Continuously improve policies to develop the corporate bond market

| Ten years of development of the Government bond market | |

| Corporate bond market thriving yet risky | |

| Bond market proves efficient capital mobilization channel |

|

| Bond issuance is an effective new capital raising channel for enterprises. Photo: ST |

9.91% of GDP scale

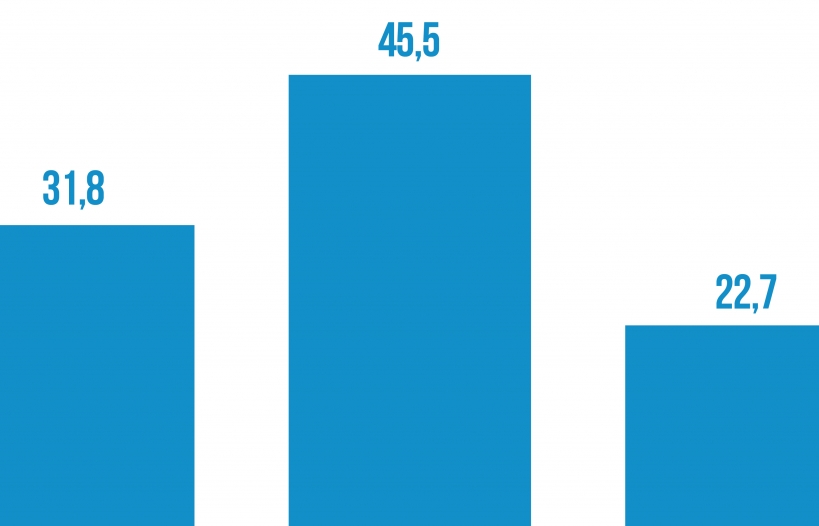

An overview of the corporate bond market which has just beenreleased by the Research Department of SSI Securities Company (SSI Retail Research) gave positive comments on the corporate bond market in the past few months of 2019.Based on the information released on the stock exchanges and information disclosure of businesses, SSI Retail Research found that the largest issuer was commercial banks with a total value of issuance in eight monthsof about 56,060 billion VND (accounting for 47.9%); followed by real estate enterprises with 36,946 billion VND (accounting for 31.5%). Infrastructure development businesses issued 9,207 billion VND (accounting for 7.9%). Non-bank financial institutions issued 4,423 billion VND (accounting for 3.8%), and the remainderwere other businesses.

Both the Ministry of Finance and SSI Retail Research shared the opinion that the market's excitement was largely thanks to the fact that the legal basis for corporate bond issuance has been continuously renovated and improved, investors have gradually diversified, and the market infrastructure has been enhanced.

Especially, from the end of 2018, Decree 163/2018/ND-CP on corporate bonds issued by the Government has created a more open legal corridor for the market.Accordingly, corporate bonds are issued in two forms: public and private.In particular, private placement is issued to less than 100 investors, excluding professional stock investors and those who do not use the media or the internet.Decree 163 provides looser issuance conditions to facilitate businesses to raise capital through issuing bonds.In order to overcome the bad compliance with the information and reporting regime of bond issuing businesses, the Decree specifies responsibilities and content of information disclosure of issuing businesses to investors and Stock Exchanges,including disclosure before release, disclosure of released results, periodic disclosure and extraordinary disclosure.Along with that is the regulation on the establishment of a centralized information page on enterprise bonds managed and operated by the Stock Exchange on the basis of utilizing the existing infrastructure for centralized management of all information on the individual corporate bond market.

In addition, policies from the State Bank, such as reducing the ratio of short-term capital to medium and long-term loans, the limit of loans to one customer not exceeding 15% of the equity capital and adjusting the risk ratio for real estate lending, have created a shift of businesses from bank credit mobilization to bond issuance.At the same time, the more transparent bond issuance information and the active participation of distribution intermediaries such as banks and securities companies has made corporate bonds more attractive to investors.The increase inboth supply and demand has made Vietnam's corporate bond market more exciting than ever.

However, according to Ms. Phan Thi Thu Hien,director of the Department of Banking and Financial Institutions, Ministry of Finance, the development of the corporate bond market has revealed a number of issues such as: the market size is small; bond issuance has not become the main enterprises’ channel of capital mobilization; the secondary market has not been developed with low liquidity after issuance and limited transparency. The market infrastructure has lacked a number of factors such as inactive credit rating agencies and service delivery,and a bond valuation organization. Moreover,a specialized information page on corporate bonds has just been established and it needs to be improved in the future.In addition, the investor base is weak, lacking long-term investors with strong financial potential, and the main investor in the corporate bond market arecommercial banks.Investment funds have not participated in corporate bond investment while individual investors who tend to increase buying bonds are unable to analyze risks and lack investment experience.

A mechanism to protect investors is necessary

The Ministry of Finance is preparing a report on solutions to develop the corporate bond market, which proposes comprehensive solutions from perfecting the legal framework to developing the investor base, organizing the market and strengthening management and supervision.Accordingly, besides the issue of the primary market, the market infrastructure and secondary market development are important.

Mr. Nguyen Viet Cuong, Deputy Director of Analytical Research Center of Vietnam Bank for Industry and Trade Securities JSC (CTS), said the size of Vietnam's corporate bond market was small but hadpotential and itwould develop in the future.This is a good channel to raise capital in parallel with bank credit. However, Cuong said certain risks still existed since itwas a new market in Vietnam. According to CTS’ calculation, the biggest risk of this market is transparency.In other countries, credit rating agencies often participate in the market, so they have clear classification of the risk level for each type of bond of different businesses to suit the risk positions of investor groups.Therefore, in order tohave more transparent corporate bond market, Vietnam needs to have credit rating agencies soon.

Mr. Nguyen Duc Hung Linh, Director of Analysis and Investment Advisory for individual clients of SSI Securities Company, said the development of corporate bonds was indispensable and consistent with the State's orientation to develop the capital market in parallel with the credit market. According to this expert,although the scale of corporate bond issuance haswitnesseda fairly high growth rate,looking into each issue, there are still some points to pay attention to, such as the issuance of commercial banks and the fact that commercial bankswere the buyers of many corporate bonds, including real estate corporate bonds. In addition, the disclosure of corporate bond information still has a general case such as hiding the name of the bond purchasing unit.

In terms of interest rates, according to Linh, corporate bond interest rates are safe because they are approximately equal to bank lending rates. However, without a reliable credit rating agency, bond buyers, especially individual investors, will find it difficult to determine a reasonable interest rate.According to Linh, withmore open policies related to corporate bond issuance, the protection mechanism for investors also needs to be more complete.This will be the foundation for developing a strong and sustainable corporate bond market.

According to statistics of the Ministry of Finance, the corporate bond market has grown rapidly, gradually becoming an important capital mobilization channel of enterprises, contributing to reducing pressure on capital mobilization for the bank credit channel.By the end of September 2019, the corporate bond market size reached 9.91% of GDP.It is expected that by the end of 2019, the market size would be 9.6 times higher than that of 2012, exceeding the target set for 2020 at the roadmap for developing the bond market in the period 2017-2020 and vision to 2030.

Related News

Vietnam's GDP growth forecast raised due to strong recovery trend

15:48 | 02/12/2024 Headlines

Available foundations and drivers for strong economic growth

08:34 | 13/11/2024 Headlines

The economy can achieve the GDP growth target of about 7 percent

09:16 | 14/10/2024 Headlines

The insurance industry is expected to grow by 10 percent in 2024

08:27 | 04/08/2024 Finance

Latest News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

More News

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Your care

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance