Transit goods only subject to physical inspection based on risk assessment

|

| Infringing transited goods are detected by Zone 1st Sai Gon Seaport Customs Branch. Photo: T.H |

The GDVC has requested local customs departments to implement customs inspection and supervision procedures for transit goods in line with these agreements, Article 43 of Decree No. 08/2015/ND-CP dated January 21, 2015 of the Government, and guidance in Circular No. 38/2015/TT-BTC dated March 25, 2015.

Goods in transit must be monitored by positioning seals during transportation, and must be subject to customs supervision from the entry border gate to the exit border gate. They must also move along the prescribed route and within the time limit. The Customs branches at these border gates must coordinate and strictly control cargo during transportation and storage in the Vietnamese territory.

The GDVC has requested local customs departments to strengthen customs inspection and control through operational measures, and to only conduct physical inspection of transited goods based on risk assessment and identification for specific violations. When performing customs procedures for transit and exit goods at the exit border gate, the Customs branches must check information and conduct physical inspection if the means of transport or goods show violations such as failing to maintain the status quo of the customs seal, failing to follow the prescribed route and time, or turning off the positioning signal.

If the Customs branches discover transit goods showing signs of violation, they must handle these goods. If the Customs branches detect that the goods are forged with a Vietnamese origin, the customs will handle and seize the goods as per Article 17 of Decree 128/ND-CP dated October 19, 2020 of the Government. If the consignee has an address in Vietnam, investigation and verification is required to prevent violations.

Related News

Preliminary assessment of Vietnam international merchandise trade performance in the first 11 months of 2024

10:50 | 27/12/2024 Customs Statistics

Goods trading, being seen from Lang Son border gate

13:45 | 28/11/2024 Customs

7 key export groups bring in US$234.5 billion

13:54 | 28/11/2024 Import-Export

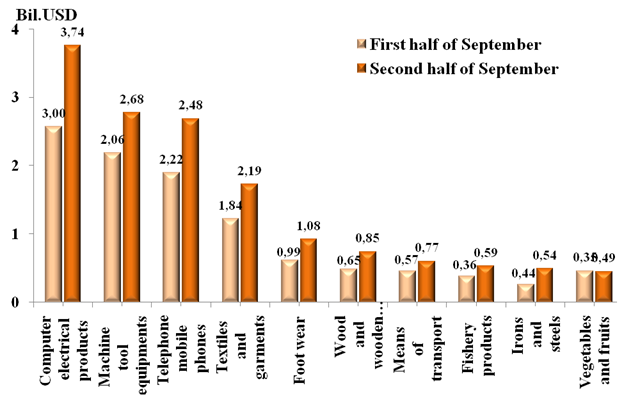

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Latest News

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

More News

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Your care

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations