Not to worry about rising rate

| State Bank of Vietnam: The exchange rate is performing quite normally. | |

| Foreign exchange market: bumpy ride in next few months | |

| Reference exchange rate sinks VND6 |

|

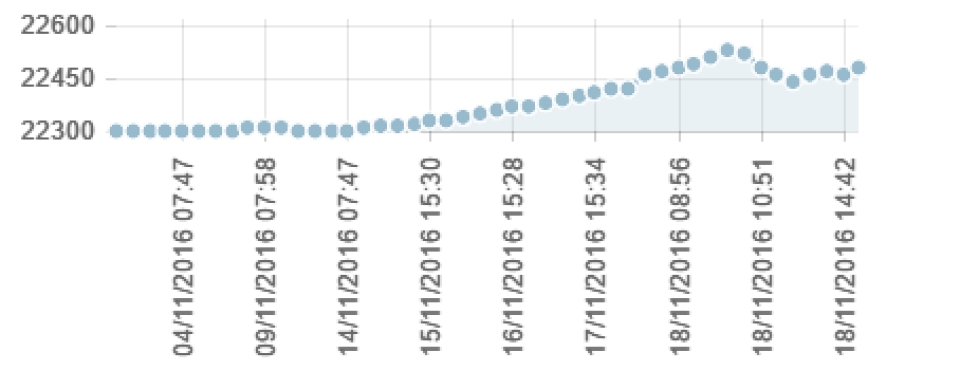

| The exchange rate’s path since the beginning of November to the afternoon of 18/11. Source: Eximbank |

After a long quiet period, the foreign exchange market has been "hot" again with the rapid raisingof the USD.

According to economic expert Dr. Dinh Tuan Minh, Institute of Science and Technology Policy and Strategy, a member of the Consultative Group on macroeconomics of Economic Committee of Congress, the vnd/USD exchange rate increased swiftly due to the impact of end-year season factors where ordinary import was increasing. Moreover, the volatility of the economy and world politics such as a high probability that the FED will raise the USD rate, the results of the US presidential election also make dollar price hikes, accompanied by a number of other currencies such as the Japanese Yen, Euro have also increased, while the price of the Yuan fell sharply to its lowest level over last 8 years.

Moreover, experts said, although the exchange rate is growing strongly, but incomparison with an increase of 2015, the path of the exchange rate in 2016 is still much "weaker".

In a report of Bao Viet Securities JSC (BVSC) compared to the beginning of 2016, the central rate has increased by nearly 1%, while in 2015, the State Bank of Vietnam (SBV) had had the exchange rate adjusted in a range of up to ± 3%.

In a published statement on the exchange rate developmentover the last few days, the State Bank pointed out that foreign currency supply and demand hadcontinued to have positive development by dint of being supported from sources such as the disbursement of foreign direct investment, capital inflows from the purchase and sale, merger, remittances activities in end of the year.

Foreign currency demand does not havethe pressure to increasesince the credit continues to be controlled at a reasonable level by the State Bank; part of the foreign currency demand of customers will be met by foreign currency credit of the banking system as the State Bank continues to extend foreign currency loans until the end of 2017; the flexible exchange rate handling in both directions has reduced speculation of foreign currency status.

In particular, Dr. Minh Dinh Tuan said that in the past year, the State Bank has accumulated a large amount of foreign exchange reserve, up to $US 40 billion, in order to be able to launch the intervention in case of necessity. Therefore, with the general administration of the Government focused on macroeconomic issues, we must ensure that inflation does not exceed 5%, then the sharprate rise over the last period of time is not a problem, this is the rule of the market context and the market itself will manage.

To enterprises, if the exchange rate development continues to have upward adjustment in the long term, this would be good news for exporters as getting lots of benefits from exchange rate differences. But with importers and enterprises which are borrowing in foreign currency, this is a bad news and the solution needs to be figured out.

| Brexit does not impact on public debt |

However, according to Mr.Phu Ngoc Trinh, Deputy Director of Ho Guom Garment JSC, since contractswere signed prior with the fixedprice at the time of signing, therefore no matter how wildly the exchange rate fluctuates, there would be no effect at all.

This is also thesigning, business perspective and method of import and export businesses today. Many businesses also said that they had already boughtexchange rate insurance or pre-agreed with partners on the exchange rate in the payment. Moreover, with the volatility of the exchange rate, enterprises should pay attention to derivative instruments of credit institutions.

Related News

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

Managing price effectively, reducing pressure on inflation

12:09 | 04/10/2024 Finance

Pressure on exchange rate plunges

18:02 | 01/09/2024 Finance

Inflationary pressure seen from monetary policy

09:47 | 21/07/2024 Finance

Latest News

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

More News

Striving for average CPI not to exceed 4%

16:41 | 01/11/2024 Finance

Delegating the power to the government to waive, lower, or manage late tax penalties is suitable

16:39 | 01/11/2024 Finance

Removing difficulties in public investment disbursement

09:30 | 31/10/2024 Finance

State-owned commercial banking sector performs optimistic growth, but more capital in need

09:28 | 31/10/2024 Finance

Stipulate implementation of centralized bilateral payments of the State Treasury at banks

09:29 | 29/10/2024 Finance

Rush to finalize draft decree on public asset restructuring

09:28 | 29/10/2024 Finance

Inspection report on gold trading activities being complied: SBV

14:37 | 28/10/2024 Finance

Budget revenue in 2024 is estimated to exceed the estimate by 10.1%

10:45 | 28/10/2024 Finance

Ensure timely and effective management and use of public asset

11:31 | 27/10/2024 Finance

Your care

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance