26 organizations pay tax via Portal for foreign suppliers

| Challenges in tax management of e-commerce | |

| Deploying electronic tax applications, towards Digital Ministry of Finance by 2030 | |

| Portal launched to track foreign suppliers on digital platforms |

|

| E-portal for foreign suppliers. |

The General Department of Taxation has reported to the Government and the National Assembly to adopt the Law on Tax Administration 38/2019/QH14. For the first time, the law provides management responsibility of the tax authorities, and stipulates that the foreign enterprises in e-commerce, digital-based business and other services without a permanent establishment in Vietnam must register, declare and pay tax at the Portal for foreign suppliers. In addition, it also regulates the responsibilities of individuals and banks in Vietnam related to the trading of goods and use by foreign suppliers.

Deputy Director General of the General Department of Taxation Dang Ngoc Minh said that these are part of the key legal framework on tax administration for foreign enterprises doing e-commerce, digital-based business and other services, without a permanent establishment in Vietnam.

On March 21, the Ministry of Finance officially launched the portal for foreign suppliers to modernize tax management. The foreign suppliers can register, declare and pay tax at the Portal, creating convenience, equality and transparency in tax registration, declaration, and payment under the international tax administration trend.

As a result, in the three months since the launch of the Portal on March 21, 26 major foreign suppliers (Microsoft, Facebook, Netflix; Samsung; TikTok; eBay ...) have registered for tax, declared tax and paid taxes worth about US$20 million. Vietnam has become one of the first four countries in Southeast Asia that succeeds in implementing the national tax administration right for major the foreign suppliers.

From 2018 to July 14, revenue from e-commerce activities through organizations in Vietnam that were authorized by the contractor to pay taxes reached VND5,458 billion. The average revenue rate is 130%, the average revenue is about VND1,200 billion/year. Some foreign suppliers have paid taxes with large revenues such as: Facebook (VND2,076 billion); Google (VND2,040 billion); Microsoft (VND699 billion).

Related News

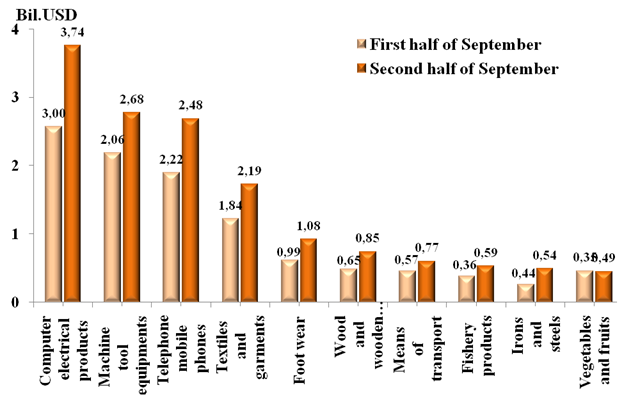

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Closely control imported products traded via e-commerce

09:19 | 17/11/2024 Customs

Regulating goods across Huu Nghi International Border Gate during peak times

19:37 | 02/11/2024 Customs

Steel industry proactively “coexists” with trade defense lawsuits

08:57 | 30/10/2024 Import-Export

Latest News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

More News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance