Corporate bond market hoped to develop sustainably

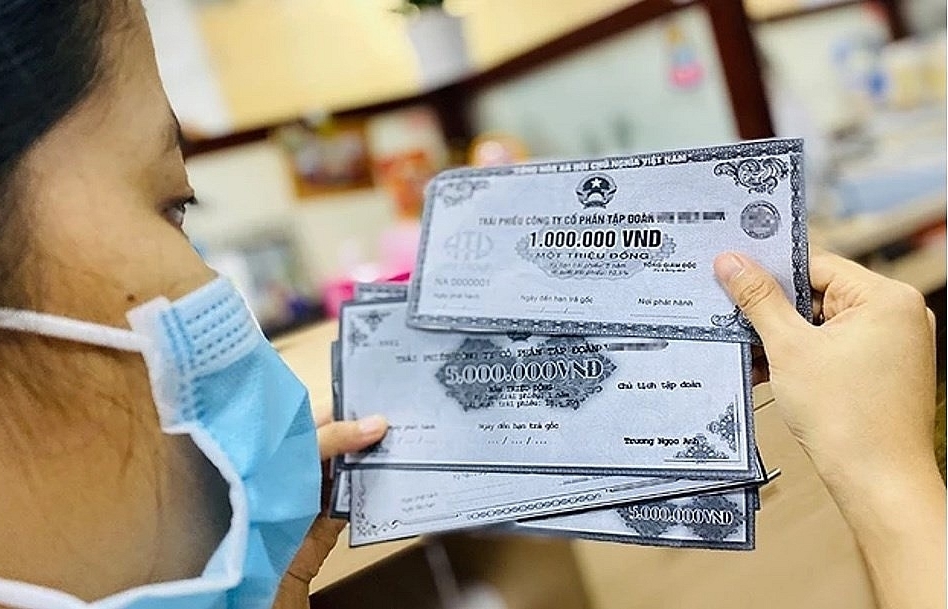

The outstanding value of Vietnam's corporate bond market is currently equivalent to more than 15% of the GDP. (Photo: VNA)

Following the recent launch of the privately-placed corporate bond trading system, Minister of Finance Ho Duc Phoc has said if transparency and safety are ensured, privately-placed corporate bonds will effectively prove their role in mobilizing capital for businesses.

He said the launch of this system reflects his ministry’s strong determination to develop the financial and stock markets. The system will help State agencies better manage the bond market while people can engage in supervision, thus improving market transparency.

On July 19 – the opening day of the system, 19 privately-placed corporate bonds had their registrations approved and were offered for transaction. Four bonds with more than 5 million units worth over 1.78 trillion VND (74.9 million USD) were traded.

Phoc considered this as a good sign, saying if transparency and safety are ensured, privately-placed corporate bonds are completely able to bring into play their role in mobilizing capital for businesses.

According to the Finance Ministry, the corporate bond market of Vietnam remains relatively modest compared to others in the region. Its outstanding value is currently equivalent to more than 15% of the GDP, which is targeted at 20% by 2025 and at least 25% by 2030 under the financial strategy.

The minister noted the corporate bond market has developed rather positively over the past years. A legal framework has been basically built to facilitate this market’s development and assist businesses to raise funding for their operation.

However, the market’s quality has yet to match its fast growth. Some risks have appeared and need precise assessment to devise appropriate solutions to help the market develop in the right direction and in a safe and sustainable manner.

Therefore, a legal framework and policies for the market are gradually taking shape through the issuance of laws, decrees, and circulars, Phoc went on.

On March 5, the Government released a decree which amended and supplemented some regulations of the previous ones on privately-placed corporate bonds. The new document aims to create a legal corridor for tackling certain short-term difficulties for businesses and, at the same time, guarantee investors’ rights and interests.

According to the Vietnam Bond Market Association, almost no businesses issued bonds in the market in late 2022 and the first two months of 2023. However, from the time the new decree was released to mid-July, more than 68.5 trillion VND worth of corporate bonds were issued, comprising nearly 9.3 trillion VND via 11 public offerings (13.5%) and 59.2 trillion VND via private placements (86.5%).

Deputy Minister of Finance Nguyen Duc Chi held that this was a positive sign showing the policy’s effectiveness in enhancing businesses and investors’ confidence.

Since the launch of the new decree, market stakeholders’ awareness has improved substantially while issuers and service suppliers have also seriously complied with the rules on information provision for investors, he said, expressing his hope that the market will develop sustainably./.

Related News

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

The corporate bond market will be more vibrant in the second half of the year

08:20 | 23/07/2024 Finance

The corporate bond market will enter new period of development

08:44 | 03/03/2024 Finance

Corporate bond market is expected to prosper soon

10:59 | 10/01/2024 Finance

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

More News

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance