Practical requirements for management of corporate bond market

| Government urges caution on corporate bond risks | |

| New regulations about corporate bond issuance | |

| Corporate bond market to boom in second half |

|

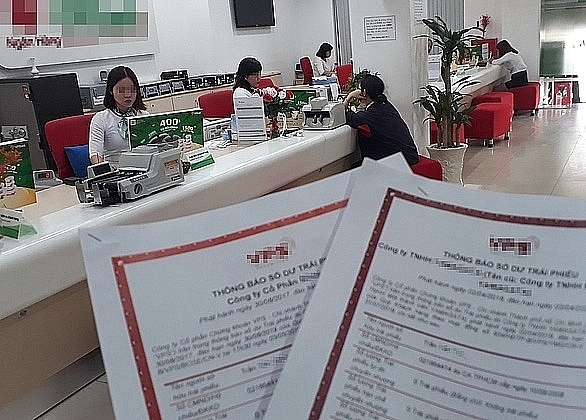

| The size of the corporate bond market has increased sharply in recent months. Photo: Internet |

Potential risks

The corporate bond market has seen rapid growth in size, by the end of July, it was equivalent to 11.2% of GDP in 2019. Although the corporate bond market is still small compared to some countries in the region, the rapid development of the corporate bond market has also posed a number of risks.

Enterprises, including small enterprises and real estate enterprises, promote the mobilisation of bond capital for production, business, project investment and development. If the operations of enterprises are in trouble, enterprises will not be able to pay principaland interest, causing market instability. If bond investors do not analyse and evaluate risks, but invest in bonds only for high interest rates, they will face a risk of losing capital when enterprises cannot fulfill their obligations of payment of principals and interests. Corporate bonds distributors, warrantors and issuers (possibly commercial banks, securities companies) are at risk of failing to fulfill their obligations and commitments to investors according to the bond terms and conditions due to failure to meet regulations on financial safety norms as prescribed by specialized laws.

According to Nguyen Hoang Duong - Deputy Director of the Department of Banking and Financial Institutions under the Ministry of Finance, the policyon the issuance of corporate bonds has been improved to support enterprises to raise capital and increase transparency and reduce market risks. Whileenterprises promote the issuance of bonds to raise capital and small and individual investors canstill buy privately issuedcorporate bonds, the Ministry of Finance has submitted to the Government to issue Decree No. 81/2020 / ND-CP to amend Decree No. 163/2018 / ND-CP to improve standards and conditions on issuance; control the volume of bonds under private issuance method; stipulate time between issuance period of a minimum of six months; standardised issuance documents; request enterprises to disclose specific information on the purpose of bond issuance to facilitate bond investors' supervision; to strengthen information disclosure and the reporting regime.

In addition, the revised Securities Law and the revisedEnterprise Law were issued and will come into effect from January 1, 2021, unifying the private placement of corporate bonds of enterprise types and distinguishing private issuance from issuance to the public.Individual corporate bonds are only issued and traded among professional securities investors. The Ministry of Finance is developing decrees guiding the issuance of corporate bonds to the public and private issuance for implementation from the start of next year.

Supervision and management has been strengthened through interdisciplinary inspections. In addition, the Ministry of Finance will work with the State Bank and the National Financial Supervisory Commission to strengthen inter-agency supervision in the financial market andrequest the State Bank to strengthen management and supervision of issuance, transaction and service supply of corporate bonds of credit institutions.

Regulations improved

The phenomenon of some enterprises issuing bonds in large volumes and high interest rates has still taken place recently. Information about these enterprises has been provided by the Ministry of Finance to the State Bank for the joint management and supervision of credit granting. In addition, the State Securities Commission and units of the Ministry of Finance have also strengthenedmanagement of the issuance, investment and provision of services related to the issuance of corporate bonds by securities companies. In the near future, inter-ministerial inspection delegations will be established to inspect the issuance, service provision, investment and transactions of corporate bonds in compliance with the law.

According to Nguyen Hoang Duong, the Securities Law 2019 and the Enterprise Law 2020 will take effect from January 1, 2021, and the Ministry of Finance is urgently developing decrees and circulars to create a unified and synchronous legal framework for corporate bond issuance and transaction. The issuance to the public will be associated with credit rating, credit rating cases and the application of a roadmap of credit rating will be guided by the Government.

| People should not buy corporate bonds due to high interest rates: Ministry of Finance VCN- The Ministry of Finance has made recommendations for bond issuers, investors, and bond distributors when investing, ... |

For individual corporate bonds, only professional securities investors can participate in trading these bonds. The draft decree prescribes the organisation of a private corporate bond trading market for professional securities investors at the stock exchange to have full information from the issuance to the trading of bonds, and to increase the liquidity of bonds.

| Decree No. 163/2018 / ND-CP of the Government regulating corporate bond issuance adds regulations on restricting transactions within one year from the date of issuance to distinguish private issuance from issuance to the public; improved the mechanism of information disclosure and establishment of a website on individual corporate bonds; required bonds to be registered and deposited to control investors and limit bond transactions. |

Related News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Vietnam Customs kicks off campaign for innovation, breakthrough, and growth

14:15 | 21/01/2025 Customs

Complying with regulations of each market for smooth fruit and vegetable exports

13:06 | 09/01/2025 Import-Export

Request for price management and stabilization, avoiding unusual fluctuations during Tet 2025

13:56 | 30/12/2024 Headlines

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Minister of Finance Nguyen Van Thang works with GDVC at the first working day after the Tet holiday

14:43 | 04/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance