Lending interest rates need a delay to reduce substantively and deeply

| Expecting a wave of interest rate cuts to support enterprises | |

| Lending interest rates are under increasing pressure | |

| Sixteen banks reduced more than VND15,500 billion in lending interest rates |

|

| Capital and interest rates continue to be significant problems causing difficulties for enterprises. Photo: Internet |

Very few enterprises are willing to take out a new loan

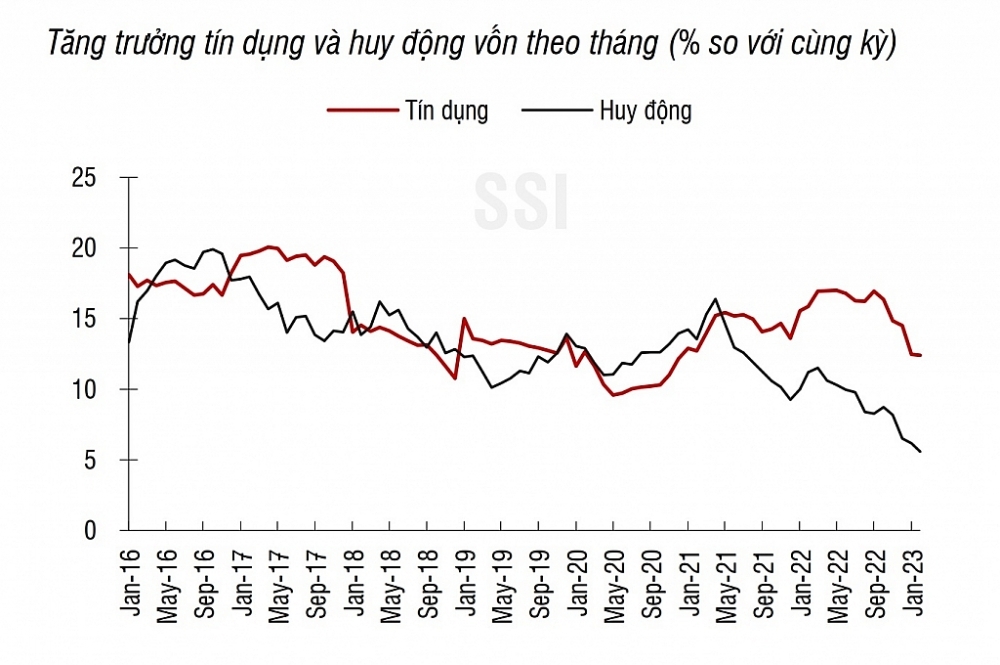

According to a report by the Ministry of Planning and Investment, credit growth only increased by 0.77% by the end of February 2023, less than one-third of the credit growth rate in the same period last year.

Credit growth is slow not because banks lack liquidity or credit growth limit (room) at the end of 2022 but because the problem mainly comes from the capital absorption of enterprises.

Leaders of the State Bank (SBV) explained that credit growth was slow for several reasons. Firstly, the first 2 months of the year coincided with the Lunar New Year; Secondly, many enterprises were still affected by the Covid-19 pandemic; some did not meet the loan conditions, and the orders of many enterprises declined, making the demand for loans not as high as last year. Primarily, credit for real estate increased lower than in previous years.

Talking about the business situation, many import-export enterprises said that they were facing difficulties in orders. Mr Cao Huu Hieu, General Director of Vietnam National Textile and Garment Group (Vinatex), said that most of the enterprises in the group had new orders by the end of February 2023, orders in the following months were very low, available orders trended retail ones with more complex, and along with lower processing prices and high competition. Nevertheless, he forecasted that the garment industry's orders would recover in the second quarter of 2023.

|

| Source: SSI |

For wood companies, the situation is not good when some comments said that orders had also decreased by 30-35% compared to last year. In addition, a recent survey conducted by the Ho Chi Minh City Business Association in February 2023 with more than 100 enterprises showed that up to 83% of them were facing difficulties. In particular, capital and interest rates continued to be a big problem causing difficulties; 43% of enterprises answered that loan interest rates were high, and 38.2% answered that loan procedures were complicated and took a long time.

Currently, in the market, many commercial banks have launched programs to help reduce lending interest rates with a reduction of 1-2% per year compared to the current interest rate.

In a statement issued on March 6, the State Bank said that banks had committed to reduce deposit interest rates from 0.2-0.5% per year compared to the interest rates of each bank since February 27. 2023 for the term from 6 to 12 months. Therefore, in February 2023, the interest rate level was stable, and interest rates in the market tended to decrease. The average new lending interest rate had decreased by about 0.4% annually; 22 commercial banks reduced their average lending rates.

However, according to experts of SSI Securities Company, this had only appeared on a small scale, with each product being designed specifically for several specific industry groups. Moreover, compared to the same period last year, the lending interest rate was higher by 3-3.5%, causing the deposit and lending interest rates to decrease compared to the end of 2022 but still at a high level compared with the actual needs of the economy. For example, the lending interest rate in the market for ordinary manufacturing enterprises fluctuates at 10-10.5% per year for a 6-month term and 11-12% per year for a 12-month term, while the consumer loan rate has been pushed up to 14-16% per year.

According to the assessment of Dr Nguyen Huu Huan, the University of Economics Ho Chi Minh City, with the current high-interest rate level of 12-14 %/year, very few enterprises are willing to take new loans for investment, production and business. However, the mass of enterprises borrows to solve liquidity problems.

Cutting actual interest rate

Enterprises all expressed their desire to have more favourable interest rate policies for them.

But to fall lending rates, according to experts, there will be a lag.

According to Dr Nguyen Huu Huan, the adjustment of lending interest rates would be differentiated among commercial banks. A wave of a sharp reduction in loan interest rates might occur in large commercial banks because of large credit room and lower input capital mobilization costs. Small commercial banks, which had mobilized deposits with interest rates around 10%/year for long terms over the past time, needed a delay in the next few months if interest rates want to sharply reduce.

Therefore, this expert said that it was expected that the new wave of interest rate decline would be broader and more profound from the end of the second quarter and the beginning of the third quarter of 2023.

Sharing the same opinion, Mr Tran Duc Anh, Director of Macroeconomics and Investment Strategy of KB Securities Vietnam, said that lending interest rates would have a certain lag because it depended on the supply and demand of capital and the demand of commercial banks when credit risk was high, they might require a high net interest margin (NIM) of mobilization deference to have room, and make provision.

Therefore, according to experts, management agencies, banks and enterprises should synchronously deploy solutions to bring the lending interest rate to around 10% per year, helping to provide more support for enterprises. And the economy in the current challenging context. To do so, the deposit interest rate also needs to decrease to around 6-7% per year on average. This interest rate is also suitable when compared with inflation so that the real deposit interest rate is positive, which is beneficial for depositors.

At the Government's regular meeting in February, Prime Minister Pham Minh Chinh requested the SBV to operate monetary policy firmly, proactively, flexibly and effectively; closely and synchronously coordinate expansionary fiscal policies with other policies. Research and organize to reduce interest rates, increase access to capital, increase credit growth towards drivers (consumption, investment, export) and identify priority areas.

The Prime Minister also requested research and management of interest rates reasonably, effectively, and in line with inflation control, cutting interest rates.

Related News

The biggest challenges businesses are facing

15:28 | 20/10/2024 Headlines

Opportunities for supporting industries to join the global supply chain

09:40 | 21/08/2024 Import-Export

Digitizing the process, banks actively lend online

21:56 | 09/06/2024 Finance

Effectively implement the State's credit capital investments to attract borrowers

11:13 | 17/03/2024 Finance

Latest News

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

More News

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export

Exporters urged to actively prepare for trade defence investigation risks when exporting to the UK

14:57 | 25/12/2024 Import-Export

Electronic imports exceed $100 billion

14:55 | 25/12/2024 Import-Export

Forestry exports set a record of $17.3 billion

14:49 | 25/12/2024 Import-Export

Hanoi: Maximum support for affiliating production and sustainable consumption of agricultural products

09:43 | 25/12/2024 Import-Export

Việt Nam boosts supporting industries with development programmes

13:56 | 24/12/2024 Import-Export

VN's wood industry sees chances and challenges from US new trade policies

13:54 | 24/12/2024 Import-Export

Vietnam's fruit, vegetable exports reach new milestone, topping 7 billion USD

13:49 | 24/12/2024 Import-Export

Aquatic exports hit 10 billion USD

13:45 | 24/12/2024 Import-Export

Your care

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export