Covid-19 polarizes the packaging industry

|

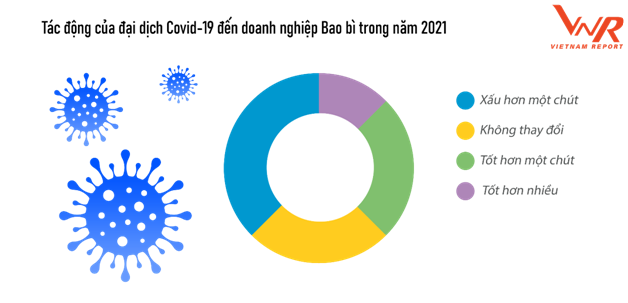

| Impact of the Covid-19 pandemic on Packaging businesses in 2021. Source: Vietnam Report |

Strong polarization

According to FiinGroup, in the 2015-2020 period, the packaging field is one of the fastest-growing fields in the Vietnamese market with a growth rate of 13.4% per year. However, the majority of sales revenue belongs to the segment of plastic packaging, paper packaging and cartons with over 80%, the rest belongs to the segments of paper and cardboard, plastic, metal, glass, wood, textiles and other suitable materials such as foam, leather, etc.

Since the beginning of 2020, the Covid-19 pandemic has had both positive and negative impacts on the packaging industry. In terms of product groups, the demand for packaging for pharmaceuticals, foodstuffs, disinfectant labels, soaps, detergents and hand sanitizers increased while the demand for packaging for luxury and industrial products tends to decrease.

In terms of material properties, soft packaging for food accounts for a high proportion and has good growth. Rigid plastic packaging has grown well in the food and beverage sector, but faced difficulties in the field of packaging of industrial plastic, makeup, cosmetics and consumer goods.

In addition, the segment of packaging paper, paper boxes and cartons experienced strong growth due to the demand for packaging ancillary products, serving online sales and direct distribution, and growing export activities, especially in industries with a high proportion of exports such as textiles and garments, footwear, seafood, components and electronic equipment.

Metal packaging also recorded positive results as consumers turned to long-term food storage as a result of the pandemic. Glass packaging was impacted by hotel and restaurant closures and was only offset to some extent by higher retail sales of beverages. In the high-end segment, glass packaging was affected by a large decline in demand from the cosmetics industry such as perfumery.

However, no matter which segment, the profit margin of packaging businesses has decreased sharply. This is because packaging materials are mainly imported and account for 60%-70% of the cost, so when the Covid-19 pandemic broke out, the supply chain was disrupted, raw materials were in short supply, raw material prices were high, resulting in increased costs, narrowing profit margins.

The survey results of Vietnam Report show that, out of 16 listed packaging enterprises, there are 15 enterprises with revenue growth in the first nine months of 2021 compared to the same period, but only seven enterprises have increased profits.

Opportunities

Experts say that, in 2022 and the following years, opportunities will continue to open up for industries that use a lot of packaging such as agriculture, forestry, fishery, processing industry, when the EVFTA, the CPTPP, the RCEP are signed and put into effect.

|

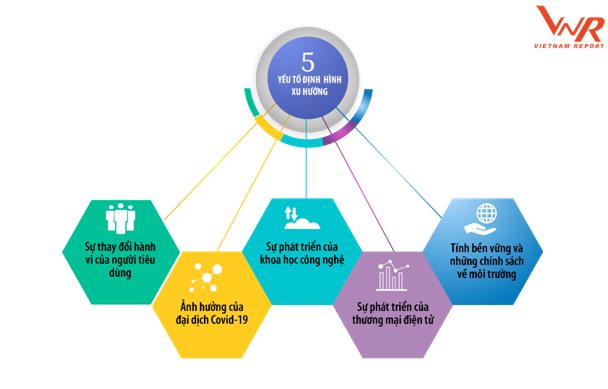

| Five factors shape the packaging industry's trends in the next period. Source: Vietnam Report |

The survey results of Vietnam Report show that, in 2022, the export market of food - beverages, electronics, pharmaceuticals, cement packaging will continue to grow.

The pharmaceutical sector is forecast to grow packaged sales at the fastest rate, followed by electronics and food and beverage. In the industrial sector, intermediate bulk container (IBC) sales are expected to accelerate as demand for plastic and steel drums increases due to their durability and reusability.

Preliminary statistics of Vietnam Report show that, in Vietnam, food packaging accounts for 30%-50%; electricity - electronics account for 5%-10%; pharmaceutical chemicals from 5%-10%.

The development of the food industry is the driving force behind packaging, which always achieves an average growth rate of 15% -20% per year, plastic packaging alone has achieved a growth rate of 25% per year and accounted for the highest proportion of revenue in the structure of the plastic industry (38% - 39%).

Worldwide, industrial and shipping are the largest final packaging applications, accounting for 41.6% of sales in 2020, followed by food with 29.6% and beverages with 13.9%.

However, the Vietnam Report survey also shows that polarization continues to happen and opportunities are only available to businesses that can adapt due to the five variables that have the most influence on the performance of packaging businesses, including: change in consumer behavior; fluctuations in prices and sources of raw materials and additives; competitive pressure from domestic and foreign enterprises; resilience of the economy; the increase in investment, technological innovation and improved production processes.

Therefore, in the five solutions that need attention, including increasing investment in technology, digitizing business operations; strengthening financial and supply chain risk management measures; training and developing high-quality human resources, adapting to digital transformation; expanding the market, promoting marketing activities; implementing strategies for sustainable development and environmental protection.

In addition to prioritizing the enhancement of digitization of operations (almost 80% of businesses), businesses need to pay more attention to implementing sustainable development strategies (40% of businesses), manufacturing environmentally friendly products to enhance the brand value of enterprises (sustainable development) on the one hand, and on the other hand, together with the Government to fulfill its commitment to minimize negative impacts on the environment, saving energy, towards building a greener and cleaner planet.

Related News

Customs focuses on promoting the digitization of documents handling administrative procedures

16:25 | 07/05/2024 Customs

Opportunity for Vietnamese goods as Switzerland scraps tariff on industrial product imports

14:09 | 18/01/2024 Import-Export

Exports of processed industrial products continued to decline sharply

09:08 | 14/05/2023 Import-Export

COVID-19 drug-related trafficking prosecuted

09:23 | 30/03/2023 Anti-Smuggling

Latest News

VN faced with increasing trade defence investigations on rising protectionism

18:58 | 22/12/2024 Import-Export

Việt Nam expects to officially export passion fruit to the US next year

18:55 | 22/12/2024 Import-Export

UK’s carbon tax to affect VN exports

18:51 | 22/12/2024 Import-Export

Removing obstacles in granting certificates of exploited aquatic products

13:56 | 22/12/2024 Import-Export

More News

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export

Agricultural exports in 2024 to exceed 60 billion USD?

13:53 | 22/12/2024 Import-Export

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export

Binh Dinh province works to attract investment from Japan

15:44 | 19/12/2024 Import-Export

Agricultural, forestry and fishery exports “reach the target” early

15:20 | 19/12/2024 Import-Export

Your care

VN faced with increasing trade defence investigations on rising protectionism

18:58 | 22/12/2024 Import-Export

Việt Nam expects to officially export passion fruit to the US next year

18:55 | 22/12/2024 Import-Export

UK’s carbon tax to affect VN exports

18:51 | 22/12/2024 Import-Export

Removing obstacles in granting certificates of exploited aquatic products

13:56 | 22/12/2024 Import-Export

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export