Bad debts under the new circumstance

|

| The SBV has issued many regulations to effectively control bad debt. Source: Internet. |

The new rules

Over the past time, the SBV and other authorities have issued many legal regulations on dealing with bad debts of credit institutions. Specifically: Law of the State Bank of Vietnam, Law on Credit Institutions 2010, Project "Dealing with Bad Debts of Credit Institutions" and "Establishment of the Asset Management Company of Vietnam Credit Institutions (VAMC)" etc.

Due to drastic measures, according to the SBV, bad debts have been curbed, bringing the bad debt ratio in the balance sheet at the end of 2016 to 2.46% (down from 2.55% at the end of 2015). Of which, up to 31st December, 2016, the debt still to be treated at VAMC is about 190,000 billion VND; the outstanding debt at the stage of execution as of 30th September, 2016 was about 58.998 billion VND.

According to experts, the bad debt recovery has initially been satisfactory, but the current bad debt and potential bad debts have remained high, hiding risks to safety and effectiveness of credit institutions performance; the State and the Government supporting mechanisms and policies to handle bad debts, the law on dealing with bad debts and security assets still have many inadequacies; lack of resources and specific mechanism for VAMC to operate. At the same time, in the credit institutions system, there are still a number of credit institutions with high bad debt proportion, mainly concentrated in specially controlled credit institutions and some weak financial and financial leasing companies, therefore, it is necessary to have a drastic solution in the coming time not to stop the bad effect to the system safety and ensure the feasibility of the handling of weak credit institutions.

Recently, the SBV has issued a draft Decree detailing the appraisal of the starting price of bad debt and collateral assets of bad debts and the establishment of the Council for the bad debt auction and bad debt collateral for bad debts and the bad debt collateral with high value.

This draft Decree was developed to guide the implementation of the Property Auction Law (effective from July 1st, 2017), which is appropriate to the particular nature of the auction of bad debts and the VAMC's bad debt guarantee property; to ensure the process of speeding up the handling of bad debts of credit institutions and VAMC.

Commenting on this matter, according to Lawyer Truong Thanh Duc, Chairman of the Basico Law Firm Board, the handling of bad debts is difficult due to many factors beyond the control of the bank. In particular, the handling of security property is still difficult due to the unclear legal regulations. This is also the "common sense" of many banks and professionals when dealing with bad debt.

Effective lending

Along with the above regulations, in Circular 39/2016/TT-NHNN regulating the lending activities of credit institutions and foreign bank branches for customers, the State Bank loosened interest rates when the specific lending interest rate was removed, except for some specific cases; or the fact that the SBV has closely followed the practice of lending with three new lending modalities: crop season loans, revolving loans, circulating loans and many regulations to simplify lending procedures, ensuring transparency in lending activities and protecting the borrowers’ interests as well as ensuring not to increase bad debts etc.

Noticeably, Circular 39 provides more details on the case of repayment of loans at lending credit institutions, other credit institutions and the revolving lending method. However, credit institutions and customers are allowed to apply revolving loans if they meet all four conditions: By the repayment period, the customer has the right to repay or extend the repayment period for a further period of time for a part or all of the debt balance of the loan; the total loan term does not exceed 12 months from the initial disbursement date and does not exceed one business cycle; at the time of loan review, customers do not have bad debts at credit institutions; in the process of revolving loans, if customers have bad debts at credit institutions, they can not extend the repayment period as agreed.

While previously, on 16th September, 2016, the SBV Governor issued official letter No. 6960/NHNN-TTGSNH on fixing new loans before maturity and/or granting credit in the form of revolving loans of credit institutions and foreign bank branches. In particular, the Governor asked credit institutions to stop making new loans before maturity and/or granting credit in the form of revolving loans.

Attorney Truong Thanh Duc said that Circular 39 was more clearly regulated by the State Bank of Vietnam on circular lending, to distinguish between circular lending and debt reversal. Given that circular lending and debt reversal are not the same, so in this regulation, the repayment schedule is still very tight, making it impossible for the bank to provide the debt reversal loan, while a debt reversal loan is one of the forms to hide bad debts of credit institutions.

Circular loans are not a flexible method of lending, helping businesses to save the lending costs, in line with international practices, and to help them to develop. Therefore, experts and businesses are "excited" when this method is continued, but still ensure the safety of the control of bad debt.

It can be seen that in recent years, the SBV has continuously introduced many options and guidelines as well as the legal basis to improve the efficiency of dealing with bad debt. However, the problem is how these measures are put into practice, so that in order to practically reduce bad debts, still need more time to solve.

Related News

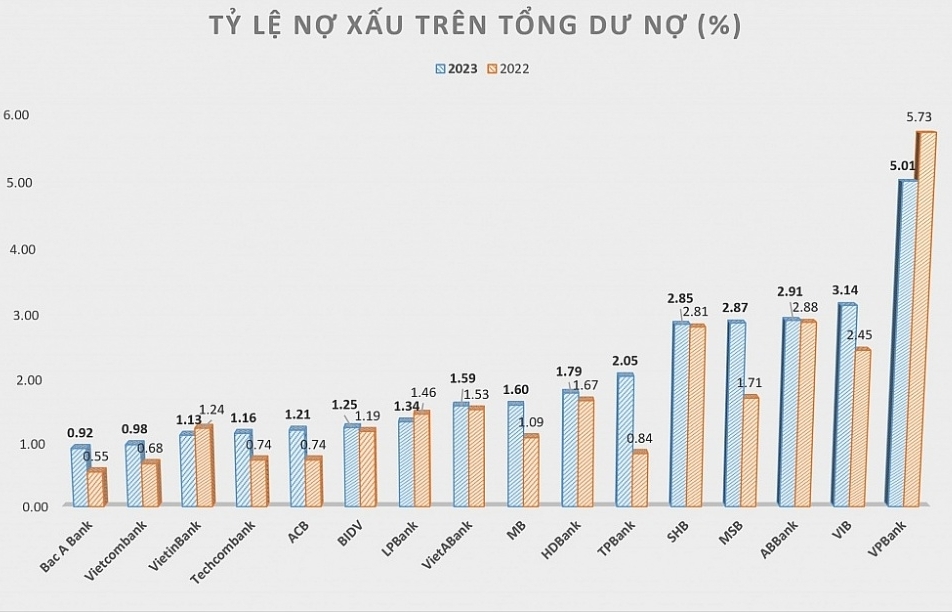

Accumulating bad debt ratio put pressure on banks

09:53 | 11/03/2024 Import-Export

The bad debt ratio has increased, putting pressure on banks

08:42 | 03/03/2024 Finance

Credit quality suffer from objective factors declining bad debt handling effectiveness

00:00 | 28/10/2023 Finance

The WB highlights a series of challenges, the banking system must enhance resilience

13:57 | 25/08/2023 Finance

Latest News

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

More News

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

Striving for average CPI not to exceed 4%

16:41 | 01/11/2024 Finance

Delegating the power to the government to waive, lower, or manage late tax penalties is suitable

16:39 | 01/11/2024 Finance

Removing difficulties in public investment disbursement

09:30 | 31/10/2024 Finance

State-owned commercial banking sector performs optimistic growth, but more capital in need

09:28 | 31/10/2024 Finance

Stipulate implementation of centralized bilateral payments of the State Treasury at banks

09:29 | 29/10/2024 Finance

Rush to finalize draft decree on public asset restructuring

09:28 | 29/10/2024 Finance

Inspection report on gold trading activities being complied: SBV

14:37 | 28/10/2024 Finance

Budget revenue in 2024 is estimated to exceed the estimate by 10.1%

10:45 | 28/10/2024 Finance

Your care

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance