Importers are entitled to tax refund when re-exporting unprocessed or processed goods

| Strengthen the review of dossiers, cases of tax refund, handling of overpaid tax | |

| US importers interested in made-in-Vietnam furniture | |

| Pig importers investigated for evading quarantine |

|

| An officer of the Customs Branch of Hoa Khanh - Lien Chieu Industrial Park guides customs procedures for businesses. |

CJ Vina Agri Co., Ltd. proposed the Customs agency provide specific guidance on tax refunds for imported goods of the company.

In this regard, according to the General Department of Customs, Clause 3, Article 2 of the Law on Import and Export Duties stipulates: "On-spot import and export goods and import-export goods by enterprises exercising their right to export, import, or distribute the goods are subject to import and export duties”.

Also in Point c, Clause 1, Clause 2, Article 19 of the Law on Import and Export Duties, any taxpayer who has paid import duty but the imports have to be re-exported shall receive a refund of import duty and does not have to pay export duty.

Paid import duties on the following imports that have to be re-exported shall be refunded and export duties thereon shall be canceled: Imports that have to be re-exported and returned to their owners; Imports that have to be exported to a foreign country or exported into a free trade zone for consumption therein. The re-export of goods must be done by the initial importer or a person authorized by the initial importer. The taxpayer shall be responsible for accurately and trustfully declaring re-exported goods that are previously imported goods, information about contract number, date, and buyer. The customs authority shall check the declared information and state the inspection results to serve the tax refund settlement.

Articles 3 and 7 of Decree 09/2018/ND-CP also clearly stipulate the right to import and export; carry out the trading of goods and activities directly related to the trading of goods.

Accordingly, the General Department of Customs said that CJ Vina Agri Co., Ltd. registers an export declaration B11, the declaration does not show information on the import declaration of previous imports, the inspection channelization for re-exported goods under the customs regime B11 is carried out according to the principle of risk management.

Therefore, the customs authority does not have enough grounds to consider tax refund under the provisions of the Law on Import and Export Duties and Decree 134/2016/ND-CP for imported goods that are re-exported according to the declarations of customs regime B11.

| Developing a new tax refund process VCN – The General Department of Taxation held a virtual conference to collect opinions on a draft ... |

Related News

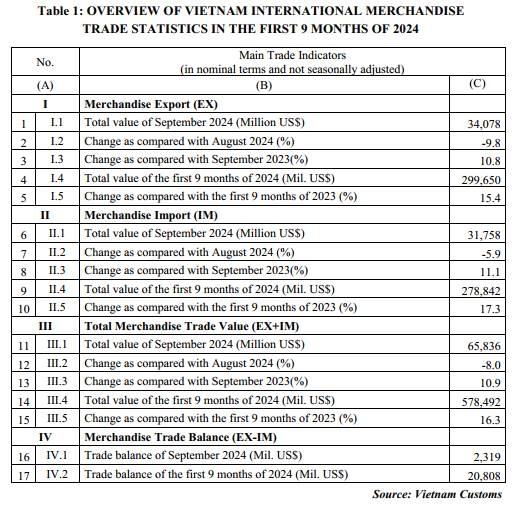

Preliminary assessment of Vietnam international merchandise trade performance in the first 9 months of 2024

09:22 | 20/11/2024 Customs Statistics

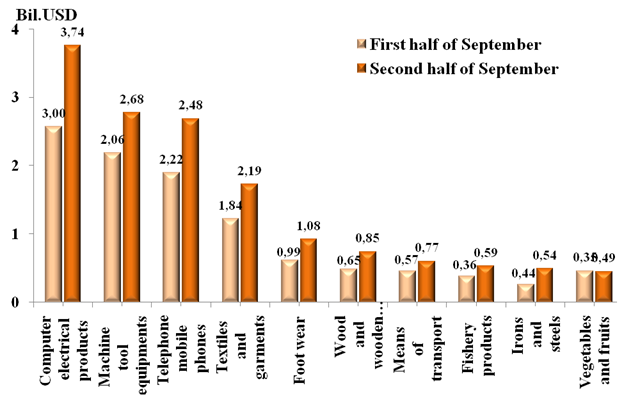

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Latest News

Hanoi Customs resolves tax policy queries for enterprises

09:26 | 22/11/2024 Regulations

Regularly check tax obligations to avoid temporary exit suspension

09:47 | 21/11/2024 Regulations

Implementing the SAFE framework in Vietnam: Assessment through the lens of international standards

09:14 | 20/11/2024 Regulations

Proposing the Tax Authority be flexible in applying tax debt enforcement measures simultaneously

09:40 | 19/11/2024 Regulations

More News

Many shortcomings in process and manual book on handling administrative violations

15:53 | 18/11/2024 Regulations

Implementing the SAFE Framework in Vietnam: Lessons from practice

10:03 | 18/11/2024 Regulations

Implementing the SAFE Framework in Vietnam: Solutions and Recommendations

09:18 | 17/11/2024 Regulations

Abolishing regulations on tax exemption for small-value imported goods must comply with international practices

13:54 | 15/11/2024 Regulations

Policy adaptation and acceleration of digital transformation in tax and customs management

10:03 | 14/11/2024 Regulations

Implement regulations on special preferential import tariffs under VIFTA

08:32 | 13/11/2024 Regulations

Perfecting tax policy for goods traded via e-commerce

09:24 | 10/11/2024 Regulations

Are belongings of foreigners on business trip to Vietnam exempt from tax?

14:23 | 09/11/2024 Regulations

Amending regulations on enforcement measures in tax administration

10:05 | 08/11/2024 Regulations

Your care

Hanoi Customs resolves tax policy queries for enterprises

09:26 | 22/11/2024 Regulations

Regularly check tax obligations to avoid temporary exit suspension

09:47 | 21/11/2024 Regulations

Implementing the SAFE framework in Vietnam: Assessment through the lens of international standards

09:14 | 20/11/2024 Regulations

Proposing the Tax Authority be flexible in applying tax debt enforcement measures simultaneously

09:40 | 19/11/2024 Regulations

Many shortcomings in process and manual book on handling administrative violations

15:53 | 18/11/2024 Regulations