The output reduction of the Tax Incentive Program for automobile manufacturing and assembly has not been considered

|

| Enterprises must meet the output conditions to receive incentives under the Tax Incentive Program for automobile production and assembly. Illustration photo: ST |

Output - an important condition for businesses to invest in expanding production

Regarding the development of a Decree amending and supplementing a number of articles of Decree No.26/2023/ND-CP on Export Tariff Schedule; Preferential import tariff schedule; List of goods and absolute tax rates, mixed taxes, import taxes out of the tariff quota, the Ministry of Finance said, Vietnam Automobile Manufacturers Association (VAMA) and the People's Committee of Hai Duong province have issued an official dispatch to request considering Ford Vietnam Co., Ltd.'s proposal to adjust the output reduction of 2023 Tax Incentive Program.

According to the Ministry of Finance, the tax incentive program for automobile production and assembly is prescribed in Decree No.125/2017/ND-CP (amended and supplemented in Decree No.57/2020/ND-CP dated May 25, 2020, Decree No. 101/2021/ND-CP dated November 15, 2021) and recently Decree No. 26/2023/ND-CP dated May 31, 2023 (replacing other these Decrees). Conditions to participate in the Tax Incentive Program and apply the MFN tax rate of 0% for imported components and spare parts for automobile production and assembly are that the automobile manufacturing and assembly enterprise must have a Certificate of eligibility to produce and assemble cars issued by the Ministry of Industry and Trade and meet the conditions prescribed in the Decree (including conditions on components; conditions on vehicle models; conditions on output; conditions on emissions; conditions on incentive consideration period; conditions on documents and procedures).

In particular, businesses must meet the production conditions (including minimum general output for all types of vehicles and minimum specific output for each vehicle model) according to regulations for each vehicle group.

The Ministry of Finance said that the regulation on output conditions is to encourage businesses to invest and expand production scale. Businesses will not enjoy the Program's preferential policies if they do not meet the output conditions during the tax incentive consideration period (6 months or 12 months). Output conditions are an important and prerequisite condition for businesses to invest capital, expand production, and increase the localization rate, thereby contributing to bringing the auto industry in the right direction and policies of the Party and State.

Also according to the Ministry of Finance, in 2021, amid the impact of the Covid-19 epidemic, automobile manufacturing and assembling enterprises face many difficulties and cannot meet the output conditions of the Tax Incentive Program to apply the 0% tax rate on imported components and spare parts for automobile production and assembly. In that context, to remove difficulties for automobile manufacturing and assembling enterprises, the Ministry of Finance has submitted to the Government to promulgate Decree No.101/2021/ND-CP, in which, based on taking into account factors such as market trends and socio-economic conditions, the Decree has extended the application deadline of the Tax Incentive Program to December 31, 2027 and adjusted to reduce output in 2021 and 2022 of some vehicle groups under the Tax Incentive Program to suit actual conditions. At the same time, Decree No. 101/2021/ND-CP also does not raise the issue of increasing output conditions over the years, but stipulates that it remains stable for the entire period of 2022-2027. Currently, Decree No. 26/2023/ND-CP has also inherited the output regulations in Decree No. 101/2021/ND-CP.

Many policies support the automobile industry

In addition, recently, to continue supporting businesses to restore production and business, the Ministry of Finance submitted to the Government to promulgate Decree No.36/2023/ND-CP dated June 21, 2023 extends the deadline for paying special consumption tax for domestically produced and assembled cars and Decree No.41/2023/ND-CP dated June 28, 2023 regulating registration fee rates for cars, trailers or semi-trailers pulled by cars and vehicles similar to cars manufactured and assembled domestically (50% reduction in registration fees from July 1, 2023 to the end of December 31, 2023). Particularly, battery-powered electric cars have been exempted from registration fees for the first time within 3 years from March 1, 2022, and registration fees are applied at 50% of the rate for cars using gasoline and diesel that have same number of seats for the next 2 years. According to the Ministry of Finance, the Government has many policies to support the domestic automobile manufacturing and assembly industry, so VAMA's continued proposal to reduce output is not appropriate to the current situation.

Regarding the automobile manufacturing industry, Toyota Motor Vietnam Company proposes to add a number of spare parts and components to the List of group 98.49 to apply the preferential export and import tax rate of 0%. The Ministry of Finance said that according to regulations, imported auto components of businesses participating in the Tax Incentive Program that are subject to an import tax rate of 0% must be in group 98.49 and must be components that can not be produced domestically. The determination of components that cannot be produced domestically is based on the regulations of the Ministry of Planning and Investment on the List of raw materials, supplies, and semi-finished products that can be produced domestically. Currently, the items in group 98.49 in the List of basic regulated product groups are all items that cannot be produced domestically and have high scientific and technological content and complex manufacturing to promote the domestic automobile production, reducing production costs.

However, comparison with this List shows that there are a number of HS codes proposed by Toyota Motor Vietnam Company that have been domestically produced such as: 3926.90.99, 7326.90.99. At the same time, some HS codes proposed by Toyota Motor Vietnam Company have been included in group 98.49 such as 8708.99.62 and 8708.99.70. Because the Company only provides HS codes, without a specific description of the goods, the Ministry of Finance has no basis to specifically consider the Company's proposal. For raw materials, supplies, consumables or electronic components of cars (pipes, screws, bolts, racks, frames, accessories made of iron, steel or basic metal, etc), the Ministry of Finance proposes not to include the content of this group in group 98.49 to apply the import tax rate under the Tax Incentive Program because these are basic goods that can be produced domestically, so a policy is needed to protect domestic production; Simultaneously, products that the quantity used in the production and assembly of cars is difficult to determine as a basis for applying preferential tax rates.

According to the Ministry of Finance, the items that Toyota Motor Vietnam Corporation recommends are mostly domestically produced items, along with the list of group 98.49 that has been revised many times and is basically consistent with reality. Accordingly, the Ministry of Finance submitted to the Government not to add spare parts and components to the List of group 98.49 to apply the 0% tax rate as proposed by Toyota Motor Vietnam Corporation.

Related News

Automobile localization: rapid development from internal strength

07:44 | 31/12/2024 Headlines

To open the door for industrial processing and manufacturing products to demanding markets

08:54 | 11/11/2024 Import-Export

20,000 Chinese cars imported in 8 months

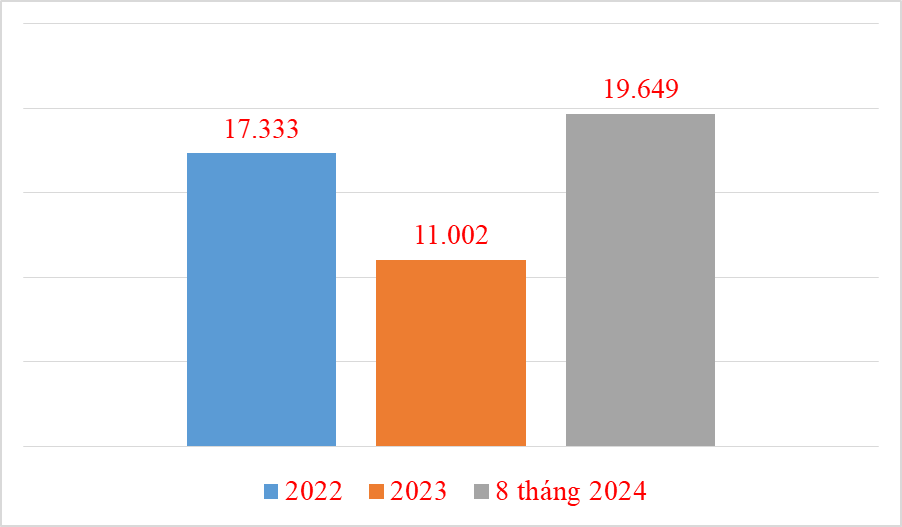

09:13 | 30/09/2024 Import-Export

Amending Law on Corporate Income Tax must ensure budget revenue and overcome tax evasion

08:58 | 25/09/2024 Finance

Latest News

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

More News

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations