Issuance of corporate bonds shows signs of recovery

|

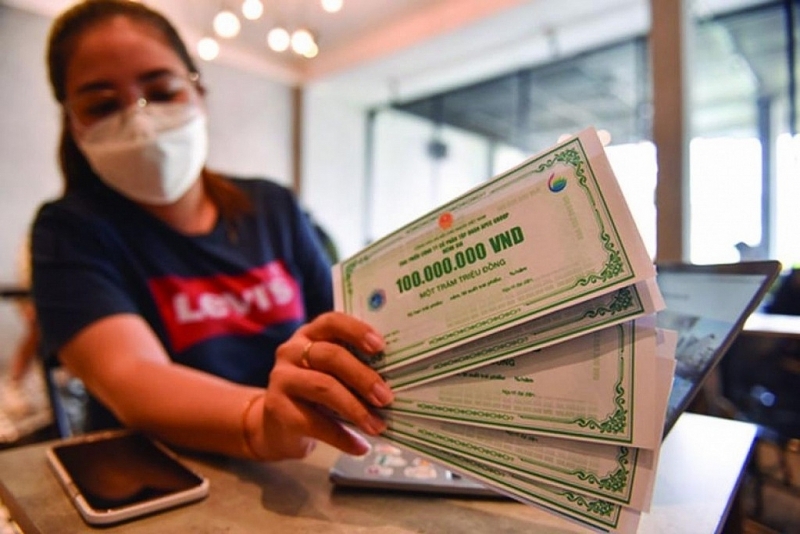

| The private corporate bond exchange is officially launched on July 19, 2023. Photo: Collected |

Showing signs of recovery in some specific groups

Commenting on the corporate bond market in the first six months of 2023, SSI Securities Joint Stock Company said that the issuance of Decree 08/2023/ND-CP has provided a suitable legal corridor for the extension/ suspension of payment of bond principal/interest and this has helped the issuance in the primary market to be somewhat more active.

Volume of newly issued bonds showed signs of recovery from the second quarter after Decree 08 took effect. By sector, real estate took the lead and accounted for 57% of total issued volume, followed by banks with 31%. Enterprises tended to focus on negotiating the extension/ suspension of debt payment with bondholders rather than accelerating acquisitions as seen at the end of 2022.

Total issued bond volume reduced in the first quarter of 2023 but showed signs of recovery in the second quarter. The VND57.3 trillion worth of privately corporate bonds were released in the first six months of 2023, down 67.8% year-on-year. Meanwhile the volume of public offerings only reached VND 5.5 trillion, down 37.9% year-on-year.

It is worth noting that bonds of real estate enterprises accounted for the highest rate (57%) in the primary market but only focused on a few issuers. Banks boosted issuance from the second quarter and accounted for 31% of the total issued volume because they had solved problems in the audit report on disbursement of bond funds.

According to SSI, after the Van Thinh Phat incident at the end of 2022, the bond acquisition activity of real estate enterprises took place quite strongly, but has slowed down since Decree 08 was issued.

Specifically, bond acquisition activity of real estate enterprises decreased to VND 24.7 trillion in the second quarter of 2023 from a peak of VND 34.8 trillion in the fourth quarter of 2022.

“We also saw the bank accelerate bond bond acquisition in the second quarter, mainly related to the term structure for the purpose of raising Tier 2 capital.”

The secondary corporate bond exchange will help demand for corporate bond recover

The most notable information in the corporate bond market in the recent times is the launching of the secondary private corporate bond exchange from July 19, 2023. All in all, this is a good start, but only by keeping a good liquidity scale with lots of traded bonds can maintain existing benefits of the secondary exchange to the market.

According to SSI's estimates, there will be a total of VND 733 trillion of bonds or 455 issuers to register on HNX within three months from July 19, 2023. To date, only 19 codes issued from Tracodi, Vietcombank and Vinfast have been registered with a total value of VND9 trillion.

The primary benefit of a secondary exchange is transparency. Previously, although issuers were obliged to report information on issuances to HNX, the access to information about issuance such as issuance purposes, collateral assets, and interest rates or the depository participating institution, or information about the remaining outstanding balance of corporate bonds or the financial situation of the issuer is quite difficult. In addition, secondary transactions and monitoring of money flows on the secondary market are nearly impossible due to the lack of a public market. As a result, this exchange can provide investors with easier and more formal access to research and track the yield curve/price movement, especially for unlisted issuers.

Besides, in an efficient market, the transactions of buyers and sellers on the secondary market will determine the trend of bond yields and will serve as directional indicators to identify risks of the issuer's financial health or macro fluctuations in the market.

| Handling bonded debt by real estate will speed up the settlement of bad debt VCN – One of the most important points of Decree 08/2023/NĐ-CP amendments to some articles of decree ... |

“With all of the above benefits, we assess that the launching of a secondary corporate bond exchange will help the demand for corporate bonds recover, first of all from institutional investors with abundant capital and high demand of investment portfolio diversification. For individual investors, perhaps there is still more work to be done to regain investment confidence and sentiment," said SSI.

Related News

Complying with regulations of each market for smooth fruit and vegetable exports

13:06 | 09/01/2025 Import-Export

Request for price management and stabilization, avoiding unusual fluctuations during Tet 2025

13:56 | 30/12/2024 Headlines

Six export commodity groups see billion-dollar growth

07:55 | 31/12/2024 Import-Export

Automobile localization: rapid development from internal strength

07:44 | 31/12/2024 Headlines

Latest News

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

More News

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance