Only conduct physical inspections for transit goods when detecting a sign of violation

|

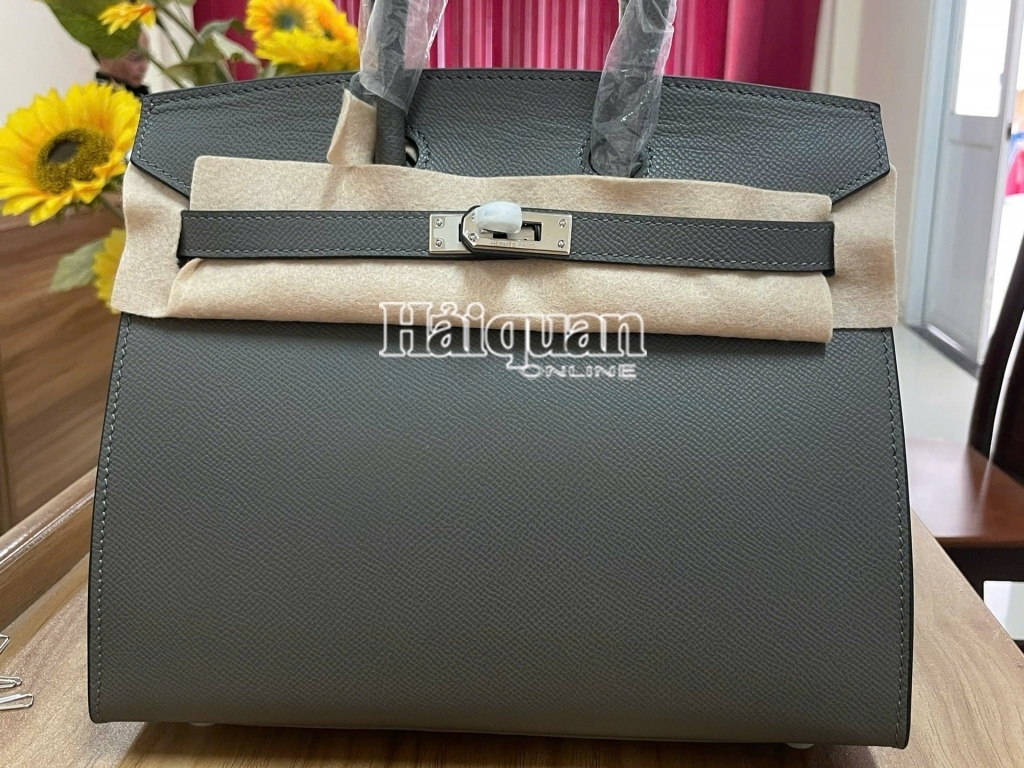

| illustration image. Photo: N.Linh |

Regarding conducting physical inspections of goods in transit, the General Department of Vietnam Customs recently received a reflection from a number of enterprises and the Goods Transit Service Business Association about the entire shipment of goods in transit through Vietnam subject to physical inspection, causing congestion of goods and difficulties for the business operation of goods in transit.

To unify the implementation, pursuant to Article 43 of Decree 08/2015/ND-CP amended and supplemented in Clause 19 Article 1 of Decree 59/2018/ND-CP of the Government, Article 51 of the Circular 38/2015/TT-BTC is amended and supplemented in Clause 29, Article 1 of Circular 39/2018/TT-BTC of the Ministry of Finance, the General Department of Vietnam Customs said the customs authority only inspects goods in transit if they show a sign of law violation.

The General Department of Vietnam Customs also requested some local customs units direct their affiliated customs branches to work with the Anti-Smuggling and Investigation Department to conduct 100% physical inspections of all transit goods of some enterprises that show suspect signs to increase control of activities of taking advantage of transit for transporting counterfeit goods, goods infringing upon intellectual property rights.

At the same time, a number of units have been also requested by the General Department of Vietnam Customs to assess inspection and control against counterfeit goods and intellectual property infringement goods as well as proposed solutions in the future.

According to the Customs Control and Supervision Department, legal provisions on management policies and customs procedures for the type of goods in transit have basically met demand on development, while ensuring the customs management of goods transport activities subject to customs supervision.

However, the implementation of customs management for transit activities still contains some potential risks for subjects to take advantage of acts of violation and trade fraud. For example, goods in transit include goods imported conditionally or banned from import. After the goods leave the territory of Vietnam, enterprises try to import them back to Vietnam.

To strengthen the management of this type, the Customs Control and Supervision Department has advised the General Department of Vietnam Customs to direct the Customs Departments of the provinces and cities to implement.

Related News

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Policy adaptation and acceleration of digital transformation in tax and customs management

10:03 | 14/11/2024 Regulations

Dozens of fake HERMÈS bags intercepted in a border crackdown

15:28 | 20/10/2024 Anti-Smuggling

The rate of physical inspection at HCM City Customs accounted 3.7%

10:18 | 21/10/2024 Customs

Latest News

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

More News

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Your care

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations