Corporate bond market is expected to prosper soon

| Managing corporate bond market to develop sustainably | |

| Continue to improve policy mechanisms to develop the corporate bond market |

|

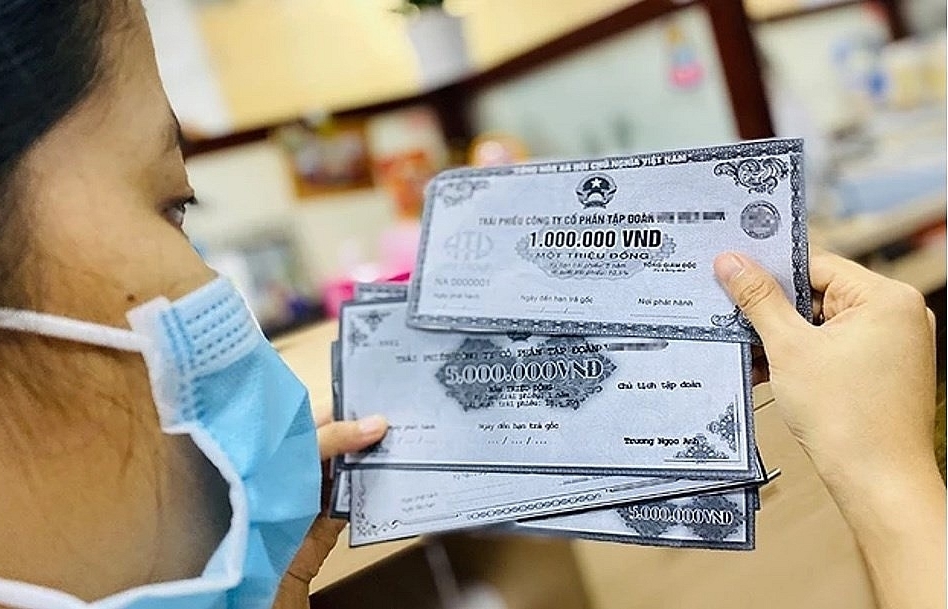

| It is expected that the insurance market will promote its development potential in the coming time. Photo: Internet. |

The corporate bond market recovered strongly in the second half of the year

In 2023, the corporate bond market faced many difficulties due to the incidents in the financial market in October 2022 and bad developments in the domestic and global financial markets. Responding to this situation, the Government has drastically directed sectors related to the market such as completing legal frame work, maintaining macroeconomic stability and improving the business production environment.

Mr. Nguyen Hoang Duong, Deputy Director of the Department of Banking and Financial Institutions (Ministry of Finance) said that the prompt promulgation of the Government Decree 08/2023/ND-CP and the allowance for enterprises and investors to negotiate, defer, postpone and exchange issued bonds in the spirit of shared risks and harmonious benefits among parties have helped the market see positive signs.

If in the first quarter of 2023 there were almost no issuances, from the second quarter onwards, businesses have returned to issue bonds, the volume issued next month was higher than the previous month.

Ms. Nguyen Ngoc Anh, General Director of SSI Fund Management Company, said that from the end of 2022, all market members voiced concern about the development of the corporate bond market in 2023, however at this current date the market has seen the stable operation. According to Anh, the along with the drastic promulgation of Decree 08/ND-CP, the operation of the secondary private placement corporate bond exchange has rebuilt investor confidence in the market.

According to the assessment of experts of Fiin Group, corporate bond issuance activities on the primary market in the second half of the year saw a strong recovery.

Mr. Tran Phu Viet, Head of Research and Product Development, Financial Information Division (FiinGroup) said that the issuance value in the third quarter of 2023 and the first half of the fourth quarter reached VND 161,000 billion or 70% of total issuance value from the beginning of 2023. In the third quarter of 2023 alone, the issuance value on the primary market increased by 180% year-on-year.

On the secondary market, issuance activities have has become much more exciting since the launch of the private placement corporate bond exchange in mid-July, the total transaction value on the secondary market has seen the strong growth. According to statistics, the average daily transaction value surged, especially in mid-October, the value increased about VND1,000-2,000 billion/session.

The market is expected to surge

According to Ms. Nguyen Ngoc Anh, the operation of the private placement corporate bond market plays an important role in creating liquidity and transparency to the market, especially for individual investors. Through the current centralized bond market, investors have rights and ability to fully access all information and have a market for buying and selling. “The end of 2023 is also the time when we see that a very difficult year has passed and this is actually an opportunity and a premise for outstanding growth in the market in 2024” Anh said.

Commenting on the prospects of the corporate bond market in 2024, experts of VIS Credit Rating Company Ltd expect that the corporate bond market in 2024 will enter a new stage of development in a stricter direction with the application of stricter requirements. Higher demand for all parties, thereby helping new bond issuance activities gradually recover.

Meanwhile, Mr. Tran Phu Viet said that the market shows key positive factors. The first positive sign is that the corporate bond market has seen stronger development after the purification period. Accordingly, events in the period 2022-2023 have helped the market classify groups of issuers under different risk levels. Enterprises with a history of paying principal and interest on corporate bonds will be the bright spot of the market, attracting investors.

The transparent information about corporate bonds is also another positive point. The establishment and operation of private placement corporate bond exchange helps investors better grasp information about bond transactions on the secondary market, especially data related to the investment yield of each bond code. This is the basis for building information about the yield curve of issuers and issuers groups.

Fiin Group experts said that credit rating activities with the participation of many rating units in 2024 will provide more information and selection for investors. “On November 28, during a meeting to collect opinions to evaluate the implementation of Decree No. 08/2023/ND-CP and policy orientation in the coming time, the Ministry of Finance proposed not to extend the deadline for suspension of mandatory credit rating regulations for privately placed corporate bonds. From January 1, 2024, issuers are required to have credit ratings, this is also an advantage to help investors have more safe disbursement options," Mr. Tran Phu Viet said.

In the long term, Fiin Group experts also recommended that the business environment may continue to be difficult, leading to the business prospects of issuers, especially in the real estate and renewable energy industries that do not enough cash flow to pay principal and interest on bonds due in the near future. Therefore, the market still needs a long time to completely recover as well as demonstrate the positive role of safe and transparent capital channels for investors to return to the market.

| According the Ministry of Finance, in the first 11 months of 2023, 77 enterprises issued bonds worth about VND220,000 billion. Of which, the number of bonds issued since Decree 08/2023/ND-CP took effect is valued at VND213.5 trillion. |

Related News

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

The corporate bond market will be more vibrant in the second half of the year

08:20 | 23/07/2024 Finance

The corporate bond market will enter new period of development

08:44 | 03/03/2024 Finance

Removing 5 barriers to promote the corporate bond market

09:51 | 18/12/2023 Finance

Latest News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

More News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance