Customs authority determines to strictly control exported limestone

|

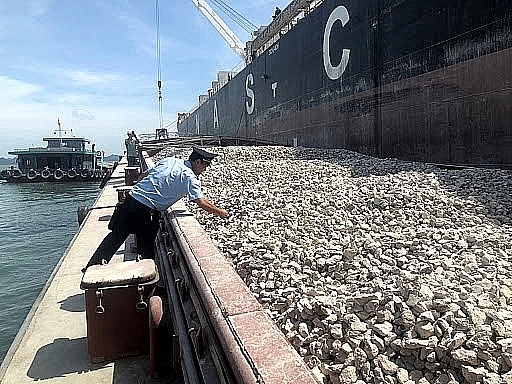

| Customs officials of Cam Pha port Customs Branch conduct inspection for limestone at Hon Net area (Cam Pha City). |

Review classification

Recently, several enterprises reported there were a number of export enterprises declared as construction stones derived from limestone, with declaration code 2517.49.00.30 and export tariff rate of 15%. However, the stone products of these enterprises were limestone with CaCO3 content> 85%, so per Point g, Clause 1, Article 64 of the Mineral Law and the National Standard TCVN 6072: 2013, this item must be applied with the HS code 2521.00.00 and export tariff rate of 17%.

To fight tax loss, ensure equality in business and strictly enforce the Law on Minerals, after considering and basing on the provisions of law on minerals, the provisions on commodity classification, on December 22, 2020, the General Department of Vietnam Customs issued Official Letter 8019/TCHQ-TXNK on the classification of stone products.

The General Department of Vietnam Customs requested provincial customs departments review and classify export items as limestone, calcium-containing stone (except limestone, white limestone and white marble), meeting national standard TCVN 6072: 2013 is in heading 25.21 and check export declarations and export dossiers for items declared as limestone, calcium-containing stone and construction stone meeting the national standard TCVN 6072: 2013 but has not classified under heading 25.21 stated in Point 1 of Official Dispatch No. 8019/TCHQ-TXNK to classify and apply tax rates, fully collect taxes and sanction.

After the General Department of Vietnam Customs issued a document on the above classification, several export enterprises that declared as construction stone originating from limestone issued a petition for the use of Point g, Clause 1, Article 64 of the Law on Minerals are incomplete.

The enterprises believed the exported stone products qualify as raw materials for Portland cement production in accordance with Vietnamese standards but are not eligible as raw materials for the production of paving stones and art stones in Vietnam, the item which is in the list of minerals as a common material.

However, based on the content agreed between the General Department of Vietnam Customs, the Department of Building Materials (the Ministry of Construction) and the Vietnam Institute of Standards and Quality (General Department of Standards, Metrology and Quality) - the Ministry of Science and Technology) and the results of the control showed the petition of “The application of point g, Clause 1, Article 64 of the Law on Minerals is incomplete by a number of export enterprises declared as construction stone derived from the limestone” is ungrounded.

At a meeting held on the afternoon of December 30, between the leaders of the General Department of Vietnam Customs and representatives of the Building Materials Department (the authority formulating regulations, guides on the export of minerals as building materials) and representatives of the Institute Vietnam Quality Standard (the appraisal unit of Vietnam Standard TCVN 6072: 2013 on limestone for production of Portland cement clinker), the representatives of the units agreed and gave opinions on point g, Clause 1 Article 64 of the Law on Minerals stipulates.

At the same time, the General Department of Vietnam Customs checked some export documents provided by Quang Ninh Customs Department on the petition of enterprises, these items were declared construction stone originating from limestone, do not declare the content of CaCO3 and MgCO3, but on the invoice and the contract, the item has a trade name of limestone. The General Department of Vietnam Customs also collected some other documents of enterprises like the Certificate of Origin (C/O) issued by Vietnam, the export products of enterprises all have trade names such as limestone, HS code 2521.

Also based on the inspection results issued on December 25, 2020 of the branch of FCC Inspection and Disinfection Joint Stock Company in Hai Phong, announced the analysis results of the samples in the two above declarations were stone originating from limestone containing calcium carbonate (CaC03) more than 85% and magnesium carbonate (MgC03) below 7%, HS code number 2521.00.00 (an export tax rate of 17%). Therefore, the limestone product meets TCVN 6072: 2013 on limestone as raw materials for the production of Portland cement clinker (National standard TCVN 6072: 2013 on limestone for the production of Portland cement clinker is not on the list of minerals as common building materials). At the same time, the determination of limestone as raw materials for Portland cement production still applies TCVN 6072: 2013, with no additional or replacement standards.

Not considering settlement of limestone shipments at the border gate

According to the General Department of Vietnam Customs, Clause 1, Article 82 of the Law on Minerals clearly stipulates the competence to grant mineral exploration licenses and mineral exploitation licenses. The Ministry of Natural Resources and Environment has competence to grant mineral exploration licenses and mineral exploitation permits for minerals not included in Clause 2, Article 82 of the Law on Minerals.

Also in Point g, Clause 1, Article 64 of the Law on Minerals stipulates that the mining of minerals as common building materials and limestone meets the national standard TCVN 6072: 2013 on limestone for the production of Portland cement clinker that are not on the list of minerals as common building materials and the Ministry of Natural Resources and Environment is the authority to issue permits to exploit limestone products as raw materials for Portland cement production.

Also in Clause 4, Article 2 of Circular 05/2018/TT-BXD dated June 29, 2018 of the Ministry of Construction guiding exports of minerals as building materials, the limestone item meets national standard TCVN 6072: In 2013, limestone for the production of Portland cement clinker must have legal origin in accordance with the provisions of the mineral law (allowed to be mined from mines licensed by the Ministry of Natural Resources and Environment).

After the inspection, the General Department of Vietnam Customs found the export consignments of enterprises are currently declared as construction stone with code HS 2517 49 00. This case is identified as minerals as common construction materials in accordance with Article 64 of the Law on Minerals and licensed by the provincial People's Committee for exploration and exploitation in accordance with the provisions of Article 82 of the Law on Minerals.

After being requested to inspect and review, Quang Ninh Customs Department said the shipments of limestone for exporting were being kept at the border gate originated from mines licensed by the provincial People's Committee.

Compared to the instructions in Official Letter 8019/TCHQ-TXNK of the General Department of Vietnam Customs on the classification of stone and limestone items on export declarations to meet the National Standard TCVN 6072: 2013 on limestone for serving to produce Portland cement clinker in heading 2521 and must be exploited from mines licensed by the Ministry of Natural Resources and Environment for exploring and exploiting under the provisions of Article 82 of the Law on Minerals.

“Therefore, the consignments of limestone for exporting being stored at the border gate originating from mines licensed by the Provincial People's Committee were not in compliance with the provisions of Article 82 of Law on Minerals, so they have not been considered for clearance yet,” the General Department of Vietnam Customs said.

Related News

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Checking and reviewing the classification of exported copper

09:37 | 10/10/2024 Regulations

Vietnam Customs proactively participate in negotiation and develop AHTN Nomenclature

10:02 | 13/06/2024 Customs

Latest News

An Giang Customs Department escalates multiple tax fraud cases to law enforcement

16:30 | 15/02/2025 Anti-Smuggling

Customs crackdown nets 1,430 violations in first month

14:50 | 14/02/2025 Anti-Smuggling

Customs administrations coordinate to seize nearly 20,000 endangered wildlife

09:15 | 14/02/2025 Anti-Smuggling

An Giang Customs strictly controls goods moving across the border

08:45 | 09/02/2025 Anti-Smuggling

More News

Remodel cars to hide drugs

20:47 | 30/01/2025 Anti-Smuggling

Illegal transportation of gemstones by air to handled

18:36 | 28/01/2025 Anti-Smuggling

Routine security screening uncovers hidden weapons at point of entry

20:30 | 25/01/2025 Anti-Smuggling

Strictly handling illegal transportation of gemstones by air

14:16 | 21/01/2025 Anti-Smuggling

Nearly 18,000 cases of smuggling, trade fraud and counterfeit goods detected

20:58 | 05/01/2025 Anti-Smuggling

Customs seizes smuggled goods and infringing products worth VND31,000 billion

06:36 | 05/01/2025 Anti-Smuggling

India launches anti-dumping investigation on nylon yarn imports from Việt Nam

13:32 | 01/01/2025 Anti-Smuggling

Hanoi Customs: 92% of post-clearance audits reveal violations

07:53 | 31/12/2024 Anti-Smuggling

Noi Bai International Border Gate Customs Sub-department: "Blocking" drugs via air

07:42 | 31/12/2024 Anti-Smuggling

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

An Giang Customs Department escalates multiple tax fraud cases to law enforcement

16:30 | 15/02/2025 Anti-Smuggling

Customs crackdown nets 1,430 violations in first month

14:50 | 14/02/2025 Anti-Smuggling

Customs administrations coordinate to seize nearly 20,000 endangered wildlife

09:15 | 14/02/2025 Anti-Smuggling

An Giang Customs strictly controls goods moving across the border

08:45 | 09/02/2025 Anti-Smuggling

Remodel cars to hide drugs

20:47 | 30/01/2025 Anti-Smuggling