It must be listed price for freight service by sea

|

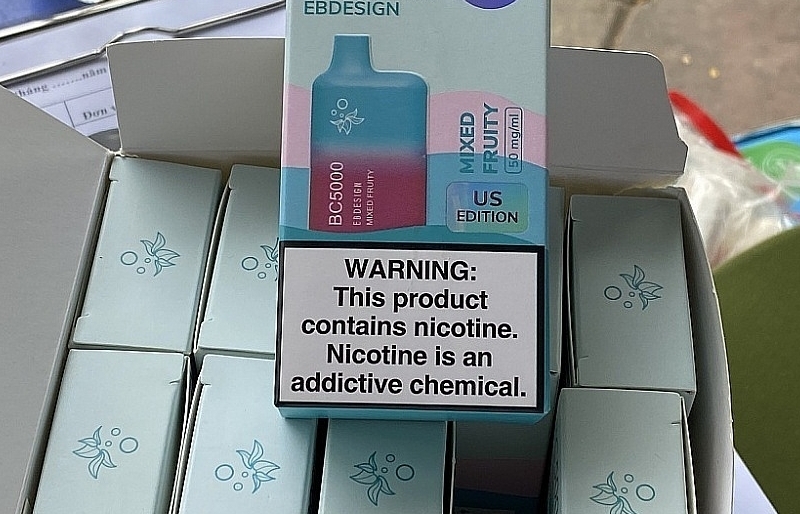

| It must has list price and additional fees except from service price for transporting container via seaway. Photo: H.Diu |

Accordingly, the currency which is used in the prices listed for container transportation service by sea of the enterprises established in Vietnam, is Vietnam Dong (VND); currency prices listed for the enterprises established outside Vietnam is Vietnam Dong or foreign currency that is converted in accordance with the law. Furthermore, the currency for extra fees and service fees charges at the seaport of enterprises is Vietnam Dong.

The content posted in price lists includes: point of departure and point of destination of the shipping line; price lists and shipping service by sea, corresponding extra fees for shipping line and type of goods being transported; Listed prices are inclusive of incurred service charges and all taxes, fees and charges (if any). Besides that, the content must have business information, fresh forwarding or authorized business is listed, including business name, trading address, telephone number, fax number, website of the enterprises.

In addition, the content of services listed prices at the seaport including seaports business information (business name, trading address, telephone number, fax number, website of the enterprises); service tariffs at the port that was declared to the competent authorities according to regulations. Listed prices are inclusive of all taxes, charges and fees (if any).

Transportation prices by sea and extra fees are valid since the date that listed price in the first time under the provisions of this Decree. For the price of seaport services, the valid day will be counted since the date that seaport enterprises or enterprises providing services at ports complete the price declaration for the price and the price listed as prescribed by law under the provisions of this Decree.

In case there is a change in price by sea transport, increase extra fees that has been listed, the effective date of the price will be determined and stipulated by the enterprises but not earlier than 15 consecutive days since the price list change. Also, in case of reducing in transport costs by sea and extra fees that has been listed, the effective date of the price is calculated from the date the listing was changed.

For the changes in seaport service price, the enterprises will declare to the competent authorities and list the price in accordance with the law.

The shipping enterprise and authorized business or enterprise providing services at seaport are only to collect the price in seaway shipping and extra fees that are listed under the listed time and conditions.

Related News

Fighting smuggling on the Southwest border has no end in sight

20:13 | 18/05/2024 Anti-Smuggling

Interest rate management: From high rates to loosening

13:50 | 17/01/2024 Finance

The Government clearly stipulates the responsibilities of each agency in preventing and combating counterfeit money

10:55 | 16/12/2023 Regulations

Need to effectively use tools to prevent exchange rate risks in import and export field

10:32 | 02/04/2023 Import-Export

Latest News

E-commerce frauds require utmost in attention from regulators

20:07 | 18/05/2024 Regulations

Is animal feed containing Formic Acid precursors "helpless" in management?

16:09 | 15/05/2024 Regulations

Businesses and people expect VAT cut extension to be approved

17:06 | 13/05/2024 Regulations

Proposal to continue reducing VAT by 2% to support people and businesses

08:16 | 12/05/2024 Regulations

More News

Research and correct customs supervision processes at international airports

10:05 | 11/05/2024 Regulations

Small, low-value items imported on e-commerce platforms should be taxed

14:43 | 09/05/2024 Regulations

Customs finds difficulties because there is no e-cigarette management policy

09:56 | 09/05/2024 Regulations

Are goods imported on-spot for export production eligible for tax refund?

09:32 | 08/05/2024 Regulations

Risk prevention solutions for export processing and production enterprises

09:12 | 07/05/2024 Regulations

Conditions for price reduction of imported goods

15:38 | 06/05/2024 Regulations

Circular 83/2014/TT-BTC will be abolished from June 8

14:29 | 06/05/2024 Regulations

Proposal to continue reducing VAT by 2% in the last 6 months of 2024

10:35 | 05/05/2024 Regulations

Seafood exporters are worried about some inadequacies from the two new decrees

06:47 | 30/04/2024 Regulations

Your care

E-commerce frauds require utmost in attention from regulators

20:07 | 18/05/2024 Regulations

Is animal feed containing Formic Acid precursors "helpless" in management?

16:09 | 15/05/2024 Regulations

Businesses and people expect VAT cut extension to be approved

17:06 | 13/05/2024 Regulations

Proposal to continue reducing VAT by 2% to support people and businesses

08:16 | 12/05/2024 Regulations

Research and correct customs supervision processes at international airports

10:05 | 11/05/2024 Regulations