Customs sector worked closely with enterprises to overcome difficulties

| Information technology application of Customs sector will be changed | |

| Da Nang Customs has new Deputy Director | |

| Customs sector collects revenue exceeding VND200,000 billion |

|

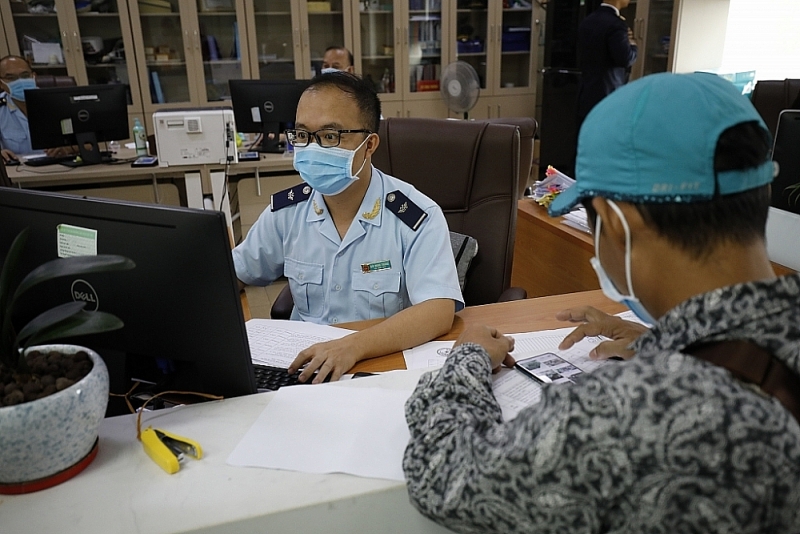

| Implementing the "dual" goal of the Customs sector is to ensure customs clearance of import and export goods and ensure pandemic prevention requirements. In the photo: An officer of MongCai Customs Branch completesprocedures for enterprises. Photo: TKTS |

Shorten and simplify procedures for businesses

In the context of the Covid-19 pandemic, for import and export activities, the Customs sector has studied and improved, shortened and simplified many procedures in the work of customs supervision and management in the direction of finding practical and appropriate solutions to create maximum advantages for businesses to overcome difficulties and stabilize production.

Accordingly, the General Department of Customs has submitted to the Ministry of Finance for promulgation Circular No. 47/2020/TT-BTC dated May 27, 2020 on the time of submission of proof of origin and forms of proof of origin.

Origin of imported goods applied during the acute respiratory infections caused by Coronavirus. The provisions of the Circular have solved problems and difficulties of enterprises in submitting original C/O due to the impact of the Covid-19 pandemic and assisted enterprises in considering special incentives do not have the original C/O, as well as prolonging the delay of submission to Customs for enterprises to enjoy special tariffs, in the context of the pandemic in some countries.

The General Department of Customs also advises, develops and submits to the Ministry of Finance for promulgation Decision No. 155/QD-BTC dated February 7,2020 and Decision No. 436/QD-BTC dated March 27, 2020 promulgating the List of goods exempt from import tax for prevention and fight against Covid-19, at the same time there is a written instruction on tax exemption dossiers and procedures, and reporting regime for tax-exempt goods.

Also according to the General Department of Customs, due to the impact of the Covid-19 pandemic, enterprises have faced difficulties in exporting types of goods stored in bonded warehouses, and business goods are tax free; during the time of storage of goods, which is limited by law, the Customs authorities and enterprises have not had a solution to handle the congested goods at the border gate closed by the foreign country, and when the partner does not accept the goods.

Facing this fact, the General Department of Customs has reported to the Ministry of Finance to submit to the Government for promulgation a resolution extending the time limit for temporary import for re-export of goods stored at duty-free shops and warehouses due to the absence of customers.

XNC cannot sell goods; the time of sending goods in bonded warehouses to enterprises is due to the fact that the counterparty cannot receive the goods because of the Covid-19 pandemic.

Accordingly, the Customs sector has applied measures to manage customs risks, thereby reducing the burden of customs procedures in the process of carrying out import and export procedures of enterprises. Customs authorities do not require customs declarants to submit paper documents of the customs as photocopies; not required to sign, stamp on these documents when sending through the system.

In addition, in the process of implementing the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the Customs authority has reduced procedures, not requiring businesses to submit proof for the case of goods.

Goods are transported in a whole container, lead from the exporting country until arriving in Vietnam; accept the master bill of lading for each leg, the secondary bill of lading if the secondary bill of lading shows the goods transported from the exporting country to the importing country.

In addition, the customs office does not impose administrative penalties for means of transport that are past the time limit for re-import and re-export as prescribed if there is a document identified in a force majeure case applied by the Government of Laos the measure of temporary suspension of entry and exit or the operator of the means of transport is subject to the measure of concentrated isolation at the time the means of transport must be re-exported or re-imported.

Support businesses to clear goods 24/7

With the solutions directed by the General Department of Customs to implement, the provincial and city customs departments have deployed many solutions to support enterprises in the customs clearance process, helping enterprises to have raw materials, materials, machinery and equipment for production activities.

In particular, at the customs departments of the provinces and cities where the international airport has cooperated with the authorities at the border gate to quickly settle the procedures, create conditions for tourists to enter or pass through the area.

Amid the Covid-19 pandemic, inbound passengers' baggage inspection channel (including same flight, carry-on baggage); ensure that the number of masks and equipment for disease prevention on flights is fast and smooth.

In particular, the Customs agency has implemented many solutions to promote the export of Vietnamese agricultural products, coordinate to resolve agricultural products congestion, congestion and direct the facilitation in importing components, raw materials and machines for production.

Practically helping businesses overcome the impact of the Covid-19 pandemic, the customs departments of provinces and cities also promote the application of information technology in the settlement of customs procedures, maintain good implementation of declarations and customs clearance online, increasing the number of records to be resolved through online public services.

At concentrated inspection locations, the customs office applies goods inspection (container screening) 24/7 according to the needs of enterprises. In particular, the customs sub-departments regularly arrange officers on duty outside office hours to handle customs procedures for businesses.

For enterprises that have suspended operations and operated moderately due to the Covid-19 pandemic, the customs departments often hold information and keeps in touch with enterprises in the area to remove difficulties arising and providing the support solutions.

At the same time, strengthening to answer questions about customs procedures for businesses through the industry's portal; receive and quickly settle tax refund and tax exemption dossiers, helping enterprises have conditions for re-investment and boost production and business.

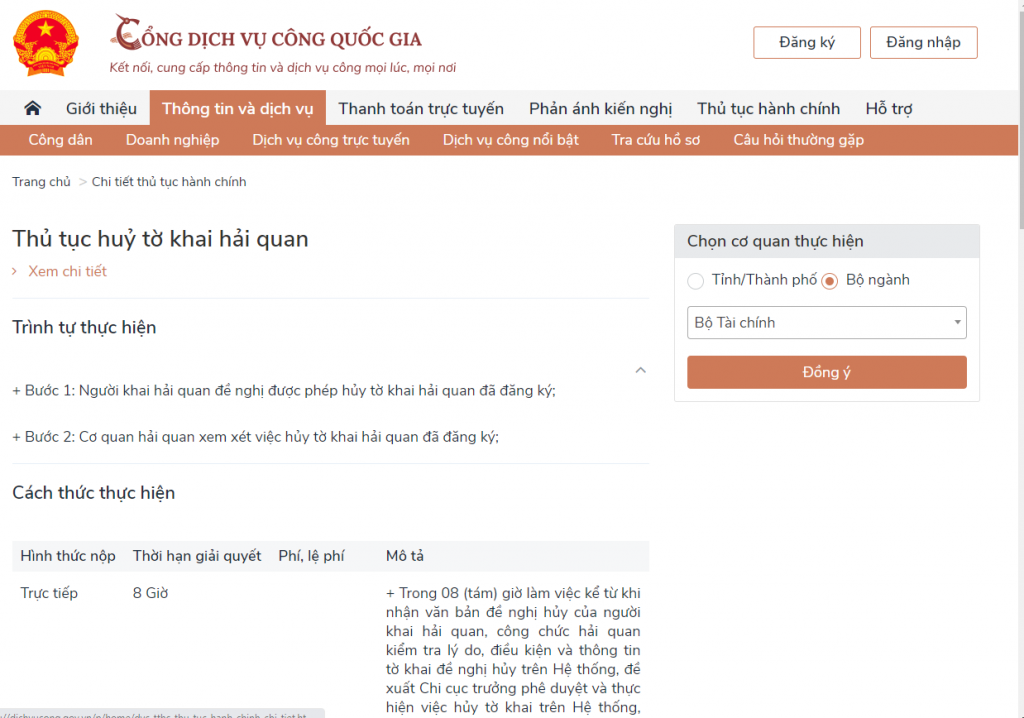

| Customs sector strengthens connection to National Public Service Portal VCN- Following the direction of the Government and the Ministry of Finance, the General Department of ... |

Regarding the proposals of enterprises beyond their authority, the customs departments of the provinces and cities actively reported and proposed the extension of tax payment time for enterprises facing difficulties due to the impact of the Covid-19 pandemic.

Related News

Researching and proposing amendments to 2014 Customs Law to meet the requirements of innovation

11:18 | 20/01/2025 Customs

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Enterprises focus on Tet care for employees

18:59 | 22/12/2024 Headlines

Customs sector deploys work in 2025

16:43 | 17/12/2024 Customs

Latest News

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

More News

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export

Rice export prices drop, but decline expected to be short-term

08:10 | 17/02/2025 Import-Export

Key agro products expected to maintain export growth this year

08:08 | 17/02/2025 Import-Export

EU issues 12 warnings against Việt Nam’s food and agricultural exports

08:07 | 17/02/2025 Import-Export

Việt Nam to impose VAT on low-value express-imported goods

08:06 | 17/02/2025 Import-Export

Exchange rate risks need attention in near future

16:31 | 15/02/2025 Import-Export

Vietnam kicked off the year with a strong start in trade, exceeding US$63 billion in the first month

16:30 | 15/02/2025 Import-Export

Import and export turnover reaches about US$29 billion in the second half of January 2025

14:52 | 14/02/2025 Import-Export

Market edges up slightly as liquidity remains low

14:48 | 14/02/2025 Import-Export

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export