Additional tax incentives for environmentally-friendly cars

|

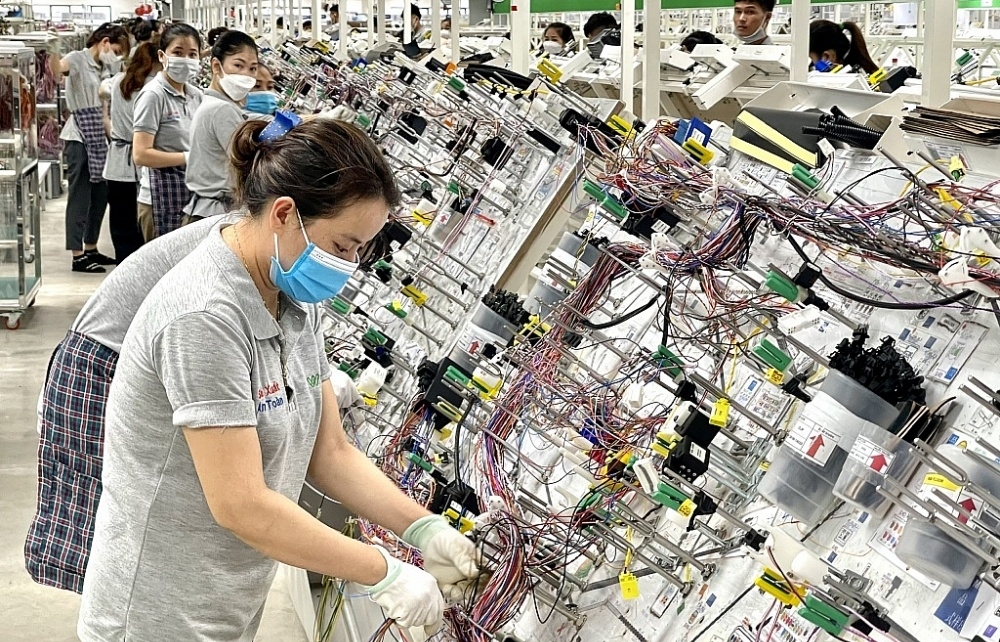

| Encouragement of the production and assembly of environmentally-friendly cars is a common trend of all countries. Photo: internet. |

Tax incentives promote growth of import and export turnover

On September 1, 2016, the Government issued Decree No. 122/2016 / ND-CP promulgating Schedules of Export Tariffs, Preferential Import Tariffs, the List of goods and its flat tax, compound tax and out-of-quota import tax.

The official importation of goods outside the customs quotas is effective.

More than a year later, when Decree No. 125 amending and supplementing a number of articles of Decree No. 122 was issued, it has given apreferential import tax rate of 0% tocar components for the 2018-2022 period in Article 7a.

The above decrees have contributed to promoting the growth of import and export turnover. The tax rates are prescribed on the principle of encouraging the import of raw materials and materials for production, giving priority to domestic types that have not yet met requirements described in the Law on Import and Export Duties. Provisions in the Decree are simple, transparent and convenient for taxpayers.

In fact, import tax rates have reduced gradually from finished products to raw materials. Export tax rates have increased gradually from finished products to raw materials. Partly thanks to this policy, import and export activities have been more favorable and grown continuously.

In 2017, the total import-export turnover of goods increased by 21% compared to 2016; in 2018increased by 12.6% compared to 2017; in 2019 increased by 7.8% compared to 2018. Even, in 2018, trade surplus was US$7.2 billion; in 2019, trade surplus was US$11.1 billion.

Notably, the addition ofincentives for imported car components has contributed to promoting the development of the automotive industry and other mechanical industries, helping increase the state budget revenue. It is a solution to address difficulties for domestic automobile manufacturing and assembling enterprises in the period of commitments on reducing taxes on cars (the special import tax rate under the ATIGA Free Trade Agreement reduced to 0% from January 1, 2018).

| According to the data reported by participating companies (Toyota Company and Hyundai Thanh Cong Vietnam Automobile Manufacturing Joint Stock Company, Truong Hai Company, Ford Vietnam Company), their paid taxes to the State budget in 2018 increased about VND7,300 billion compared to 2017. In 2019, it increased about VND4,000 billion. |

Moreover, this contributes to supporting Vietnam's automobile market to grow stably and maintain domestic assembly and manufacturing. Therefore, automobile assembling and manufacturing enterprises have made significant contributions to the budget.

Additional incentives

However, inadequacies still exist. The Ministry of Finance has pointed out that there are no regulations on incentives for environmentally-friendly cars (electric cars, hybrid cars) while environmentally-friendly vehicles are modern vehicles appreciated in countries around the world and used to reduce impacts on the environment.

Currently, some manufacturers are aiming to invest in Vietnam, so it is necessary to includeenvironmentally-friendly cars to subjects of import tax incentive programs to encourage the development of the automotive industry according to the Government's orientation.

Therefore, the Ministry of Finance has submitted to the Government for promulgationDecree No. 57/2020 / ND-CP, which amends a number of contents related to participants in the program, conditions of application, and procedures toenjoy incentives for imported car components to ensure they are practical, transparent and clear in implementation and encourage domestic production to develop in the context that the import tax on cars from ASEAN has been reduced to 0%.

Along with that is the addition of environmentally-friendlycars including electric cars, fuel-cell cars, hybrid cars, fully biofuel cars, natural-gas cars to be subject to tax incentives.

Because these carsnewly appear on the market, it takes time for manufacturing enterprises to explore the market, so the Decree stipulates that these cars are not required to register their models when participating in the incentive program.

Regarding models, according to the former regulations in Decree No. 125, enterprises participating in the incentive program must register one model for groups of cars with lessthan 9 seats, minibuses, buses and two models for the group of trucks. In the process of implementation, enterprises proposed to allow the change of models of cars to match production, business, customer tastes, and to increase the number of models committed to the busesand to revise regulations on model criteria.

On the basis of receiving comments, the newly issued Decree has amended the regulations on car models. Regarding the number of registration models, the enterprise is allowed to register at least one model for the group of passenger cars of 9 seats or less (with cylinder capacity of 2,500 cc or less, fuel consumption of under 7.5 liters / 100km); one model for mini bus group; one or two models for buses; one or two models for EURO 4 truck group and one model for EURO 5 truck.

The determination of criteria of under 5 liters / 100km is basedon fuel consumption of the combined cycle specified in the fuel consumption certificate issued by the Registry Department.

| Attract FDI: Need tax incentives to encourage long-term investment |

The new Decree stipulates that during the period of implementation of the tax incentive program, enterprisesare allowed to change the registration model but must still meet the minimum specific production conditions for each incentive period.

Related News

Launch of FDI Annual Report 2023

16:25 | 17/04/2024 Import-Export

Negotiating actively FTAs, increasing benefits for businesses

09:32 | 10/04/2024 Import-Export

Production recovered, the driving force for exports accelerated

14:02 | 08/03/2024 Import-Export

The business environment is the key for all businesses

10:25 | 14/03/2024 Import-Export

Latest News

Seafood exporters are worried about some inadequacies from the two new decrees

06:47 | 30/04/2024 Regulations

Risk prevention solutions for processing and export manufacturing businesses

07:52 | 29/04/2024 Regulations

Reporting to the National Assembly for considering VAT reduction in the second half of 2024

17:09 | 14/04/2024 Regulations

The Prime Minister requested that before April 25, complete the revision of regulations on import and export of medicinal materials

10:33 | 13/04/2024 Regulations

More News

No need to reduce the output of manufacturing and assembling automobile to enjoy preferential tariff

09:09 | 11/04/2024 Regulations

Hundreds of tons of cinnamon essential oil are left in inventory due to export regulations

09:31 | 10/04/2024 Regulations

Business suspension of temporary import and re-export of Monazite ores and ore concentrates will be valid on May 13th

20:09 | 07/04/2024 Regulations

Improving the customs legal system to be modern, synchronous, unified and transparent

10:33 | 07/04/2024 Regulations

New points about rules of origin in AKFTA

08:05 | 03/04/2024 Regulations

It is necessary to build a national database on cross-border trade and transport

15:23 | 29/03/2024 Regulations

Removing difficulties in tax exemption and refund policies for export processing enterprises

14:48 | 27/03/2024 Regulations

Reviewing the list of scrap that is temporarily suspended from temporary import and re-export business

15:41 | 24/03/2024 Regulations

New law expected to boost financial leasing

14:05 | 22/03/2024 Regulations

Your care

Seafood exporters are worried about some inadequacies from the two new decrees

06:47 | 30/04/2024 Regulations

Risk prevention solutions for processing and export manufacturing businesses

07:52 | 29/04/2024 Regulations

Reporting to the National Assembly for considering VAT reduction in the second half of 2024

17:09 | 14/04/2024 Regulations

The Prime Minister requested that before April 25, complete the revision of regulations on import and export of medicinal materials

10:33 | 13/04/2024 Regulations

No need to reduce the output of manufacturing and assembling automobile to enjoy preferential tariff

09:09 | 11/04/2024 Regulations