Ministry of Finance suggests not implement 50% reduction in car registration fee

|

| A 50% reduction in registration fee collection for domestically manufactured and assembled cars can reduce state revenue on registration fees by about VND 8,000 - 9,000 billion. Photo: N.Ha. |

Impact on state budget revenue

According to the Ministry of Finance, reducing the registration fee by 50% for domestically manufactured and assembled cars also has shortcomings and limitations besides the achieved results. Accordingly, the 50% reduction in registration fees will affect localities' balance of state budget revenues. According to the provisions of the State Budget Law, the registration fee collection belongs to the local budget.

Information on the impact of the reduction of registration fees on state budget revenue, the Ministry of Finance said, according to statistics, the total registration fee collection for domestically manufactured and assembled cars in the last 6 months of 2020 (the implementation period of Decree 70/2020/ND-CP) was about VND 7,314 billion and from December 2021 to the end of May 2022 (the implementation time of Decree 103/2021/ND-CP) was about VND 8,727 billion. Thus, regarding policy, the state budget revenue has been reduced regarding registration fees, equivalent to VND 16.041 billion.

The 50% reduction in registration fee collection for domestically manufactured and assembled cars has increased the number of cars sold and registered, so the registration fee, VAT and excise tax may increase. However, the Ministry of Finance said that the actual VAT and excise tax revenues are concentrated in only eight localities: Vinh Phuc, Hai Duong, Hai Phong, Ninh Binh, Da Nang, Quang Nam, Binh Duong, and Quang Nam. Ho Chi Minh City (where there are domestic automobile manufacturing and assembling companies) and registration fee collection only increased in 11 localities; the remaining 52 localities all reduced revenue from this policy (localities already have requested the central budget to compensate for this revenue shortfall to ensure the balance of local budgets). Therefore, the continued implementation of a 50% reduction in the registration fee for domestically manufactured and assembled cars will impact the 2023 budget balance of many localities.

At the same time, the 50% reduction in registration fees policy will affect international commitments to which Vietnam is a member. It is suggested that this policy may not fully comply with the provisions of the National Treatment principle within the framework of the World Trade Organization (WTO) and free trade agreements (FTAs). Vietnam is currently a member of the WTO and has signed many bilateral and multilateral FTAs, in which it has committed to implement the principle of national treatment in trade and investment. Currently, tax, fee and charge policies in legal documents are applied uniformly between domestically produced goods and imported goods.

Therefore, the Ministry of Finance believes that the implementation of the policy of reducing the registration fee by 50% for domestically manufactured and assembled cars can be applied in the short term in the condition that in 2021-2022 most all countries are severely affected by the Covid-19 epidemic and also have many specific policy adjustments. However, if it continues to be implemented in 2023, WTO members may see this policy adjustment as a government subsidy, and some countries may not have automobile manufacturing and assembling activities in Vietnam and continue to send requests and complaints.

According to the Ministry of Finance, although Vietnam has not received any complaints from other countries, it has received many requests for policy explanations when there is a distinction in the application of policies between domestically manufactured and assembled cars and automobiles imported from countries that do not have domestic production or assembly activities in Vietnam.

At the Vietnam Business Forum, Vietnamese auto importers and Eurocharm proposed to reduce the registration fee by 50% for both imported cars to ensure signed international commitments. However, if this option is implemented, it can greatly affect the state budget balance of localities.

It is difficult to promote the effect of stimulating demand

According to the Ministry of Finance, in 2020 and 2022, the main cause of difficulties for the domestic automobile manufacturing and assembly industry is the disruption of the supply chain, leading to disruptions in the supply and demand for cars of the people is still high, not affected by an inflation factor.

In that context, the 50% reduction in registration fee collection for domestically manufactured and assembled cars under Decree No. 70/2020/ND-CP and Decree No. 103/2021/ND-CP has encouraged encourage manufacturers and distributors of domestically produced and assembled cars to resume supply chains to meet people's car buying needs. This caused the consumption of domestically manufactured and assembled cars to increase sharply, so the state budget revenue from registration fees, excise taxes, and VAT has offset the reduction in registration fee collection in terms of the policy.

However, in the current period, purchasing power and consumption are different from the context of 2020 - 2022; the people's demand to buy cars is assessed to be lower. Therefore, the continued implementation of the preferential registration fee policy for domestically manufactured and assembled automobiles in the current period is forecasted to be unlikely to promote the demand-stimulating and growth-promoting effects as in the previous period.

The increase in revenue from excise tax and VAT will not be achieved as in the previous period to compensate for the reduction in registration fees. According to the assessment, a 50% reduction in the registration fee collection for domestically manufactured and assembled cars can reduce the state budget revenue on registration fees by about VND 8,000 - 9,000 billion (in the first 6 months of 2022, the reduction in registration fee collection in terms of policies is VND 8,727 billion).

In addition, at the end of 2022 and the beginning of 2023, to be timely and proactive in implementing socio-economic development goals, the Ministry of Finance has been studying and proposing to competent authorities appropriate solutions to support businesses and people, including domestic automobile manufacturers and assemblers, with a total support package of about VND 186,700 billion (of which the tax exemption and reduction package is VND 65,500 billion and the tax extension package is VND 121,200 billion).

On the other hand, the Ministry of Finance is coordinating with ministries and branches to develop a decree on extending the excise tax on domestically manufactured and assembled cars according to a simplified order and procedures, with the expected tax amount to be extended being VND 11,200 billion.

Based on the above analysis, the Ministry of Finance submitted to the Government Standing Committee that a 50% reduction in registration fee collection for domestically manufactured and assembled automobiles hadn't been implemented.

| Ministry supports 50% cut on auto registration fees The Ministry of Industry and Trade (MoIT) said that it is necessary to devise a 50% cut ... |

In case the Government Standing Committee decides to reduce the registration fee by 50% for domestically manufactured and assembled automobiles, the Ministry of Finance is requested to assume the prime responsibility for and coordinate with relevant agencies in building the Government's Decree on registration fee collection for domestically manufactured and assembled cars (to reduce 50% of registration fee collection for domestically manufactured and assembled cars in 2023) ) according to the simplified order and procedures specified in the Law on Promulgation of Legal Documents and assign the Ministry of Industry and Trade to assume the prime responsibility for, and coordinate with relevant agencies in reviewing and developing response plans in case Vietnam is sued for violating international commitments.

Related News

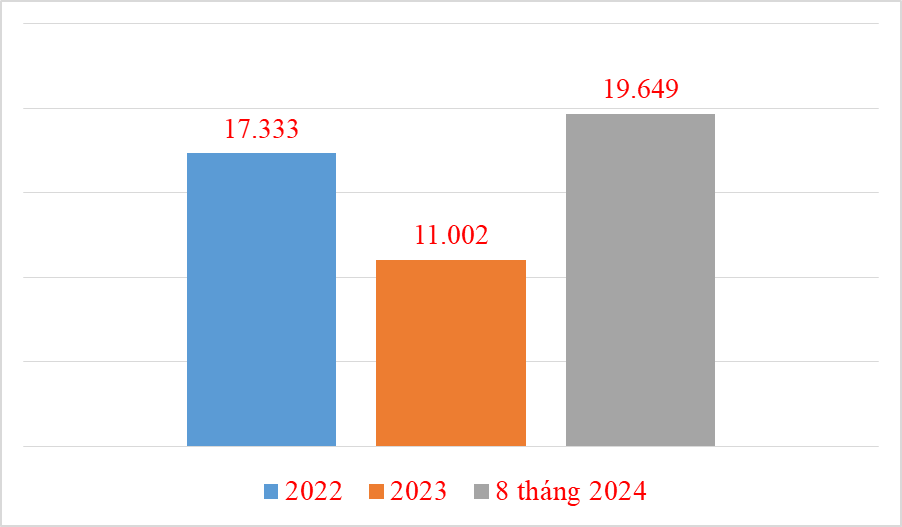

20,000 Chinese cars imported in 8 months

09:13 | 30/09/2024 Import-Export

From case of illegally importing three cars in Hai Phong: What are conditions for doing business of car import?

10:13 | 19/08/2024 Customs

Hai Phong Customs detects 3 smuggled cars hidden inside empty container

14:20 | 15/08/2024 Anti-Smuggling

Minister of Finance: continue to advise on promulgating fiscal policies to help economy recover and develop

15:15 | 08/07/2024 Finance

Latest News

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

More News

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Your care

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations