Sixteen banks reduced more than VND15,500 billion in lending interest rates

Implementing Resolution 63/NQ-CP of the Government and direction of the SBV, 16 commercial banks have agreed (through the Bankers Association) to reduce lending interest rates applied from July 15, 2021, to the end of 2021 with an estimated total reduced profit for customers of VND20,613 billion.

Particularly, four state-owned commercial banks continue to commit to a separate support package of VND4,000 billion to reduce interest rates, reduce 100% of banking service fees for customers in localities that are implementing social distancing according to Directive 16/CT-TTG of the Prime Minister.

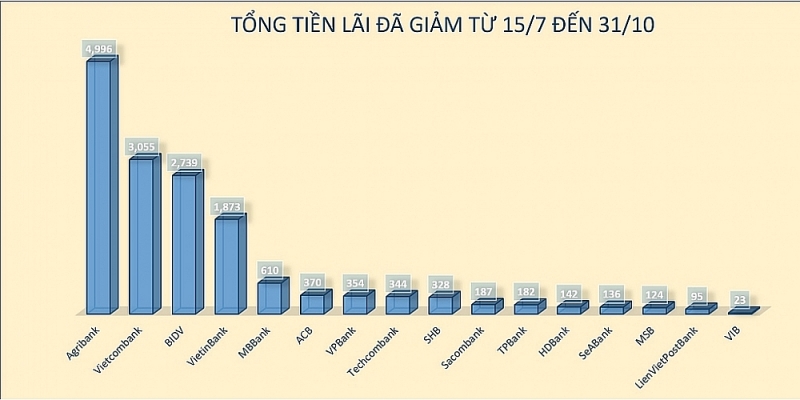

According to the report on the results of reducing interest rates and customer support fees affected by Covid-19, 16 commercial banks including VietinBank, Vietcombank, Agribank, BIDV, MB, LienVietPostBank, TPBank, VIB, ACB, Seabank, SHB, HDBank, MSB, VPBank, Techcombank and Sacombank (accounting for 75% of the total outstanding loans of the economy) have reduced lending interest rates as committed with the total reduced interest accumulated since July 15, 2021, to October 31, 2021, will reach about VND15,559 billion, an increase of VND3,323 billion compared to September 30, 2021, equivalent to an increase of 27.16%.

|

| Results of reducing lending interest rates as committed by 16 banks. Photo: H.Diu |

According to the latest results, Agribank continues to be the bank with the highest interest reduction with a total of VND4,996 billion of reduced interest for customers, the total value of debt with interest rate reduction is nearly VND1.3 trillion for nearly 3.2 million customers.

Vietcombank has risen to second place with a total of VND3,055 billion in reduced interest for customers, and over VND1.14 million in reduced interest rates for 236,403 customers.

Among joint-stock commercial banks, MB continued to be the bank with the most reductions with a total of VND610 billion in reduced profit for customers, and VND118,653 billion in interest-reduced debt for 104,282 customers.

Next is ACB with the total amount of interest reduced for customers of nearly VND370 billion, the total value of debt with interest rate reduction is VND206,048 billion. VPBank has reduced interest by more than VND354 billion, Techcombank is more than VND344 billion.

Many banks have sharply increased the amount of interest reduction compared to the previous month announced by the SBV.

Previously, the SBV publicly announced the results of each bank's commitment to reducing interest rates and fees on mass media, and at the same time strengthened supervision by many direct and indirect measures of the implementation of commitments of the whole banking system and each commercial bank branch in provinces and cities.

Related News

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Green credit proportion remains low due to lack of specific evaluation criteria

09:02 | 24/11/2024 Finance

Control of major shareholders in banks

09:25 | 16/09/2024 Finance

Latest News

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

More News

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Your care

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance