Continue to improve policy mechanisms to develop the corporate bond market

| Corporate bond market hoped to develop sustainably | |

| Managing corporate bond market to develop sustainably |

|

| Deputy Minister of Finance Nguyen Duc Chi chaired the meeting |

Resolve difficulties promptly

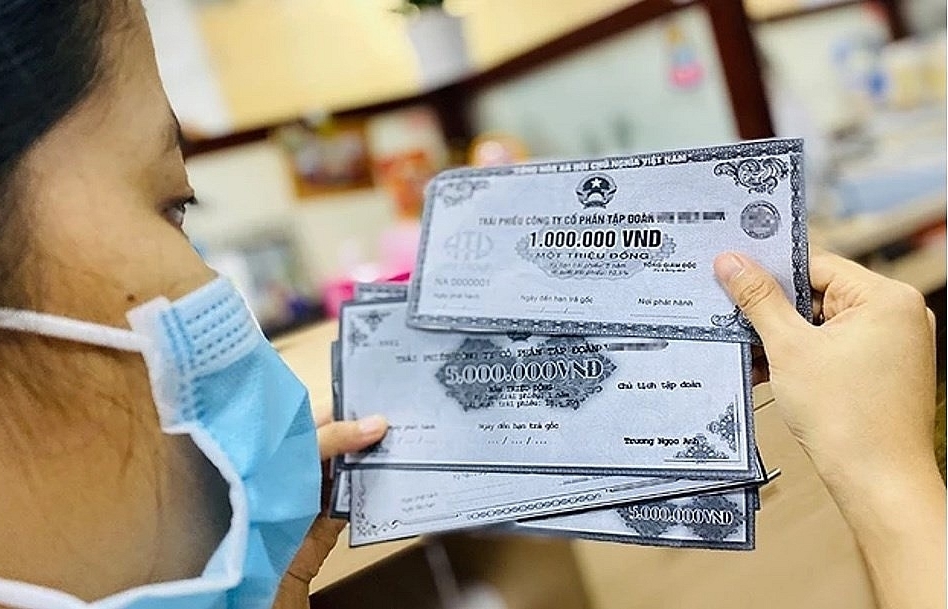

According to reports from units, after the incident of SCB Bank and Van Thinh Phat Group, the corporate bond market fluctuated strongly, investors lost confidence and required businesses to buy back bonds before maturity, businesses have difficulty issuing new bonds. At the same time, the macro economy, domestic and foreign financial markets are complicated, interest rates are increasing, and the economy's liquidity is facing difficulties.

Faced with that situation, the Government issued Decree No. 08/2023/ND-CP (Decree 08) postponing some regulations in Decree No. 65/2022/ND-CP (Decree 65) until December 31, 2023 to neutralize the legitimate interests of issuing businesses and investors buying bonds in the spirit of "harmonious benefits, shared difficulties", supporting bond-issuing businesses to mobilize capital, pay due debt obligations to investors and continue production and business activities.

At the meeting, Mr. Nguyen Hoang Duong, Deputy Director of the Department of Finance of Banks and Financial Institutions (Ministry of Finance), said that in recent times, the Ministry of Finance has proactively deployed solutions to stabilize the market. In addition to submitting to the Government for promulgation of Decree 08, the Ministry of Finance regularly monitors and urges businesses to pay bond debt; Strengthen inspection, supervision, correction and handling of violations. Communication work has also been enhanced to restore investor confidence. Thanks to that, from the second quarter of 2023 until now, the market has gradually stabilized.

Discuss the provisions in Decree 08 on payment of principal and interest on bonds using other assets and that effective bonds issued before Decree 65 are negotiated to extend the maximum term to no more than 2 years, representative of the Department of Finance of banks and financial institutions said that according to the provisions of Decree 08, these policies will continue to be implemented in the coming time.

According to the assessment of the management agency, recently, businesses have had difficulty with liquidity, leading to the possibility of delay in payment of principal and interest on corporate bonds. They have actively negotiated with investors to pay principal and interest on bonds with other assets (mainly real estate products), extending the bond term or changing other conditions and terms of the bond (changes in time, method, frequency of principal and interest bond payments). Up to now, many businesses that are slow to pay have had plans to negotiate with investors.

This policy in Decree 08 is one of the legal bases for businesses to negotiate with investors to restructure bond debt, reduce debt repayment pressure, thereby giving businesses time to adjust their operating scale, restoring production and business to create cash flow to repay debt.

Do not extend the validity of some regulations

At the meeting, there were 13 comments from ministries, central agencies, and associations sent to the Ministry of Finance on issues such as identifying professional securities investors and mandatory credit rating regulations, regulations to reduce bond distribution time, etc. Most opinions agree with the proposal of the Ministry of Finance that it is not necessary to extend the period of suspension of regulations enforcement on identifying professional securities investor as an individual who buys corporate bonds individually.

|

| Deputy Minister of Finance Nguyen Duc Chi. |

Up to now, after more than 8 months of implementing Decree 08, professional securities investors who are individuals have accumulated enough time of 180 days to meet the regulations for professional securities investors in Decree 65, so it is not necessary to extend the period of suspension of this regulation’s enforcement.

Regarding the policy of suspending the enforcement of credit rating regulations, the Ministry of Finance also proposed not to extend the suspension period of mandatory credit rating regulations for individual corporate bonds. In the context of businesses having difficulty mobilizing capital to serve production and business activities, performing credit ratings takes a certain amount of time and increases the issuance costs of the business, in addition, at that time there were only 2 licensed credit rating businesses in the market, so Decree 08 stipulated to stop implementing regulations on credit ratings for individual corporate bonds until December 31, 2023.

From January 1, 2023, corporate bonds offered for public sale have implemented regulations on credit ratings for offerings that require credit ratings. Businesses going public in 2023 are not subject to mandatory credit ratings. For private placement, from the time Decree 08 takes effect until November 3, 2023, if the provisions of Decree 65 are applied, there will be few businesses that are required to have credit ratings according to regulations.

Thus, according to the provisions of Decree 65, similar to bonds issued to the public, only in some cases that meet all conditions, a credit rating is required, so the number of issuances with a cradit rating is limited. Therefore, continuing to implement regulations in Decree 65 will not have any problems.

Currently, the Ministry of Finance has also licensed one more enterprise, the total number of enterprises that can provide credit rating services is 3 out of the maximum allowed number of 5 credit rating enterprises, in which there is an enterprise that has a joint venture with an international credit rating organization.

At the meeting, the Ministry of Finance also said that it is not necessary to extend the period of suspension of regulations enforcement on reducing bond distribution time. Decree 65 stipulates that the bond distribution time of each offering does not exceed 30 days (the previous regulation in Decree No. 153 was 90 days, similar to corporate bonds offered to the public). The goal of this regulation is to limit businesses from taking advantage of the long bond distribution period and inviting small individual investors who are not professional securities investors to buy bonds.

To contribute to supporting businesses in balancing and mobilizing resources to pay due debt obligations, Decree 08 stipulates to suspend the implementation of regulations on reducing bond distribution time until December 31, 2023.

Until now, market liquidity has stabilized. To limit risks to the corporate bond market, limit the situation where businesses take advantage of distribution and invite small individual investors who are not professional securities investors to participate in buying bonds, it is not necessary to extend period of suspension of this regulation’s enforcement.

Proposing a series of solutions towards sustainable development of the corporate bond market

Speaking at the meeting, Deputy Minister of Finance Nguyen Duc Chi said that the Ministry of Finance will absorb both opinions related to the above proposals and consider carefully to come up with appropriate plans with the actual situation.

Deputy Minister Nguyen Duc Chi emphasized that for opinions related to technical issues, the Ministry of Finance will assign relevant units to research and have clear regulations to propose to the Government, aiming to continue to stabilize and develop the market. The Ministry of Finance will try to build a sustainable development of the bond market in general and individual corporate bonds in particular.

To continue to stabilize and develop the corporate bond market, the Ministry of Finance has reported to the Government Leaders a comprehensive series of solutions. Regarding solutions on mechanisms and policies in the medium and long term, the Ministry of Finance has reported to the Government Leaders for an overall review, research and report to competent authorities to amend regulations on private corporate bond issuance and related people (in the Securities Law, Enterprise Law and related laws).

In case of necessity, propose competent authorities to promulgate Laws amending and supplementing a number of provisions to promptly handle legal problems in the corporate bond market. Simultaneously, review, complete and improve the effectiveness of implementing legal regulations on corporate bankruptcy so that businesses have enough procedures to carry out bankruptcy in an orderly manner. Along with that, the Ministry of Construction researches and submits to competent authorities to supplement regulations on financial safety indicators in the fields of construction and real estate.

Related News

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

The corporate bond market will be more vibrant in the second half of the year

08:20 | 23/07/2024 Finance

The corporate bond market will enter new period of development

08:44 | 03/03/2024 Finance

Corporate bond market is expected to prosper soon

10:59 | 10/01/2024 Finance

Latest News

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

More News

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Your care

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance