strong promotion of public investment and specific policies to promote production activities, consumer economy, and investment.

Along with the real economic sector, according to the expert group, Vietnam's financial sector in 2024 is forecasted to be more positive. Monetary policy is forecasted to be proactive, flexible, with interest rates remaining low to promote growth. Although the exchange rate is still under pressure before the Federal Reserve (FED) decides to reduce interest rates, it will gradually cool down from the end of the second quarter of 2024, with an increase of about 2.5-3% in 2024.

Additionally, the capital supply structure of the economy in 2024 and the following years is expected to shift more positively as the proportion of credit channels decreases, the proportion increases through the capital market channel and private investment.

Market liquidity is expected to improve positively. Credit growth is forecasted at 14-15% due to higher economic growth, low interest rates, and a better recovery in the real estate and consumer markets.

The profit growth of financial institutions in 2024 is forecasted to be higher than in 2023, due to economic recovery and higher growth; production and consumption are recovering as well as the policy of promoting consumer credit.

Specifically, bank profits are forecasted to be more optimistic, increasing by 10-15% compared to the previous year, but there is differentiation among banks depending on financial capacity, approved credit growth plans, asset quality, and service development.

Dr. Can Van Luc, Chief Economist of BIDV, said that the legal framework for the financial market continues to be improved.

Among them, the most noteworthy change is the Law on Credit Institutions (amended) officially taking effect from July 1, 2024, and other important laws such as the Land Law, Housing Law, and Real Estate Business Law taking effect from the beginning of 2025, with many important new points.

In addition, the legal framework for the stock market and insurance market will continue to be improved towards promoting safe and sustainable market operations, aiming to upgrade Vietnam's stock market in 2025.

Non-performing loans will peak in the second quarter of 2024

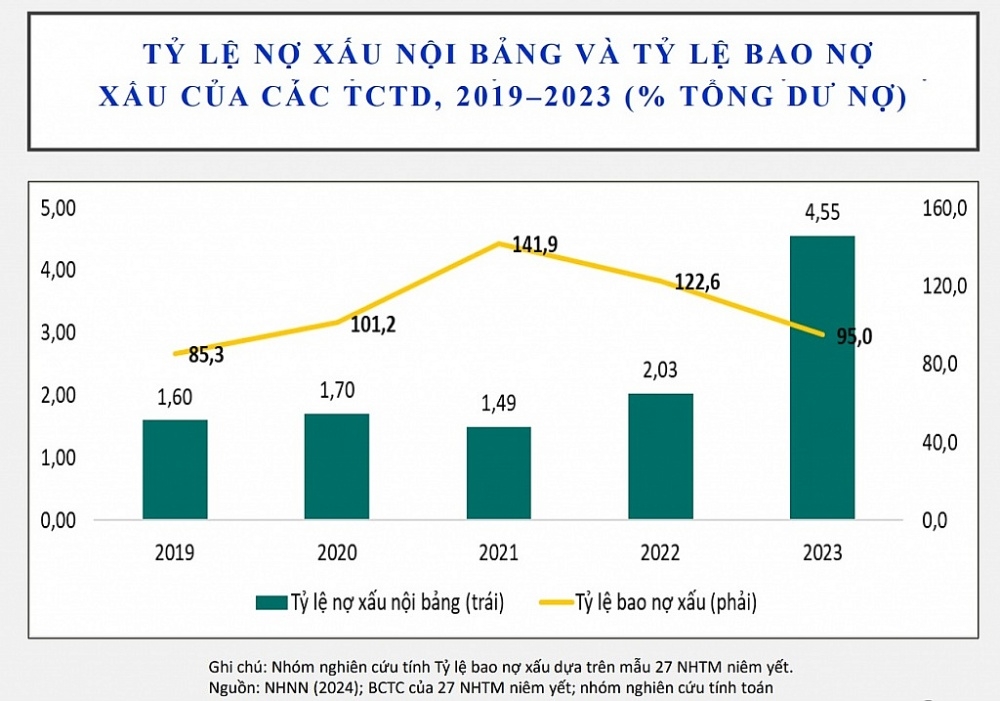

Experts also pointed out that the financial market in 2024 still had some issues to consider, such as the increasing bad debts in the first half of the year but would gradually decrease along with the economic recovery. Luc stated that the research group forecasted that bad debts of the banking system would peak in the second quarter of 2024.

|

| Source: Report on Vietnam's financial market in 2023 and prospects for 2024. |

Furthermore, the demand for and absorption capacity of capital in the economy is still weak, but credit is recovering and may increase by 14-15% throughout the year. The corporate bond market and real estate market are recovering slowly and need time to have clearer transformations. Moreover, the process of digital transformation and the trend of green growth, green finance require investment resources, institutional development, and high-quality human resources.

Regarding this issue, Vu Nhu Thang emphasized the potential interconnected risks between the real estate market and the financial market, which were still within control, along with increasing risks related to technology and cybersecurity, requiring more effective control in the future.

Therefore, to stabilize and develop the financial market, the expert group recommends focusing on removing difficulties for the corporate bond market to reduce long-term capital pressure on the banking system, realizing the plan to upgrade the stock market according to the set schedule; accelerate the process of improving management and supervision institutions of the financial market to remove current difficulties and obstacles as well as to take advantage of new trends, new opportunities in green growth, energy transformation, green finance and digital transformation, including financial technology (fintech)

In addition, experts recommended accelerating the restructuring of credit institutions, especially weak ones; speeding up the legal clearance for the real estate market to free up resources, and supporting the resolution of bad debts to strengthen the system.

Related News

Exchange rate risks need attention in near future

16:31 | 15/02/2025 Import-Export

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance