Banks are cautious about profit target

|

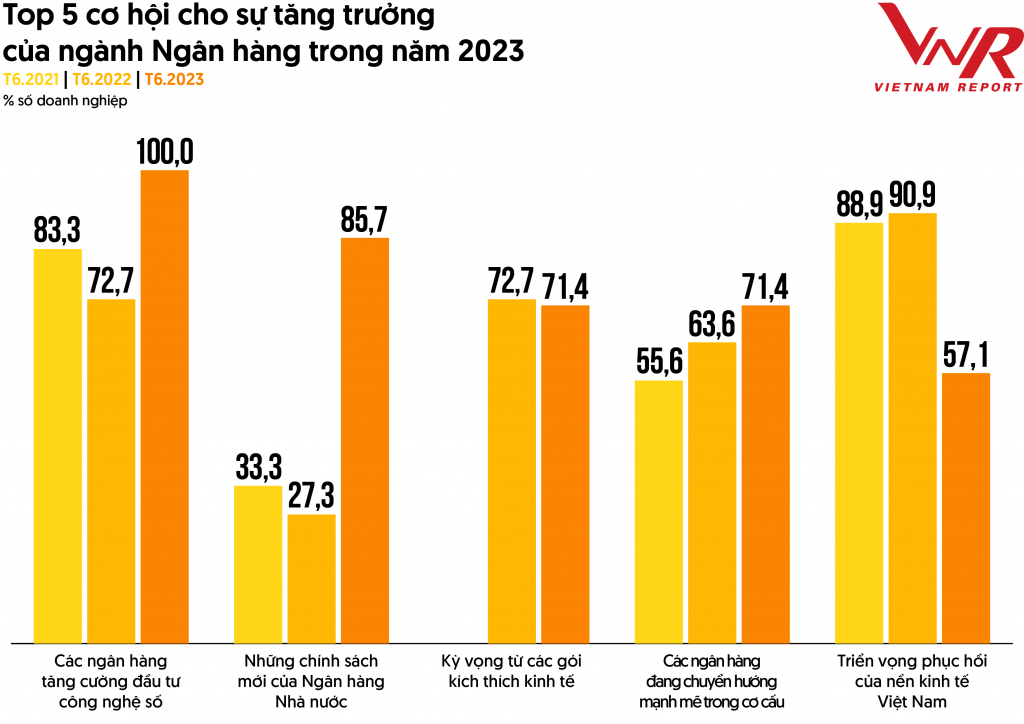

| The bank still has many opportunities for growth in the second half of the year. Image |

Optimistic

According to the survey results on business trends of credit institutions in the third quarter of 2023 by the Department of Forecasting and Statistics (SBV), the business situation of the banking system in the second quarter of 2023 continued to "improve". significantly slower than the previous quarter, pre-tax profit grew slightly but lower than expected in the previous survey period. Therefore, credit institutions have significantly narrowed their expectations of business and profit in the coming time. In addition, credit institutions expect that the credit balance of the banking system will increase by 4.4% in the third quarter of 2023 and increase by 12.5% in 2023, adjusted down by 0.6 percentage points compared to that of the third quarter of 2023. forecast level of 13.7% in the previous survey period.

In the outlook report for the second half of 2023, experts at Bao Viet Securities Company (BVSC) said that the State Bank has reduced the operating interest rate four times and the deposit interest rate has also decreased rapidly from the peak of the first half of the year. in 2023. This helps banks' profit margins (NIM) stabilize in the second quarter and may increase slightly in the second half of 2023. The downward pressure on asset quality is ongoing, but This force will be reduced somewhat thanks to Circular 02/TT-NHNN of the SBV allowing loan restructuring. Along with that, interest rates are cooling down and if the economy recovers from the second half of the year, the bank's asset quality will stabilize and begin to recover.

From the above analysis, BVSC forecasts that the profit of the banking industry (estimated based on the group of banking stocks analyzed by BVSC) will grow by about 7% in 2023 and grow by about 17.6% in 2024. based on the expectation of economic recovery.

Mr. Tran Hoai Phuong, Director of Corporate Banking Division, HDBank said that the current difficulties can be seen clearly such as the risk of bad debt increases, businesses may not be able to survive with their cash flow, some export companies do not receive orders like before... However, most difficulties have started to pass, and hopefully the remaining two quarters will be more optimistic.

According to Ms. Pham Lien Ha, Research Director of the financial services industry, Ho Chi Minh City Securities Corporation (HSC), the biggest opportunity for the banking industry in the second half of the year is interest rates. Interest rates fell relatively quickly in the first six months of the year and especially in the second quarter, thereby helping to reduce the cost of capital, creating conditions for banks to continue to reduce lending interest rates, promoting economic growth as well as promoting economic growth. such as credit growth in the last six months of 2023.

Challenges "Waiting"

|

| Source: Vietnam Report |

Previously, at the 2023 annual general meeting of shareholders, many banks had carefully set their business plans for 2023 based on the assessment of the year 2023 with many difficulties and challenges as they had to continue to share resources. , shared difficulties with businesses in the context of slowing global economic growth, along with problems related to interest rates, bad debts, risk provisioning, etc., and difficulties from the real estate market, bonds…

According to a survey by Vietnam Report, 71.4% of surveyed banks expect to increase provisioning in 2023. In addition, a decrease in global trade affects the outlook for domestic economic growth in 2023, leading to a decrease in credit demand; investment, consumption, and international tourism all weakened. In a low-growth environment, businesses and individuals have a lower propensity to borrow and invest, reducing the credit and other financial products offered by banks. Deteriorating economic conditions cause businesses to face financial difficulties, leading to higher default rates, increasing the risk of default on loans to banks. At the same time, these factors can adversely affect the value of collateral held by banks, such as real estate or stocks, leading to deterioration in asset quality, capital buffers, and term limits lending capacity.

Vietnam Report also assessed that the downturn of the stock market, real estate, and bonds and the impact of the bancassurance crisis (cross-selling of insurance through banks) made many banks worried that it would directly affect the economy. bank's business from the perspective of asset quality risk and confidence erosion. The emergence of Fintech companies with fierce competition, challenging the market dominance of banks and increasing pressure to increase charter capital in order to improve capital adequacy ratios and ranking position of banks. Banks are also listed as challenges that banks need to face in the coming time.

Related News

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

Necessary conditions for operating a "natural flavor" business

19:28 | 14/12/2024 Import-Export

Mong Cai: Smuggling concerns amid sluggish business activities

09:43 | 08/12/2024 Anti-Smuggling

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

More News

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance