Pressure of bad debts in banks

|

Bad debts still expanding

According to the latest figures from the State Bank of Vietnam (SBV), by the end of September 2023, the total outstanding restructured debts under Circular 02/2023/TT-NHNN regarding debt repayment terms and maintaining debt groups reached about VND140 trillion (accounting for 1.09% of the total credit of the entire system). However, the financial reports for the third quarter of 2023 from many banks showed that most banks were facing a rapid increase in bad debts.

The total bad debts as of the end of the third quarter of 2023 for banks increased by 61% compared to the end of the previous quarter, reaching VND196.755 trillion. Moreover, looking at the classification of bad debts, there is an increase in groups 3, 4, and 5 (substandard debt, doubtful debt, and potential loss debt). Therefore, experts believed that the above bad debt figure did not fully reflect the true nature of bank bad debts because bad debts were not yet accounted for in the outstanding debt being restructured, deferred under Circular 02.

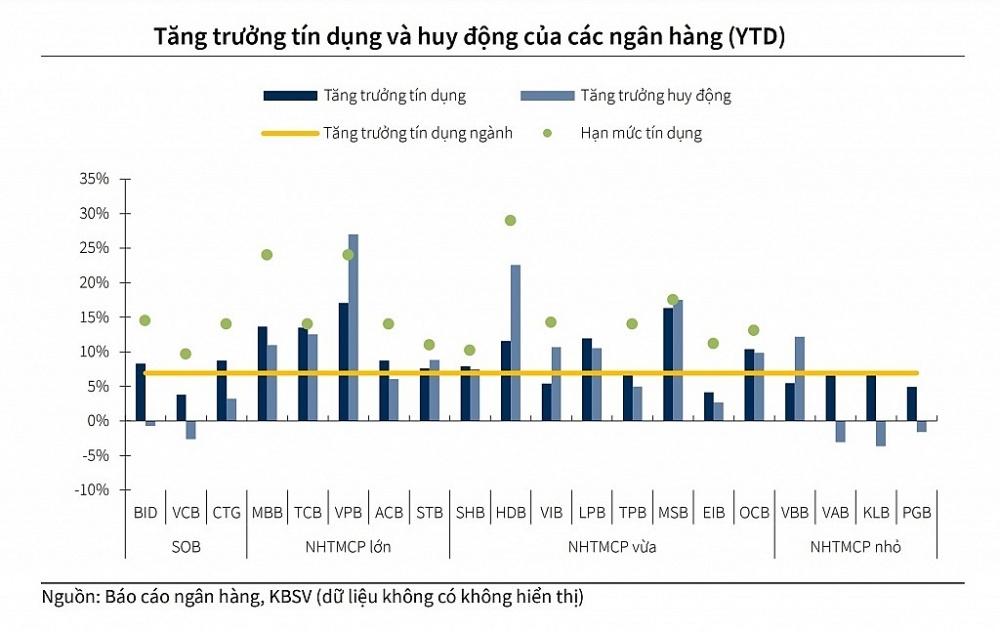

Experts from KB Securities Vietnam (KBSV) believed that by the third quarter of 2023, bad debts for the entire banking industry had increased for the fourth consecutive quarter since Circular 14/2021/TT-NHNN related to restructuring support debts for customers affected by Covid-19 expired. Therefore, in 2023, the implementation of Circular 02 has created conditions for banks to maintain debt groups, thereby contributing to restraining the increase in bad debts.

According to information from the KBSV, among the banks, VPBank has restructured debts of VND14,900 billion (nearly 2.86% of outstanding debt) and BIDV with nearly VND20,000 billion (almost 1.5% of outstanding debt), helping to control the surge in bad debts in the third quarter of 2023. Other banks, due to not facing significant pressure of bad debts and not prioritizing the use of Circular 02 (because they have to set aside more), have a small proportion of restructured debts in total outstanding debts. Specifically, Vietcombank is at 0.14%, ACB 0.4%, Techcombank 0.27%, MSB 0.25%, and HDBank 0.5%.

Moreover, the report from the KBSV also revealed that bad debts were putting pressure on large and medium-sized commercial banks (such as MB, Techcombank, TPBank, and MSB) as they still face negative impacts from the corporate bond market, real estate, and difficulties from the personal customer segment. From these analyses, it is apparent that the asset quality of banks will be temporarily under control at the current level until the end of 2023. However, experts noted that bad debts might "expand" further as we move into 2024.

(LLCR) đang có sự phân hoá rõ rệt giữa các ngân hàng. Nhóm ngân hàng quốc doanh vẫn duy trì bộ đệm trên 200%, trong khi tỷ lệ này ở các nhóm ngân hàng còn lại đều đã dưới mức 100% tính đến quý 3/2023.

To extend or not to extend Circular 02?

In 2024, according to experts and bank representatives, the risks that may cause bad debts to expand next year are still significant. This could come from Circular 02, which expires in June 2024, and the previously restructured debts will return to their proper debt classification groups. Along with this is the contraction of banks' reserve buffers in 2023, making the room for debt resolution in the following year limited. The loan life coverage ratio ratio (LLCR) is significantly differentiated among banks. State-owned banks still maintain a buffer above 200%, while this ratio for other groups of banks is already below 100% as of the third quarter of 2023.

In reality, the risk of an increase in bad debts has been warned since the peak days of the Covid-19 pandemic until now, especially when the real estate market is facing difficulties, making it challenging to liquidate assets to handle banks' bad debts in the current period.

Nguyen Quoc Hung, Vice Chairman and Secretary General of the Vietnam Banks Association, said that asset liquidation was very difficult, many collateralized assets were high-value real estate that was difficult to liquidate due to the nearly frozen real estate market. Moreover, pricing the distressed sale of assets sometimes does not follow market prices, often calculated by adding principal and interest, each time deducting only 5-10%, so assets auctioned may take over two years to sell.

Additionally, the legal corridor for handling bad debts may be depleted because Resolution No. 42/2017/QH14 of the National Assembly on the pilot handling of bad debts will expire at the end of this year, while the draft Law on Credit Institutions (amended) has to wait until the next session of the National Assembly to be passed.

In the context of increasing bad debts, difficulties in handling bad debts, many banks are worried that they will have to tighten lending to focus on risk management. Many bank leaders have proposed that the SBV extend Circular 02 even though there are still six months before it expires. The leadership of VPBank, for example, believed that the SBV should continue to extend to support banks and businesses, along with additional support for the bad debt resolution work of banks.

Disagreeing with this proposal, economic expert Assoc. Prof. Dr. Dinh Trong Thinh believed that extending Circular 02 would make the "bubble" of bad debts even bigger, thereby posing risks to the financial system of banks. This expert expected the economy to improve in mid-2024, helping businesses recover and gradually repay debts. Therefore, it is necessary to consider and add solutions to expedite the handling of bad debts and ensure assets for banks.

Regarding this issue, speaking at a recent credit meeting, SBV Governor Nguyen Thi Hong said that Circular 02 had a very practical effect in supporting banks and businesses, but it was not highly appreciated internationally because it "blurs" the true picture of the bad debts of the system. Therefore, in the coming time, the SBV will review, evaluate, and propose to extend Circular 02. From the government's side, the Prime Minister has also requested the SBV to urgently review, amend, supplement, and extend the implementation time for Circular 02 and some other related circulars to suit the actual situation, stabilize the monetary market, and ensure the safety of the system of credit institutions.

Related News

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export

Latest News

Removing obstacles in granting certificates of exploited aquatic products

13:56 | 22/12/2024 Import-Export

Agricultural exports in 2024 to exceed 60 billion USD?

13:53 | 22/12/2024 Import-Export

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

More News

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export

Binh Dinh province works to attract investment from Japan

15:44 | 19/12/2024 Import-Export

Agricultural, forestry and fishery exports “reach the target” early

15:20 | 19/12/2024 Import-Export

Thailand remains Vietnam’s biggest trading partner in ASEAN

15:35 | 18/12/2024 Import-Export

Rubber value soars in 2024: VRA

15:33 | 18/12/2024 Import-Export

Vietnamese businesses struggle to access green finance

09:58 | 18/12/2024 Import-Export

E-commerce: a gateway to boost Vietnamese commodities in the UK market

16:55 | 17/12/2024 Import-Export

Your care

Removing obstacles in granting certificates of exploited aquatic products

13:56 | 22/12/2024 Import-Export

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export

Agricultural exports in 2024 to exceed 60 billion USD?

13:53 | 22/12/2024 Import-Export

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export