Pressure to raise capital to get "priority" on credit

| Credit for real estate to be under stricter control | |

| Prime Minister requests strengthening of prevention and struggle against "black credit" | |

| Credit upgrade - great opportunity to attract investment |

|

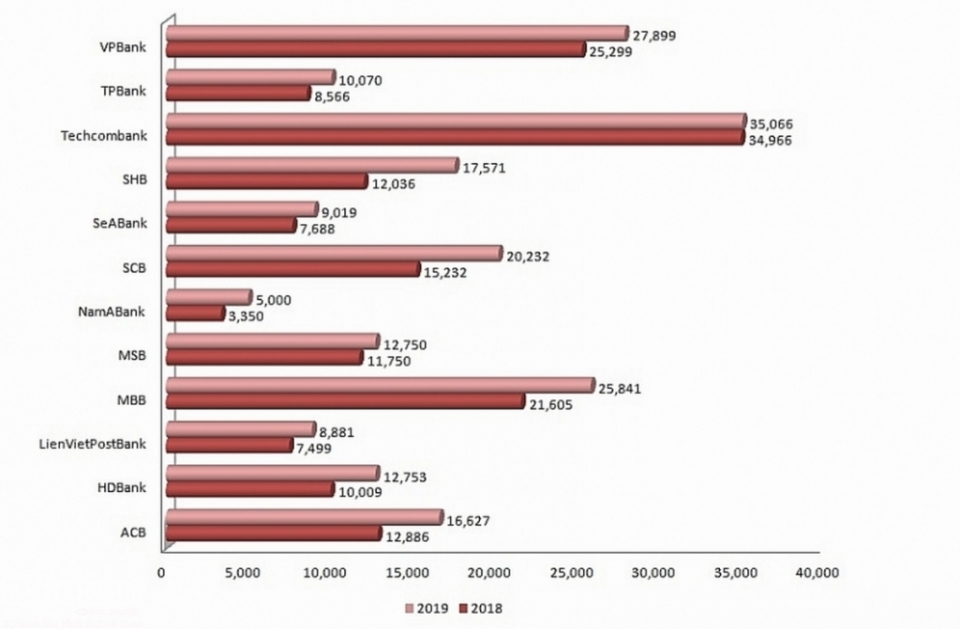

| The chart compares the capital increase of commercial banks in 2018 and 2019. Chart: H.Diu |

"Trillions" race

The shareholders' meetings of the banks recently approved a series of proposals related to capital increase. The main reason given by banks for approval is to follow Circular 41/2016/TT-NHNN stipulating the capital adequacy ratio for banks in line with Basel II standards, which will become effective in early 2020. According to the National Financial Supervisory Commission, in 2018, the average minimum capital adequacy ratio (CAR) of the credit institution system was improved, reaching 11.1%, due to its own capital increase of 12,2%, while the increase of total assets with risk was lower (about 10.8%). However, there are still many banks with modest CAR, but high demand for credit growth for the economy; it happens especially in commercial banks with state capital, which provide capital for large projects for the economy.

Meeting the capital adequacy ratio in line with Basel II standards also helps the banks to be given a higher credit limit by SBV. Currently, the general credit limit of the whole industry set by the State Bank for the year 2019 is about 14%, commercial banks that have not yet followed the Basel II standards will also have credit growth around this level. However, many leaders of commercial banks have expressed their desire to loosen the credit growth to around 20%, in terms of meeting the CAR regulations and Basel II standards.

Therefore, many banks have announced plans to increase their charter capital sharply. At Tien Phong Commercial Joint Stock Bank (TPBank), the AGM agreed to issue 100 million shares at a value of 10,000 VND/share, ensuring the target of increasing capital from 8,566 billion VND to 10,070 billion VND, equivalent to an increase of 18%. Vietnam Technological and Commercial Joint Stock Bank (Tehcombank) also decided to increase its charter capital to over 35,065 billion VND through the issuance of 10 million ESOP shares (shares issued to employees at Techcombank) at an issuing price of 10,000 VND/share. Saigon - Hanoi Commercial Joint Stock Bank (SHB) also increased its capital from over 12,000 billion VND to over 17,500 billion VND; the reason given by the Board of Directors of SHB was to meet Basel II standards and to meet capital needs for their business and development of financial companies as well as subsidiaries.

Saigon Commercial Joint Stock Bank (SCB) will also increase its charter capital from 3,000 to 5,000 billion VND, equivalent to 33%, by offering 500 million individual shares to existing shareholders who own 0.5% or more of the charter capital, and to domestic and foreign investors. Asia Commercial Bank (ACB) will also increase its charter capital in 2019 from dividends by issuing more than 374 million ordinary shares to existing shareholders from retained earnings after distributing profits in 2018 with a value of 10,000 VND/ share, the rate of exercising stock purchase rights is 30%. After the issuance, it is expected that ACB's charter capital will reach over 16,627 billion VND, up 29% compared to 2018.

Difficult for big banks

According to the State Bank's statistics, in the first quarter of 2019, the total assets of the whole system increased by 0.57%, the charter capital increased by 0.16% and the minimum capital adequacy ratio reached 11.57%. In particular, the profit in the first quarter of commercial banks was very positive; the liquidity remained in good condition. According to the survey results of the State Bank, most banks expected that their business results in the next quarter and the whole year would grow better than the previous year. This would facilitate the capital raising schedule of banks.

However, the above advantages are for commercial banks. For state-owned commercial banks, the “door” of capital increase is still quite narrow. Currently, only Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) has increased its capital by selling to foreign investors as of the end of 2018. At Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), the sale of 17.65% of the capital to investor KEB Hana Bank, the largest financial group in Korea, is still at the "completion of procedures" stage. The reason given by the BIDV leader is that there are some technical barriers and the expected price has not been agreed. This also depends on the market, investors' goodwill and Vietnamese regulations. Therefore, BIDV hopes that the management agencies will create the best conditions for them to be able to complete the transaction soon.

The bank facing the most difficulty in raising capital in the group of "Big 4" banks is Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank). Currently, CAR ratio of this bank has fallen to the minimum level, less than 8%, but its capital has not been increased since 2013. Therefore, VietinBank's credit growth in the first quarter was down to minus 0.44%, and it has to reduce its credit in the second quarter.

The Chairman of VietinBank, Mr. Le Duc Tho said, in 2019, the plan to increase the bank's equity was a very urgent requirement, so it was being submitted to the competent authorities for approval. There are two options: dividing all dividends in 2018 by shares at the rate of 8.03% (equivalent to 2,990 billion VND) and retaining all profits (nearly 2,997 billion VND) to increase the charter capital.

Recently, at the Government’s regular press conference, Deputy Governor of SBV Dao Minh Tu also mentioned difficulties in raising capital of the state-owned commercial banks, because these 4 state-owned commercial banks had a relatively fast credit growth of about 16%. He said that the SBV was proposing to immediately use the dividends of commercial banks in 2018 to increase charter capital, instead of paying budget; this would help their credit growth limit increase.

| Tightening credit criteria: Difficult for banks VCN- In order to control the amount of capital put into the economy safely as well as ... |

In general, the "picture" of capital increase of the banking sector is still quite bright, especially in the context that the whole industry has achieved many outstanding and sustainable development steps. However, making healthy and improved financial capacity in terms of scale, quality and efficiency, ensuring the safety of the system by increasing capital and enhancing the quality of capital needs to be paid more attention, and also offer more marketable solutions.

Related News

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

There is still room for credit growth at the end of the year

09:43 | 08/12/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Latest News

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

More News

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export

Binh Dinh province works to attract investment from Japan

15:44 | 19/12/2024 Import-Export

Agricultural, forestry and fishery exports “reach the target” early

15:20 | 19/12/2024 Import-Export

Thailand remains Vietnam’s biggest trading partner in ASEAN

15:35 | 18/12/2024 Import-Export

Rubber value soars in 2024: VRA

15:33 | 18/12/2024 Import-Export

Vietnamese businesses struggle to access green finance

09:58 | 18/12/2024 Import-Export

E-commerce: a gateway to boost Vietnamese commodities in the UK market

16:55 | 17/12/2024 Import-Export

Agro-forestry-fisheries exports top 62 billion USD in 2024

16:51 | 17/12/2024 Import-Export

Removing “bottlenecks” for digital transformation in industrial production

10:00 | 17/12/2024 Import-Export

Your care

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export