New policy boosts insurance market's long-term development

|

An office of Bảo Việt Insurance Corporation in Hà Nội. By the end of May 2022, the total insurance premium revenue of the insurance market reached nearly VNĐ94.28 trillion, up 16 per cent over the same period last year. Photo mof.gov.vn

The newly-issued Law on Insurance Business is expected to positively impact the insurance market's long-term development.

The National Assembly on June 16 passed the amended Law on Insurance Business, with 94.2 per cent of delegates voting in favour. The revised law will enter into effect on January 1, next year.

The Law stipulates the organisation and operation of insurance companies, the rights and obligations of organisations and inpiduals participating in insurance, and State management of insurance business activities.

According to the Ministry of Finance (MoF), the country currently has 77 insurance companies, including 31 non-life insurance companies, 19 life insurance companies, two reinsurance companies, 24 insurance brokerage companies and a branch of a foreign non-life insurance company.

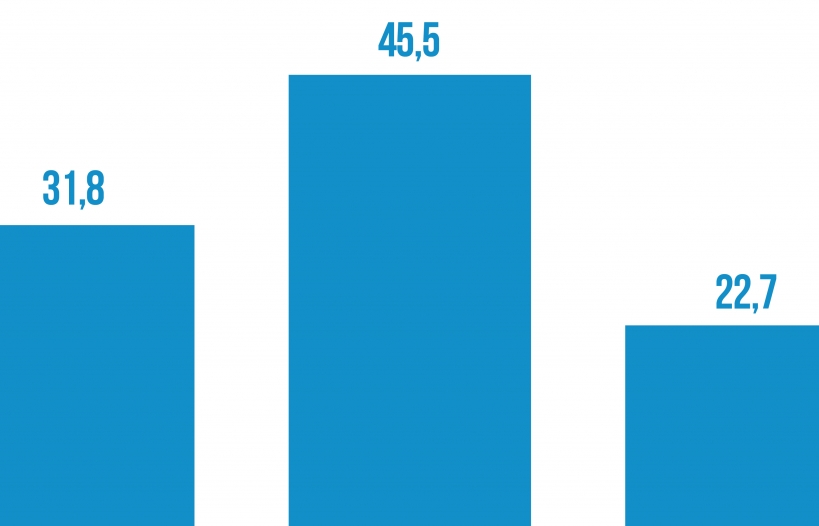

Data from the Vietnam Insurance Association showed by the end of May 2022, the total insurance premium revenue of the whole insurance market reached nearly VNĐ94.28 trillion, up 16 per cent over the same period last year. Of which, the revenue of the non-life insurance market was at VNĐ27.56 trillion, up 13.1 per cent over the same period the previous year, and the revenue of the life insurance market was at VNĐ66.72 trillion, up 17.2 per cent.

Analysts say Việt Nam's insurance market still has a lot of room for development, thanks to the support from the stable macro-economy.

SSI Research forecast revenues from insurance premiums could rise by 18 per cent to VNĐ256 trillion this year, driven by the recovery in demand and growing online insurance and collaboration with insurtech firms.

Ngô Việt Trung, Director of the MoF’s Insurance Management and Supervision Department, said Việt Nam's population was in the golden age, which creates an opportunity to develop many life insurance products such as mixed insurance and retirement insurance.

Besides, non-life insurance products had many opportunities to develop thanks to economic growth and rising investment, construction and trade.

However, experts say besides the new policy, the insurance market needs transparency to overcome unfair competition and fraud for sustained development.

According to Trung, Việt Nam is facing many challenges in developing its insurance market despite the positive prospects. Besides the unprofessional distribution channel of insurance agents, the insurance market still sees unfair competition, lack of cooperation and mutual support in sharing information among insurers to fight against fraud, which causes decreasing competitiveness in the whole insurance market.

Nguyễn Thanh Nga, director of the Vietnam Insurance Development Institute, attributed the shortcomings to the lack of a database for the entire insurance market.

Currently, the Việt Nam Insurance Association had built a database for vehicle insurance, but insurance companies had not voluntarily shared their information, which causes statistics to be incomplete and inaccurate, Nga said, adding that the insurance agency management software system also had only the agent data of life insurance companies.

Besides, insurance companies are currently using different information technology systems, so there is no common data connection, which causes insurance fraud to develop, according to Nga.

The industry needed to urgently build database infrastructure, she said. — VNS

Related News

Insurance creates trust and peace of mind for customers affected by typhoon No. 3

10:05 | 23/09/2024 Finance

Insurance brings peace of mind to customers during Yagi typhoon

20:34 | 17/09/2024 Finance

The insurance industry is expected to grow by 10 percent in 2024

08:27 | 04/08/2024 Finance

Under amended law, it needs clarification on cooperation between commercial banks and insurance companies

09:56 | 15/07/2024 Finance

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

More News

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance