Storm No. 3 destroys profits of many insurance companies

|

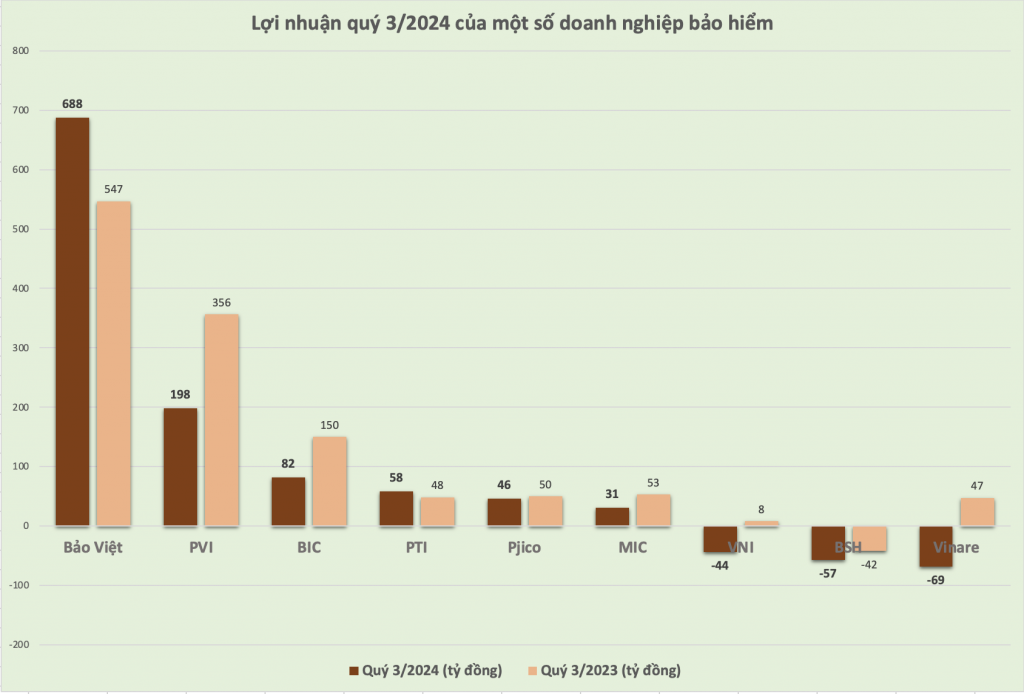

| Source: 9-month financial reports of insurance companies. Chart: H.Diu |

There are still signs of improvement.

According to the report of the Ministry of Finance, the insurance market currently has 85 insurance businesses, including 31 non-life insurance businesses, 19 life insurance businesses, 2 reinsurance businesses and 32 insurance brokerage businesses; 1 branch of a foreign non-life insurance business.

Total insurance premium revenue for the first 10 months is estimated at VND184,231 billion, down 0.3% over the same period last year. Of which, non-life insurance premium revenue is estimated at VND65,027 billion, up 12.6% over the same period last year; life insurance premium revenue is estimated at VND119,204 billion, down 6.17% over the same period last year.

Insurance benefit payments are estimated at VND 71,118 billion, up 23.36% over the same period last year; total investment back into the economy is estimated at VND 841,183 billion, up 12.6% over the same period last year.

The above growth rate shows that the insurance industry has recorded a clear recovery, as businesses have continuously implemented customer-oriented activities such as simplifying processes, introducing diverse products suitable for different segments, improving protection benefits, customer care, etc.

However, looking at the financial statements of each insurance company shows that there is a contrast in growth.

For the Bao Viet Group as the big corporation, the total revenue in the consolidated financial report for the first 9 months reached VND 42,122 billion. Consolidated pre-tax and after-tax profits reached VND 1,965 billion and VND 1,619 billion, respectively, up 14.7% and 13.4% over the same period in 2023.

In particular, in the financial report of the parent company Bao Viet Insurance Corporation, the revenue of life insurance business reached VND 982 billion, profit after tax increased by 23.3%. The non-life insurance business reached VND 250 billion in profit after tax, an increase of 40.1%. Thereby, the total revenue of Bao Viet Insurance reached VND 8,854 billion, an increase of 3.3%; profit after tax reached VND 250 billion, an increase of 40.1% compared to the same period in 2023.

Post and Telecommunication Insurance Corporation (PTI) recorded a strong increase when pre-tax profit in the first 9 months of 2024 nearly doubled compared to the same period last year to more than 316 billion VND. BIDV Insurance Corporation (BIC)'s profit increased slightly by 6% to more than 436 billion VND, but its profit in the third quarter of 2024 decreased sharply by 45% compared to the third quarter of 2023, to only 82 billion VND.

Storm No. 3 "washes away" profits

On the other hand, despite ranking second in pre-tax profit, PVI Insurance Corporation recorded pre-tax profit in the first 9 months of 2024 of more than VND 981 billion, down 6% over the same period last year. In the third quarter of 2024 alone, PVI's profit decreased by 44%. Also recording a slight decrease of 3% in the first 9 months of 2024 was Military Insurance Corporation (MIC), when its profit reached VND 207 billion. In the third quarter of 2024, MIC's profit also decreased sharply by 42%, recording VND 31 billion.

For Agricultural Bank Insurance Joint Stock Company (ABIC), in the third quarter of 2024, the Company recorded a pre-tax loss of VND 20.1 billion, a significant decrease compared to the same period last year when it reported a profit of VND 71.2 billion. In the first 9 months of 2024, ABIC's pre-tax profit reached VND 162.8 billion, a decrease of nearly 39% compared to the same period last year.

In addition, some insurance companies such as Vietnam Aviation Insurance Corporation (VNI) and Saigon - Hanoi Insurance Corporation (BSH) reported losses of VND 21 billion and VND 19 billion respectively in the first 9 months of 2024 while in the same period last year they still recorded slight profits.

According to the separate financial report of Vietnam National Reinsurance Corporation (Vinare), after the business performance in the second quarter of 2024 improved, in the third quarter of 2024, the net loss was nearly VND 51 billion. According to Vinare's explanation, the profit decreased due to a decrease in net profit from insurance business activities of more than VND 1,087 billion due to losses related to storm No. 3, which increased the insurance costs under Vinare's responsibility compared to the same period last year, mainly in property and engineering insurance.

This is also the main reason for the decline in Q3 profits of other insurance companies. For example, at ABIC, according to the explanation, the company's insurance business was heavily impacted when net profit from this activity decreased by 57%, to only VND 73.1 billion in Q3/2024. This happened in the context of insurance compensation costs skyrocketing to VND 294 billion, nearly double compared to the same period last year.

Statistics from ABIC show that the total number of the company's customers affected by this storm is up to 536 cases, including customers of parent bank Agribank. ABIC is expected to pay a total of 177 billion VND to settle compensation claims.

Or at VNI, the main reason for the loss is that the Company has made payments and advanced compensation for many cases damaged by storm No. 3. According to the latest update from VNI, the total amount of advances and guarantees that VNI has made is more than VND 11 billion.

Related News

Insurance companies adapt to e-commerce trends

09:30 | 11/09/2024 Import-Export

The trend of international business expansion of enterprises

08:54 | 11/08/2024 Import-Export

Businesses focus on building brands and increasing profits

10:05 | 04/07/2024 Headlines

Businesses focus on building brands in addition to increasing profit

10:40 | 26/06/2024 Import-Export

Latest News

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

More News

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export

Rice export prices drop, but decline expected to be short-term

08:10 | 17/02/2025 Import-Export

Key agro products expected to maintain export growth this year

08:08 | 17/02/2025 Import-Export

EU issues 12 warnings against Việt Nam’s food and agricultural exports

08:07 | 17/02/2025 Import-Export

Việt Nam to impose VAT on low-value express-imported goods

08:06 | 17/02/2025 Import-Export

Exchange rate risks need attention in near future

16:31 | 15/02/2025 Import-Export

Vietnam kicked off the year with a strong start in trade, exceeding US$63 billion in the first month

16:30 | 15/02/2025 Import-Export

Import and export turnover reaches about US$29 billion in the second half of January 2025

14:52 | 14/02/2025 Import-Export

Market edges up slightly as liquidity remains low

14:48 | 14/02/2025 Import-Export

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export