The paradox of an agricultural country spending billions of dollars to import raw materials for animal feed Part 1: Dependence on 70% of imported mat

Excessive dependence on imported feed materials is forecast to continue for a long time. To change this situation, it is necessary to have a comprehensive and methodical policy. Customs News conducted a series of articles to clarify the "picture" of import dependence as well as basic orientations and solutions to gradually reduce dependence in the future.

|

| Vietnam regularly imports a lot of corn for animal feed production while the corn area is decreasing. Photo: NT |

Vietnam is currently ranked 10th in the world and 1st in Southeast Asia in terms of industrial animal feed production. However, with the level of autonomy in feed materials only reaching about 30%, for many years, the dependence on imported animal feed ingredients has become a problem for Vietnam's livestock industry.

This situation has been causing the livestock industry to face many challenges, especially in unpredictable developments of the global economy and geopolitics.

Import value continues to increase

The import data of feed materials in the past few years showed a great dependence on import sources, with the main trend increasing.

The country's production of industrial animal feed in 2019 reached 18.9 million tons, and reached 21.9 million tons in 2021, up 15.9%. To meet the production of industrial animal feed, our country needs a large number of refined feed ingredients. In 2021, the whole country needed more than 33 million tons, of which the domestic supply was about 13 million tons (accounting for 40%), and the rest came from imports (22.3 million tons).

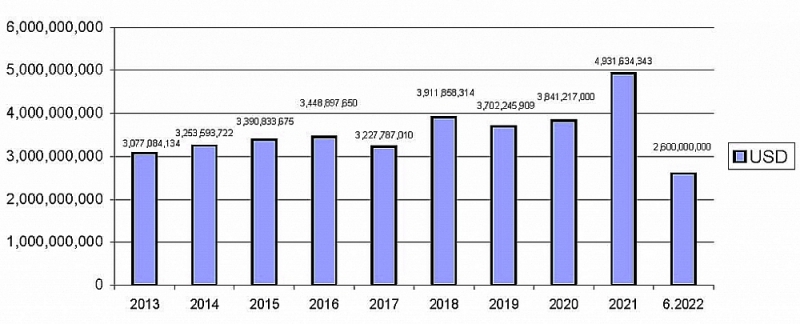

According to statistics of the General Department of Customs, from 2013, imports of animal feed and raw materials only decreased in two years, 2017 and 2019, and increased in the other years. Specifically, the import value increased steadily from more than US$3 billion in 2013 to more than US$3.25 billion in 2014; more than US$3.39 billion in 2015, and more than US$3.44 billion in 2016.

By 2017, import value decreased by 6.4% compared to 2016, reaching more than US$3.22 billion. In 2018, the import value increased sharply by 21.2% compared to 2017, reaching more than US$3.91 billion. In 2019, the import value reached more than US$3.7 billion, down 5.4% compared to 2018. After a decline in 2019, imports of animal feed and raw materials recorded a continuous increase from 2020 to the first six months of this year with import value reaching more than US$3.84 billion, more than US$4.93 billion, and more than US$2.6 billion, respectively.

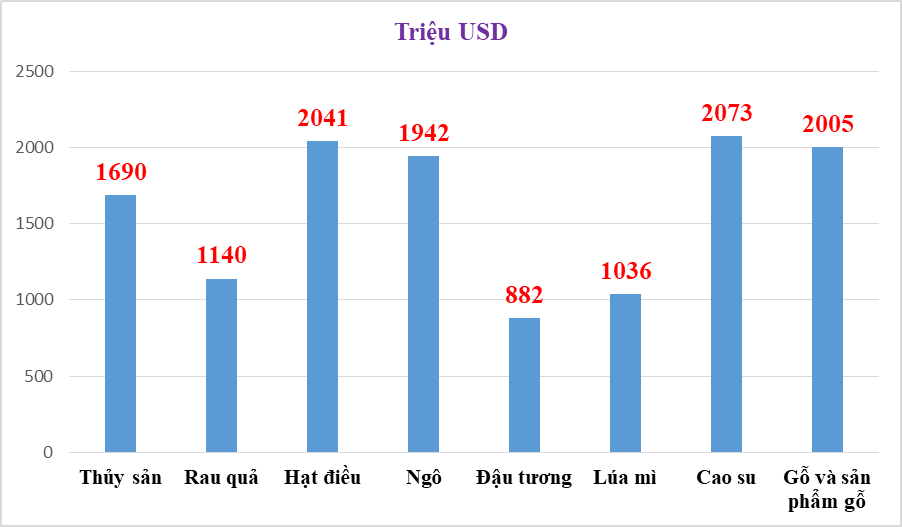

If the raw materials for animal feed are separated, information from the Department of Livestock Production (MARD) showed impressive figures. Specifically, imports of animal feed ingredients in the 2019-2021 period amounted to US$6.02 billion, US$6.06 billion, and US$7.9 billion, respectively.

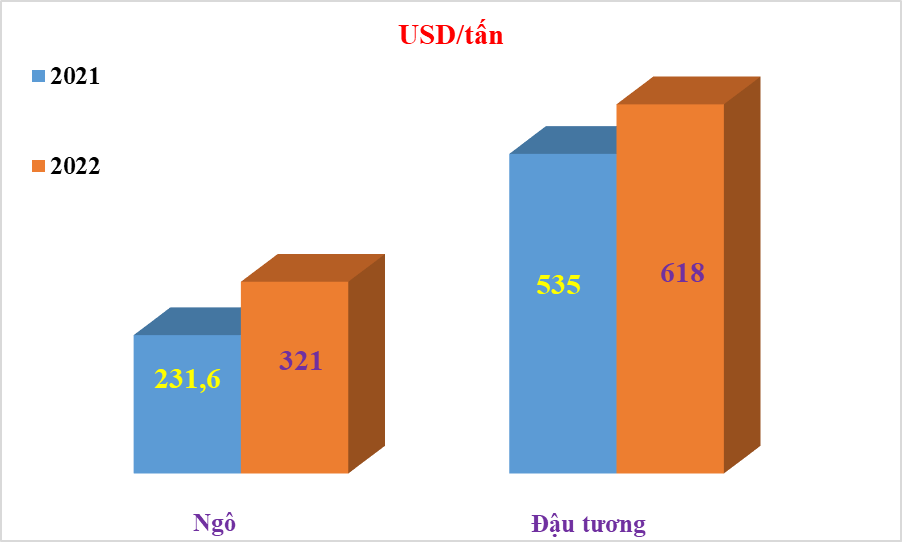

In the first six months of 2022, the whole country imported 8.5 million tons of feed materials (including aquatic products), worth US$3.7 billion (decreasing by about 33.11% in quantity and 8.9% in value over the same period in 2021). In which, corn was 3.7 million tons (decreasing by 52.3% in quantity and 14.71% in value); oilseed meal was 2.2 million tons (decreasing by 39.65% in quantity and 25.5% in value); DDGS (distillers dried grains with solubles or dry wine residue) was 0.43 million tons (down 39.8% in quantity and 17.3% in value); and wheat was 0.73 million tons (down 3.7% in quantity, up 24.26% in value).

Talking to Customs News, Nguyen Xuan Duong, Standing Vice Chairman of Vietnam Animal Feed Association, said that in the past 10 years, the amount of imported animal feed has continuously increased with an average increase of about 800,000-1 million tons/year. The dependence level on imported feed materials has been about 70%. In industrial animal feed production alone, the dependence level must be up to 85%.

Tong Xuan Chinh, Deputy Director of the Department of Livestock Production, admitted that the animal feed industry was heavily dependent on imported raw materials, mainly importing corn, soybeans, and oilseeds.

“If divided into three groups showing the dependence level on imported animal feed ingredients, including high, medium, and low groups, Vietnam belongs to the high group. The medium group includes Thailand, which is about 50-60% self-sufficient," said Duong.

Breeders are struggling

In the production of industrial animal feed, the price of raw materials usually accounts for about 80-85% of the production cost. Other costs such as fuel, depreciation, labor, loan interest, and salary account for about 10-15%. Being dependent on imported feed materials has made it difficult for Vietnam to control the price of animal feed. The livestock industry can easily fall into a passive state, especially amid unpredictable uncertainties such as political conflicts or pandemics.

Since the end of May 2022, the price of animal feed ingredients has been on a slight downward trend. Currently, prices of some main feed ingredients have decreased compared to the average in June 2022. Specifically, the price of corn kernels was VND8,600/kg (down 5.5%); soybean meal was VND14,050/kg (down 0.4%); DDGS was VND10,500/kg (equivalent); rice bran extract was VND5,550/kg (down 0.3%). It is forecast that in the future, the prices of some key raw materials may decrease but not by much.

Currently, the prices of complete compound feed tend to increase (because some businesses have not increased prices in May and June 2022, they had to use imported high-priced feed ingredients before). Specifically, complete compound feed for colored broiler chickens was VND13,000/kg (up 0.3%); complete compound feed for broiler pigs was VND13,350/kg (up 1.1%), and complete compound feed for white broiler chickens was VND13,800/kg (up 1.4%).

Tong Xuan Chinh said the price of animal feed has continuously increased since the end of 2020, especially since the beginning of 2022 due to the high world price of raw materials. The main reason was the conflict between Russia and Ukraine. These are two major wheat exporters in the world (accounting for about 30% of wheat, 20% of corn, and nearly 100% of sunflower seeds for global exports) but they have stopped exporting wheat, making global wheat prices soar. This has had a major impact on global food supply and prices, directly affecting the prices of corn, soybean meal (the main raw material for animal feed production), and other agricultural products on the global market and in Vietnam.

“Besides, some countries have had policies to suspend food exports to ensure domestic food security, which also reduces the supply and increases the price of feed materials in the world. This problem has caused many difficulties for businesses and breeders when production costs are high while the selling price of livestock products tends to decrease,” said Chinh.

Quach Thi Hoa, Director of Huong Nhuong Hill Chicken Cooperative (Huong Nhuong Commune, Lac Son District, Hoa Binh Province), said that the Covid-19 pandemic had caused stagnant production and difficult consumption when the chains of livestock products were broken, and farmers suffered losses. Meanwhile, since the end of 2020, the price of animal feed has increased continuously, making farmers face more and more difficulties.

“Due to the sharp increase in the price of animal feed, while the chicken price fell significantly and the output was difficult, as of July 2021, many members of the cooperative were forced to temporarily stop stocking. In 2017 - 2018, the price of 25kg-bran was VND270,000/bag. At that price, farmers made a profit of VND40,000 - 50,000/chicken, the lowest profit was also VND30,000/chicken. However, more than a year ago, the price of animal feed increased continuously, chicken farmers only broke even or even made a loss," said Hoa.

Nguyen Van Thanh, Director of Hoa My Cooperative (a high-tech pig farming cooperative with a scale of 3,000 sows, 1,700 commercial pigs/litter, with a turnover of more than VND10 billion/year) also said that the price of bran has increased too high, causing the sow herd size from 3,000 to be reduced to 1,500. As the first farmer to speak at the Prime Minister's Dialogue with Vietnamese Farmers in 2022 held at the end of May 2022 in Son La, Thanh asked the head of government: "What policies and measures will the government have to stabilize input prices and support farmers?"

|

| Chart: Import of animal feed and raw materials for the period 2013-2022. Illustration: M.H |

The risk of affecting food security

Being dependent on imported feed materials for years became a problem, spreading to the National Assembly. At the Q&A session, the 3rd session, the XV National Assembly took place in early June 2022, many National Assembly deputies questioned Minister of Agriculture and Rural Development Le Minh Hoan about this issue.

At the 6th session, the XIV National Assembly, delegate Tran Dinh Gia (Ha Tinh delegation) discussed that the increase in feed prices was due to the high increase in the feed ingredient corn.

That year, Vietnam imported 7 million tons of corn and by 2021, the number of corn imports was more than 10 million. Notably, Vietnam's corn area has decreased continuously since 2015 until now.

“Corn is Vietnam’s productive crop with advantages, people identify planting corn as a tradition. However, there was no policy to develop maize as a raw material for a long time. A product that has to continuously increase imports every year but the production area decreases is very worrying. Meanwhile, Vietnam has grown a lot of other agricultural crops, and even had to rescue them," said Gia.

Delegate Van Thi Bach Tuyet (HCMC delegation) also asked a question to the "leader" of the agricultural sector: “What solutions do the government and the agricultural sector have to develop raw material areas for livestock and poultry feed production to reduce imports, develop domestic production, contributing to control the price of livestock and poultry feed, as well as control the price of cattle and poultry meat in the future?"

In fact, concerns about the dependence on imported feed ingredients are not without reason. Because depending on raw materials from abroad not only causes obvious difficulties, such as price fluctuations on the world market, disturbing the domestic market, pushing farmers and livestock industry into difficulties but also causes other unpredictable consequences. Nguyen Xuan Duong said: "If being dependent too much on imported feed ingredients for a long time, in the event of instability, it can affect food security."

(Part 2: Fragmented production without vision)

Related News

Spending billions of USD to import agricultural products

10:26 | 03/09/2022 Import-Export

Price of imported corn and soybean increases while quantity falls

19:19 | 11/04/2022 Import-Export

Ready to ensure victuals for domestic market and exports

11:40 | 30/05/2021 Import-Export

Ensure balance between rice export and food security

14:29 | 22/04/2020 Import-Export

Latest News

Agricultural, forestry and fishery trade surplus value shoots up

10:54 | 23/11/2024 Import-Export

New export and business cooperation opportunities from "dual conversion"

10:53 | 23/11/2024 Import-Export

VN's food processing industry struggles to improve quality and value chain integration

15:53 | 22/11/2024 Import-Export

Approach strategy of the seafood industry when implementing UKVFTA

09:26 | 22/11/2024 Import-Export

More News

Mid-November: Vietnam's trade volume matches 2023 total, eyes record-breaking growth

09:25 | 22/11/2024 Import-Export

Vietnamese enterprises facing challenges from cross-border e-commerce platforms

14:32 | 21/11/2024 Import-Export

Vietnam, Malaysia eye new milestone in trade ties

14:29 | 21/11/2024 Import-Export

Shrimp exports surge in 10 months, generating 3.2 billion USD

14:27 | 21/11/2024 Import-Export

Vietnam’s exports to the U.S. near US$100 billion milestone

09:46 | 21/11/2024 Import-Export

From the “abnormal” coffee price, worries about the new crop

09:46 | 21/11/2024 Import-Export

What obstacles limit the market share of Vietnamese goods in the UK?

14:49 | 20/11/2024 Import-Export

Why seafood exports to some Middle Eastern Countries are stalled

14:47 | 20/11/2024 Import-Export

Storm No. 3 destroys profits of many insurance companies

14:45 | 20/11/2024 Import-Export

Your care

Agricultural, forestry and fishery trade surplus value shoots up

10:54 | 23/11/2024 Import-Export

New export and business cooperation opportunities from "dual conversion"

10:53 | 23/11/2024 Import-Export

VN's food processing industry struggles to improve quality and value chain integration

15:53 | 22/11/2024 Import-Export

Approach strategy of the seafood industry when implementing UKVFTA

09:26 | 22/11/2024 Import-Export

Mid-November: Vietnam's trade volume matches 2023 total, eyes record-breaking growth

09:25 | 22/11/2024 Import-Export