MoF proposing 50% registration fee cut for domestically assembled and produced cars

|

| The MoF has proposed registration fees for domestically assembled and produced cars being 50% of the current rate. Photo: HP |

Positive impacts of registration fee reduction

According to the MoF, the pandemic has severely affected industries including the domestic auto assembly and manufacturing industry due to disruptions of supply chains and decline in consumer demand.

To remove difficulties for domestic auto assemblers and manufacturers amid the Covid-19 pandemic, the Government issued Resolution 70/2020 dated June 28, 2020 on registration fees for domestically assembled and produced cars until December 31, 2020. Under the resolution, the registration fees for domestically assembled and produced cars from June 28, 2020 to until December, 31 2020 are cut by 50% specified in Decree 20/2019 dated February 21, 2019.

This reduction has brought positive impacts. Accordingly, the consumer will pay fewer fees for car ownership registration, raising consumer demand, especially those who have high average income, thereby stimulating consumption, the MoF said.

For domestic auto assemblers and manufacturers, the reduction has helped them sell cars in stock since the Covid-19 pandemic broke out as well as restore supply chains and boost production.

In contrast, the State revenue from registration fees for domestically assembled and manufactured cars dropped VND7,314 billion in the last six months of 2020 resulting from the 50% reduction in registration fees for domestically assembled and manufactured cars under Resolution 70.

However, this figure was still VND1,600 billion higher than the first six months of 2020 as the number of cars sold in the second half of 2020 doubled that of the first six months.

In addition, the 50% reduction in registration fees increased the sales volume of domestically assembled and manufactured cars, raising revenue from value added tax and special consumption tax.

Proposing 50% cut of current registration fees

Given the above positive impacts, the MoF said to continue removing difficulties for domestic auto assembly and manufacturing enterprises amid negative effects of the Covid-19 pandemic and boost consumer demand, the promulgation of a Decree on reduction in registration fees for domestically assembled and manufactured is necessary and reasonable.

“The decree is issued to stimulate domestic consumption, further support and reduce difficulties for domestic auto assembly and manufacturing enterprises amid the Covid-19 pandemic, contributing to accelerating social-economic recovery after the pandemic,” the MoF said.

To achieve the above-mentioned goals and follow the opinion of the Government Standing Committee at the meeting on October 20, 2021, the MoF shall submit to the Government regulations on registration fees for domestically manufactured and assembled cars being 50% the current rate, which will take effect from November 15, 2021.

The MoF plans to put the decree into force from November 15, 2021 until May 15, 2022. However, if the decree is signed and promulgated by the Government after November 15, 2021, the ministry shall propose the Government for enforcement from December 1, 2021 to May 31, 2022.

The Ministry of Finance affirmed that the extended reduction of 50% of registration fees for domestically manufactured and assembled cars will help stimulate consumption demand, encourage domestic automobile manufacturing and assembly enterprises to restore supply chains, expand investment in automobile production and assembly in Vietnam and raise total state budget revenue.

Conversely, the MoF also said the extended application of preferential policies on registration fees for cars manufactured and assembled in the country for a short period (as applied under the provisions of Decree 70/2020/ND-CP) to support the domestic automobile manufacturing and assembly industry in the context of the Covid-19 pandemic may not fully comply with the provisions of the WTO General Agreement on Tariffs and Trade, and Vietnam will receive requests for explanation from a number of countries that do not have domestic production or assembly activities in Vietnam.

However, the preferential policies are valid for six months. This is considered a short-term support measure to remove obstacles and difficulties for the domestic automobile manufacturing and assembly industry to respond to negative impacts of the Covid-19 pandemic.

Besides, the major automobile manufacturers and assemblers of many countries in the world almost all have production and assembly factories in Vietnam, even these factories have large capacity (Toyota, Mazda, Hyundai, Kia).

Thus, these preferential policies will also benefit major car manufacturers. The 50% reduction in registration fees for domestically produced and assembled cars not only has a positive impact on domestic automobile manufacturing and assembling enterprises, but also foreign enterprises that have factories in Vietnam.

Moreover, due to the benefits from these policies, a few foreign enterprises have been planning to step up assembly activities and expand production lines in Vietnam to supply the market.

Related News

Proposal extending 50% green tax cut for fuel products in 2025

09:32 | 07/11/2024 Regulations

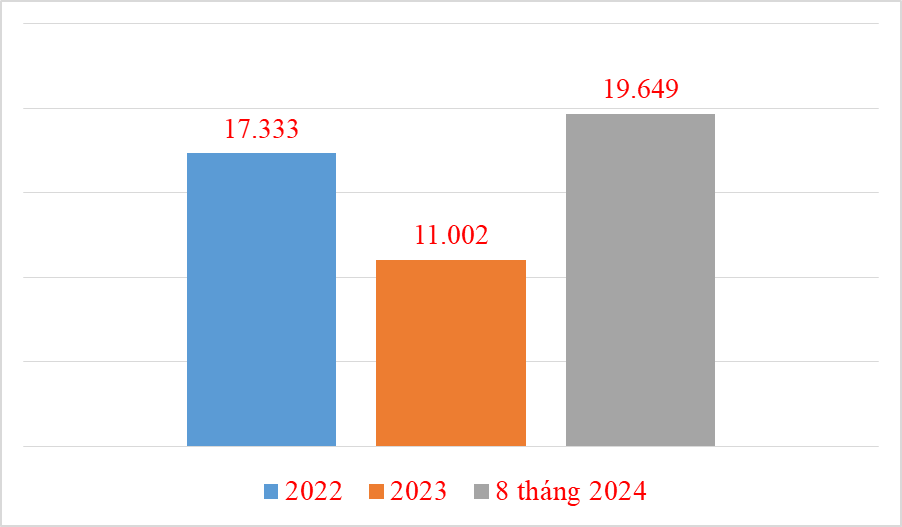

20,000 Chinese cars imported in 8 months

09:13 | 30/09/2024 Import-Export

From case of illegally importing three cars in Hai Phong: What are conditions for doing business of car import?

10:13 | 19/08/2024 Customs

Hai Phong Customs detects 3 smuggled cars hidden inside empty container

14:20 | 15/08/2024 Anti-Smuggling

Latest News

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

More News

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Your care

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations