New mindset needed for insurance industry

|

| Chung Ba Phuong, chairman of TC Advisors |

The outbreak has frozen the global economy, with some governments having to impose tough measures and restricting the daily lives of hundreds of millions of people. For life and health insurance, the ongoing pandemic has spurred stronger needs for insurance because there is greater awareness of health and medical care and how important health is. The long-term health consequences on those who recovered is still uncertain, ranging from very severe lung and brain damage to minimal impact.

For the claim payment side, we see that those who test positive for the virus can require a very long-term, costly intensive care. Insurance contracts are paying a lot of benefits to cover these costs for customers. We tend to look at the revenue but not at how much benefits have been paid to help customers. After all, paying benefits is the most important job of the insurance contract.

Globally, people have stopped spending on things like alcohol, cigarettes, travelling, or fancy restaurants and spend more on essential needs such as healthcare and insurance. The downward trend, obviously, is due to lower income because of financial hardships. The global insurance industry has witnessed digital transformation which has also helped to address customers’ problems to soften the impact of COVID-19, with tailor-made solutions. Insurance benefits are also paid in a fast and professional manner.

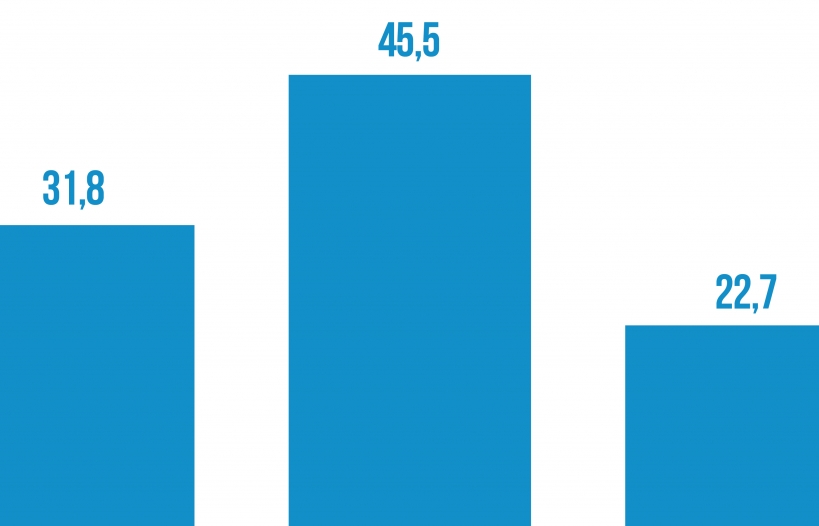

We can see that total fees, particularly new contract fees, are still increasing but at a much lower rate than in 2019. This means that people seem to be buying new contracts but not keeping their existing ones, leading to losses to the buyer.

There clearly is a trend towards lower persistency as many people abandoned their contracts because of mis-selling, including selling contracts with little life and health protection and much savings, the premiums of which of course customers have trouble paying. They do not see the value of paying such high premiums for little life and health benefits where their needs are increasing.

Also, for products where the savings element is large and return is based on the stock market, customers have suffered great losses. It is little wonder why sales still increase (slower) but abandonment rate continues to increase.

It has been noted that bancassurance is gaining much popularity, thus insurers are increasing their footprint in the market. It is no wonder insurance companies compete to give large upfront payments of hundreds of millions of US dollars so the banks can distribute insurance on their behalf.

COVID-19 is greatly highlighting the issues of poor agent quality and is helping the good companies differentiate themselves. On the flip side, insurers have spent a large amount in marketing campaigns and cooperating with banks to gain a bigger market slice, rather than training their skilled labour force. Consequently, this strategy is a chink in their armour, bringing about poor advice and wrong products being sold.

Wasting capital chasing sales is different from investing in good people, infrastructure, and brand building. Investing is very good but wasting capital chasing sales is not. Insurers would once again come up against a brick wall if they only pour more and more cash for marketing and sales. The waste of capital has been much more intense for agents who are not professional, ill-equipped with products and advice they give to customers, then abandon the customers after a sale and provide no services to them, especially during claim time.

Such scandals have made headlines many times. We have seen foreign insurers getting out of Vietnam such as Great Eastern of Singapore and Cardif of France (through its joint venture with VietinBank), to name a few. These companies are making big bucks in their home market but still got bogged down with their Vietnamese businesses.

There are a few solutions to address these issues. Money should be spent on building quality distribution, designing the right products, and having the best customer service and not on forcing sales that pressure customers to buy the wrong products.

The only change the industry needs to make – which is also the hardest – is to stop chasing sales and wasting capital. Many high-profile international corporations are enduring great financial difficulties due to bad investments and poor sales practices, and also due to massive losses on the non-life insurance side for companies that have both life and non-life operations.

Related News

Insurance creates trust and peace of mind for customers affected by typhoon No. 3

10:05 | 23/09/2024 Finance

Insurance brings peace of mind to customers during Yagi typhoon

20:34 | 17/09/2024 Finance

The insurance industry is expected to grow by 10 percent in 2024

08:27 | 04/08/2024 Finance

Under amended law, it needs clarification on cooperation between commercial banks and insurance companies

09:56 | 15/07/2024 Finance

Latest News

Launching virtual assistants to support taxpayers

17:50 | 23/11/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

More News

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Your care

Launching virtual assistants to support taxpayers

17:50 | 23/11/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance