The insurance industry is expected to grow by 10 percent in 2024

|

| Source: Vietnam Report, insurance business survey May-June 2024 |

Positive growth in the first half of the year

According to a report from the Ministry of Finance, in the first six months of the year, the insurance market continued to develop stably, however, there were signs of decline in the life insurance business.

Total insurance premium revenue for six months is estimated at about VND109 trillion, down 6.76 percent compared to the same period last year; total assets reached VND951.8 trillion, an increase of 9.57 percent; investment back into the economy reached VND795.5 trillion, an increase of 9.71 percent; insurance benefit payments are estimated at VND41.3 trillion, an increase of 15.58 percent. Of which, premium revenue from the non-life insurance sector is estimated to increase by 11.23 percent, and the life insurance sector is estimated to decrease by 9.8 percent compared to the same period last year.

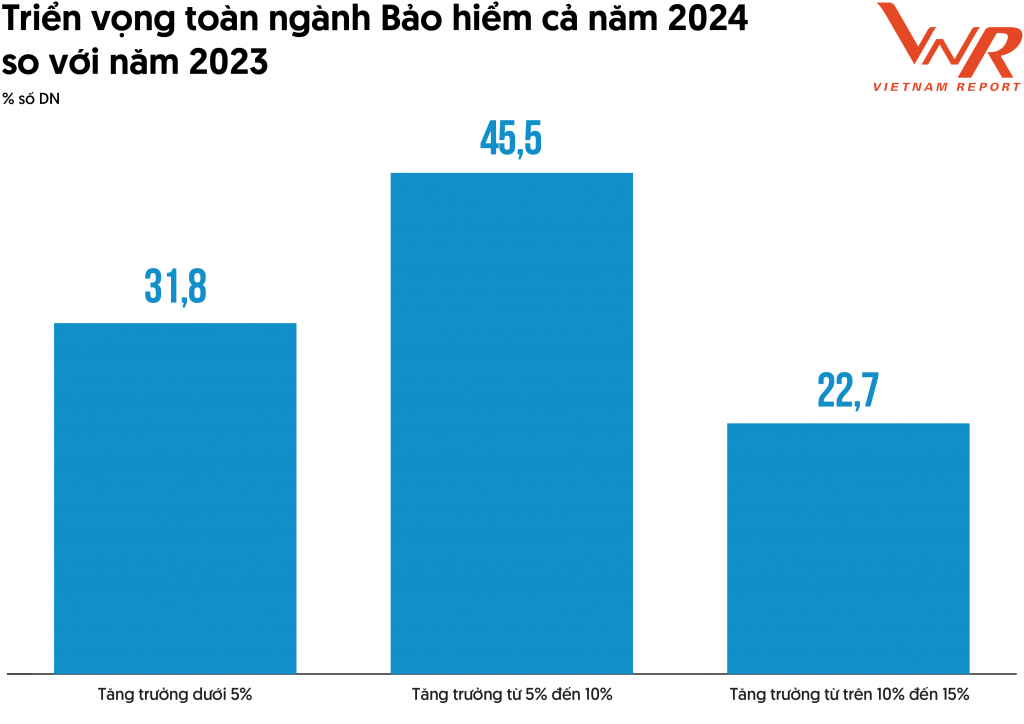

Recently, according to Vietnam Report's survey results of insurance businesses in the period May-June 2024, 45.5 percent of businesses expect the insurance industry to grow by 5-10 percent in 2024. According to the Department of Insurance Management and Supervision, Vietnam's insurance industry is heading towards a promising year with notable financial goals.

Specifically, the total assets of the industry are estimated to reach more than VND1 million billion, an increase of 9.97 percent compared to 2023.

It is expected that in 2024, the insurance industry will also contribute positively to the economy through an estimated investment capital of VND850,264 billion, an increase of 11.51 percent compared to the previous year.

Total insurance premium revenue is expected to reach VND243,472 billion, of which, non-life insurance is estimated to reach VND79,687 billion (increasing by 12 percent) and life insurance is estimated at VND163,785 billion (increasing by 5 percent).

Business results for the first six months of 2024 of insurance businesses are also gradually being announced and recording positive growth.

BIDV Insurance Corporation (BIC) recorded consolidated pre-tax profit in the first six months of 2024 reaching nearly VND370 billion, an increase of approximately 40 percent compared to the same period last year, insurance distribution channel through banks has paid insurance for more than 1,000 customers. Military Insurance Joint Stock Corporation (MIC) recorded pre-tax profit in the first half of the year reaching more than VND176.5 billion, up 10 percent compared to the same period last year. Aviation Insurance Joint Stock Corporation (AIC) recorded a "huge" profit increase of 165 percent from more than VND9 billion in the first six months of 2023 to a profit of more than VND23.5 billion in the first half of 2024.

Opportunities for development from improving legal policies

According to experts, during the recovery process, the insurance industry cannot avoid both objective and internal impacts. The biggest challenge facing businesses in the sector is still the echo of the crisis of confidence in the life insurance market in 2023, which will continue into 2024, while consumers do not really understand insurance policies.

Furthermore, competition in the industry is increasing as well as difficulties related to insurance fraud issues, many violations when providing insurance through bancassurance channels...

Regarding this issue, Ms. Tina Nguyen, General Director of Manulife Vietnam, said that the insurance industry is facing challenges of purification to change direction in the right and stronger way. Therefore, according to Ms. Tina Nguyen, short-term sales may be affected, but in the long term, people's confidence will return.

Mr. Ngo Trung Dung, Deputy Secretary General of the Insurance Association of Vietnam (IAV) also predicted that compared to the previous number of 700,000 insurance agents, this will probably decrease to about a few hundred thousand agents. People who want to stay in the profession must be trained in qualifications and professional ethics.

Faced with the above difficulties, insurance businesses said they have proactively changed to meet a series of newly issued regulations, while also seeking to regain customer trust such as having many forms of training, adjusting the way of recruiting agents to increase quality...

Also according to a survey by Vietnam Report, insurance businesses have pointed out 3 opportunities for the growth of the insurance industry in 2024, including strongly developed technology and application in all stages of the insurance industry value chain; low insurance penetration/GDP ratio; along with that, circulars detailing the Law on Insurance Business 2023 have been officially issued.

The Ministry of Finance said that it has focused on developing and consulting with relevant agencies a draft Decree amending and supplementing Decree No. 98/2013/ND-CP dated August 28, 2013 regulating sanctions for administrative violations in the fields of insurance business, lottery business, Decree No. 48/2018/ND-CP and Decree No. 80/2019/ND-CP amending and supplementing Decree No. 98/2013/ND-CP; studying the Circular amending Circular 69/2022/TT-BTC dated November 16, 2022 of the Minister of Finance providing detailed regulations on insurance certificates, insurance agent certificate, insurance broker certificate, insurance auxiliary certificate....

In particular, Circular No. 67/2023/TT-BTC detailing the Law on Insurance Business 2023 was evaluated by 59.1 percent of businesses and experts of Vietnam Report as one of the important opportunities to promote Vietnam's insurance market to develop strongly in 2024.

Related News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Multiple drivers propel positive growth in budget revenue

10:33 | 05/12/2024 Finance

Vietnam's GDP growth forecast raised due to strong recovery trend

15:48 | 02/12/2024 Headlines

Initiative to disseminate legal policies using QR codes

09:01 | 24/11/2024 Customs

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Minister of Finance Nguyen Van Thang works with GDVC at the first working day after the Tet holiday

14:43 | 04/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance