VAMC aims to resolve 50 trillion VND of bad debts this year

|

Illustrative image (Photo: VNA)

This year, the VAMC targets to buy 4.5 trillion VND (192.6 million USD) worth of non-performing loans at market value.

In a bid to fulfill its plan, VAMC has proposed raising its current charter capital from 2 trillion VND (86 million USD) to 5 trillion VND (215 million USD) this year. The move is aimed at enhancing the company’s financial capacity to buy and sell bad debts at prevailing market prices.

VAMC asked the Ministry of Finance to instruct the collection of corporate and income tax in case of mortgaged asset transfer in service of bad debt recovery, thus ensuring rights of mortgaged asset buyers.

Meanwhile, it is requesting the Ministry of Natural Resources and Environment to issue regulations on registration of mortgage of land use right, and procedures to transfer collateral of bad debts in pending property projects as stipulated at clause 1, Article 9, Resolution No.42.

Last year, VAMC purchased more than 30.9 trillion VND (1.32 billion USD) of bad debts from 13 credit institutions. As of December 2018, the company bought over 338.84 trillion VND (14.5 billion USD) worth of bad debts at a price of 307.56 trillion VND (13.16 billion USD).

Related News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

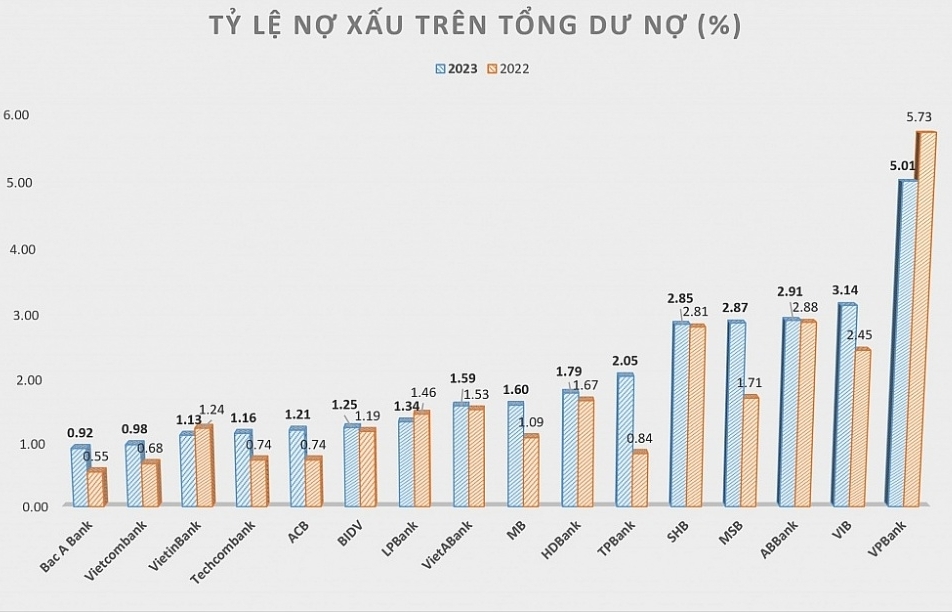

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Accumulating bad debt ratio put pressure on banks

09:53 | 11/03/2024 Import-Export

The bad debt ratio has increased, putting pressure on banks

08:42 | 03/03/2024 Finance

Latest News

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

More News

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Your care

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance