Officially submit to the Government the Decree to reduce 50% of registration fees for domestically manufactured and assembled cars

| MoF proposing 50% registration fee cut for domestically assembled and produced cars | |

| New regulations on the calculation of registration fee | |

| Ministry supports 50% cut on auto registration fees |

|

| The Ministry of Finance proposes that from the effective date of this Decree to the end of December 31, 2023, the registration fee shall be equal to 50% of the current rate. Photo: Nguyen Ha. |

Accordingly, in Report No. 119/TTr-BTC dated June 20, 2023, to the Government on the project of the Government's Decree stipulating the level of the registration fee for automobiles manufactured and assembled in Vietnam, the Ministry of Finance shall submit to the Government for the first time the rate of the registration fee for domestically manufactured and assembled automobiles as follows:

From the effective date of this Decree to the end of December 31, 2023, the registration fee shall be equal to 50% of the tax rate specified in the Government's Decree No. 10/2022/ND-CP dated January 15, 2022, regulating on registration fee and current resolutions of the People's Council or current decisions of the People's Committees of provinces and municipal cities on the local registration fee and documents on amendments, supplements, and replacement (if any).

From January 1, 2024, onwards, the registration fee will continue to comply with the provisions of Decree No. 10/2022/ND-CP dated January 15, 2022, of the Government on regulations on registration fees and current resolutions of the People's Council or the current decision of the People's Committee of the province or municipalities on the rate of registration fee in the locality.

Implement Resolution No. 88/NQ-CP of the Government on the Regular Government Meeting in May 2023 online with the locality; implementing the direction of Deputy Prime Minister Le Minh Khai in Official Letter No. 4019/VPCP-KTTH dated June 1, 2023, and Official Letter No. 4174/VPCP-KTTH dated June 7, 2023, of the Office of the Government, Ministry Finance has developed the decree project according to the order and simplified procedures specified in the Law on Promulgation of Legal Documents.

The decree project has been sent to ministries, branches, localities, the Vietnam Federation of Trade and Industry, organizations and individuals, and the Ministry of Finance has studied, absorbed, commented and finalized project documents. On this basis, the Ministry of Finance has sent an official dispatch to request the Ministry of Justice's appraisal opinion on the decree project. On June 20, 2023, the Ministry of Justice issued Appraisal Report No. 107/BCTD-BTP on the decree project. The Ministry of Finance has studied, received and explained the appraisal opinions of the Ministry of Justice and has officially submitted to the Government the project of the Government's Decree on the rate of the registration fee for domestically manufactured and assembled automobiles.

Regarding the impact on consumers, manufacturers and distributors of domestically manufactured and assembled automobiles and socio-economics, the Ministry of Finance said, in Appraisal Report No. 107/BC-BTP dated June 20 2023, on the Decree project, the Ministry of Justice agreed on the necessity of promulgating documents; the conformity of the draft Decree with the Party's guidelines, and the State's policies; the constitutionality, legitimacy and consistency of the draft Decree with the legal system; feasibility of the draft Decree; the necessity, rationality and cost of compliance with administrative procedures; the mainstreaming of gender equality in the draft Decree as well as the order and procedures for drafting the Decree.

Regarding the compatibility with relevant international treaties, the Ministry of Justice requests the drafting agency to carefully review Vietnam's commitments in relevant international treaties to which Vietnam is a member that has the principle of national treatment, from which to report to the Government for consideration and decision. In addition, the agency in charge of drafting is requested to prepare plans and arguments in case of international complaints or lawsuits.

In this regard, the Ministry of Finance said that the Ministry of Finance had assessed the impact on international commitments to which Vietnam is a member and the possibility that Vietnam may be consulted and sued.

However, according to the Ministry of Industry and Trade, the possibility of Vietnam being sued is not high and Vietnam has not received any comments or objections from WTO members or trading partners within the frameworks that Vietnam has participated in.

According to the Ministry of Finance, along with the general difficulties of the economy, the domestic automobile manufacturing and assembly industry also has many difficulties. According to the Vietnam Automobile Manufacturers Association (VAMA), although there is a significant improvement in supply, the situation of the auto industry in the first quarter of 2023 is still difficult, the sales declined, especially in the last months of 2022 (the time of the Lunar New Year), shows unusual and ominous signals for businesses in the Vietnamese auto industry.

Sales in the last 2 months of 2022 decreased sharply, especially sales in January 2023 decreased by 44% compared to the same period last year and decreased by 51% compared to the previous month. Total sales of VAMA members until the end of May 2023 decreased by 43% compared to last year.

To contribute to stimulating consumption and removing difficulties for domestic automobile manufacturing and assembling enterprises in the economy still facing many difficulties and challenges, the continued implementation of reducing the registration fee for domestically produced and assembled cars is one of the essential solutions.

The 50% reduction of the registration fee for automobiles manufactured and assembled domestically has contributed to financial support for people and businesses by directly reducing the cost of car ownership registration, thereby stimulating meet demand, promoting people and businesses to purchase domestically manufactured and assembled cars to serve consumer and business needs.

| Proposal to extend the deadline for paying excise tax in 2022 for domestically manufactured and assembled automobiles |

Thereby supporting manufacturers and distributors of domestically manufactured and assembled cars to consume their inventory of cars since the outbreak of the Covid-19 epidemic. At the same time, it is necessary to encourage domestic automobile manufacturers and assemblers to step up the production and assembly of new cars to put on the market, improving the competitiveness of domestically manufactured and assembled cars to meet the demand of the domestic market, aiming to export to the ASEAN region.

Related News

Proposal extending 50% green tax cut for fuel products in 2025

09:32 | 07/11/2024 Regulations

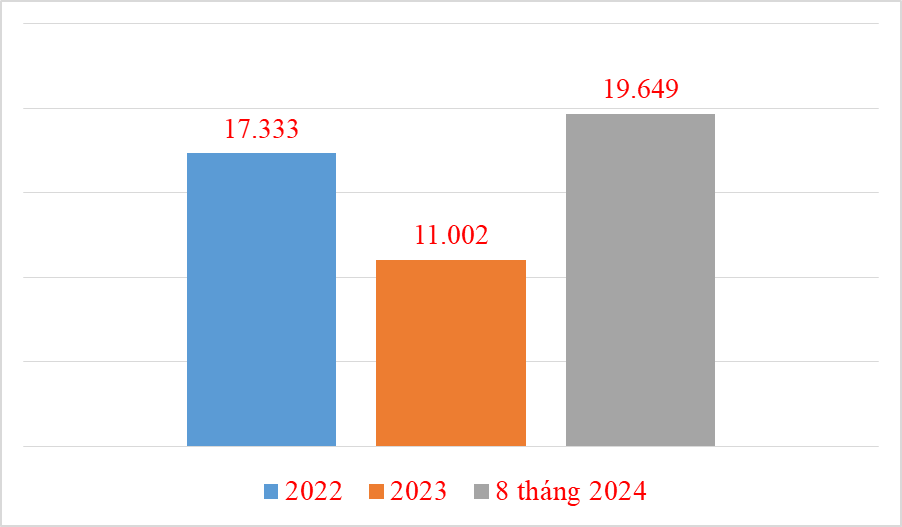

20,000 Chinese cars imported in 8 months

09:13 | 30/09/2024 Import-Export

From case of illegally importing three cars in Hai Phong: What are conditions for doing business of car import?

10:13 | 19/08/2024 Customs

Hai Phong Customs detects 3 smuggled cars hidden inside empty container

14:20 | 15/08/2024 Anti-Smuggling

Latest News

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

More News

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Your care

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations