Update guidelines on goods labeling

|

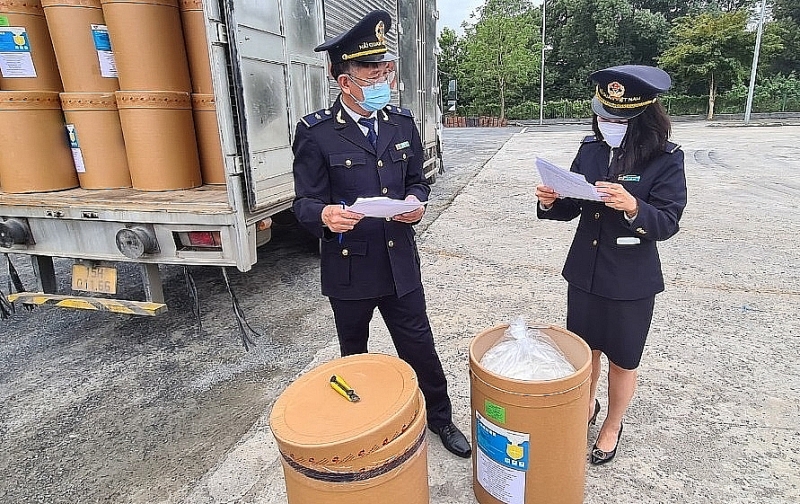

| Officials of Hoa Lac Customs Branch (Hanoi Customs Department) inspect import and export goods. Photo: T.Huong |

For imported goods that are raw materials for production of export goods which are not for domestic consumption or gifts, the General Department of Customs said, based on Clause 1, Article 1 of Decree 111/2021/ ND-CP, such goods are governed by this decree.

Accordingly, the above-mentioned imported goods must be labeled according to the provisions of this Decree.

For imported goods that are components, if the mandatory information is not shown on the goods, there must be a label on the commercial packaging of the imported goods, which must present the mandatory information specified in Section 2, Clause 5, Article 1 of Decree 111.

Also related to goods labeling under the new Decree, the General Department of Customs had issued a number of contents.

For example, regarding the labeling and packages of exported goods according to the provisions of Clause 3, Article 10 of Decree 43/20217/ND-CP, as amended and supplemented in Clause 5, Article 1 of Decree 111, the labeling of exported goods shall comply with provisions of the importing country.

In case exported goods are produced from many different sources of raw materials, the origin of which cannot be determined, according to the provisions of Clause 7 Article 1 of Decree No. 111/2021/ND-CP, on the goods, including the packaging of exported goods indicates the place where the final stage of finishing the goods is performed, expressed by one of the following phrases or combinations of phrases: “assembled at”; “bottled at”, “mixed at”; “completed at”; “packed at”; “labelled at” with the name of the country or territory where the final stage of finishing the goods is performed.

In addition, the General Department of Customs also noted that units in Decree No. 111/2021/ND-CP amending and supplementing a number of articles of Decree No. 43/2017/ND-CP have some new points as follows:

This Decree prescribes the content, manner of inscription and state management of labels for exported goods (Clause 1, Article 1);

This Decree does not apply to imported goods in bonded warehouses for export to a third country (point b, clause 2, Article 1);

Compulsory contents to be shown on the labels of goods circulating in the Vietnamese market must be written in Vietnamese, except for exported goods not for domestic consumption (Clause 1, Article 7);

| The task of advisory promoted effectively in the anti-fraud of origin VCN – The advisory, proposal of solution have played an important role to prevent and stop importing ... |

Compulsory contents must be shown in a foreign language or Vietnamese on the original label of imported goods when carrying out customs clearance procedures (Clause 2, Article 10);

Regulations on writing the origin of goods (Article 15).

Related News

Abolishing regulations on tax exemption for small-value imported goods must comply with international practices

13:54 | 15/11/2024 Regulations

Ensuring fairness between domestically produced goods and imported goods

14:20 | 06/11/2024 Import-Export

Food safety rules relaxed for emergency imports

10:58 | 12/10/2024 Regulations

Must strictly manage duty-free goods

10:16 | 08/10/2024 Regulations

Latest News

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

More News

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Your care

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations