Three big banks have great profits, but bad debts increase fast

| Bad debts at some banks have skyrocketed | |

| Banks reduce over 536 million USD worth of interest rates for pandemic-hit borrowers | |

| Banks dominate Top 10 most profitable enterprises in Vietnam in 2021 |

|

| BIDV's bad debt decreased slightly in nine months of 2021. Photo: BIDV |

Business segments are growing well

According to Vietcombank's consolidated financial statement for the third quarter of 2021, the bank had a pre-tax profit of VND5,738 billion, up 15.2% over the same period. Last year. Accumulated in nine months of 2021, Vietcombank's profit reached VND19,311 billion, up 21% over the same period in 2020.

Lending continued to be Vietcombank's main profit business with a nine-month net profit of VND31,605 billion, up 22.3% over the same period in 2020. Interest from service activities increased by 41.1%, reaching VND4,993 billion. Profit from foreign exchange business increased by 8%, gaining VND3,202 billion. Trading in securities saw a profit of VND118 billion while the same period last year suffered a loss of VND14.5 billion.

VietinBank, another “big bank”, also announced business results for the third quarter of 2021 with pre-tax profit of VND3,060 billion, up 5.6% over the same period last year. This bank's financial report showed that profit shrank in the third quarter as income from main activities, which are net profit and interest from service activities, slowed down, increasing by 8.7% and 9.3% respectively over the same period last year.

However, thanks to the high profit in the first quarter, accumulated for the first nine months of 2021, VietinBank's pre-tax profit reached VND13,910 billion, up 34.2% over the same period in 2020.

BIDV’s financial report for the third quarter of 2021 also recorded that the bank's main business segments all grew well. Net interest income reached VND12,204 billion, up 33.5%, mainly due to the bank's deep reduction in interest expenses (down 11.5%).

However, their other business activities declined. Trading securities saw a loss of VND2.4 billion while gained a profit of VND58 billion in the same period last year; net profit from buying and selling investment securities was only half of the same period last year, reaching VND151 billion; net profit from other activities reached VND794 billion, down more than 20% compared to the same period last year.

In nine months, BIDV still reported pre-tax profit of VND10,733 billion, up nearly 52%, while profit after tax was VND8,583 billion, a sharp increase of 51.5% compared to the same period in the first nine months of 2020.

|

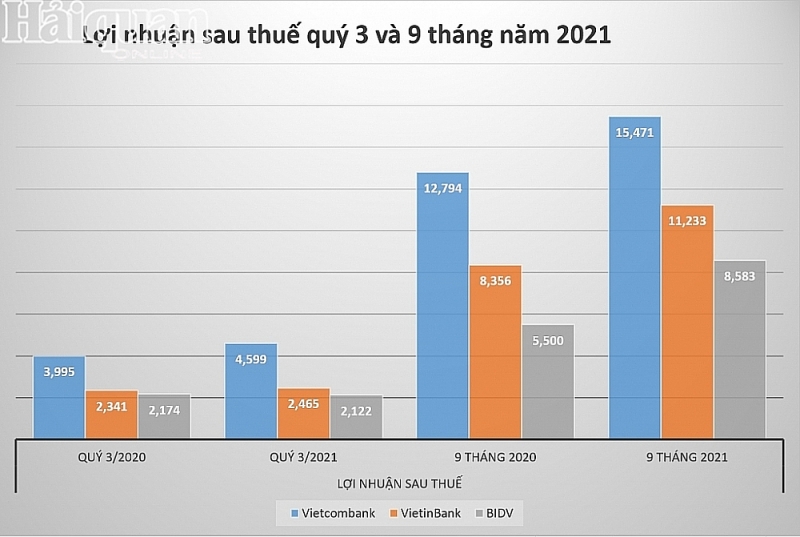

| The comparison of profit results of the three banks in the third quarter and nine months of 2020 - 2021. Chart: H.Diu |

Bad debts of Vietcombank, VietinBank both increased

However, the bad debt situation of these three "big banks" increased significantly. By the end of September 2021, Vietcombank’s bad debts reached VND10,884 billion, up 108% compared to the beginning of the year. The main reason is that debts in group 4 (doubtful debts) increased by four times in the third quarter and 14 times compared to the beginning of the year. Debts in group 5 (potentially irrecoverable debts) increased by 45%, reaching VND6,279 billion and accounted for 58% of Vietcombank's bad debt structure.

The volume of bad debts is increasing significantly, causing all three banks to sharply increase provision expenses compared to the same period last year. Vietcombank increased provision expenses by 33% to VND8,014 billion, VietinBank increased 22% to VND14,004 billion, and BIDV increased 44% to VND23,194 billion.

With this result, Vietcombank's bad debt ratio after nine months increased to 1.16% after a long time maintaining a bad debt ratio below 1%, around 0.6-0.8%.

Similarly, VietinBank’s total bad debts by the end of the third quarter was more than VND18,000 billion, nearly double compared to the same period last year. In which, although debts in the group 5 decreased by more than 40% to VND3,500 billion, debts in the group 4 suddenly increased to VND11,600 billion, nearly seven times higher than the same period last year. The ratio of bad debts to outstanding loans of VietinBank increased from 0.94% at the beginning of the year to 1.67% at the end of September 2021.

Bad debts at BIDV had a better situation when it went flat in nine months of 2021, reaching more than VND21,400 billion. However, BIDV’s debts in group 3 (sub-standard debts) increased by nearly 85%, reaching nearly VND4,404 billion. The group 4 debts also increased by about 28%, but potentially irrecoverable debts decreased by 16% to more than VND13,880 billion. This result helped BIDV's bad debt ratio decrease from 1.76% to 1.61%.

According to the latest data from the State Bank, from July 15 to the end of September, the total interest rate reduction of the three "big" banks was VND5,293 billion. In which, VND1,901 billion from BIDV; VND1,417 billion from Vietinbank; and VND1,975 billion from Vietcombank.

Related News

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

There is still room for credit growth at the end of the year

09:43 | 08/12/2024 Finance

Ho Chi Minh City achieves record state revenue of over VND500 trillion in 2024

10:33 | 10/12/2024 Finance

Vietnam's GDP growth forecast raised due to strong recovery trend

15:48 | 02/12/2024 Headlines

Latest News

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

More News

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Your care

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance