How did many banks' profits surge in Q1 2024?

|

| Chart: H.Diu. |

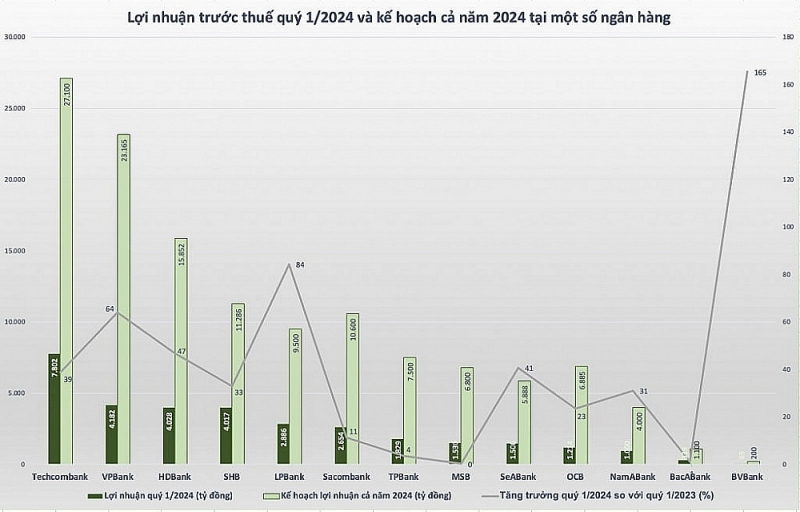

According to statistics from the business results of 28 listed banks, 18 banks recorded positive growth, although there was significant divergence with some banks growing by just 0.3% and others by 2-3 digits. Notably, the highest growth was seen at BVBank (Viet Capital Bank) with a pre-tax profit of 69.3 billion VND in Q1, up 165% year-on-year, achieving 35% of its annual profit plan. BVBank's strong growth was driven by income from core business activities (up 65% year-on-year to 472 billion VND) and foreign exchange business profits (up 76% due to a 1.5 times increase in foreign exchange trading volume in Q1 2024 compared to the same period last year). Net service income slightly decreased due to the partial impact of linked insurance. This can be seen as an "explosive" growth for this bank because by the end of 2023, BVBank's pre-tax profit reached 72 billion VND, down 84% from the previous year, fulfilling 55% of the set plan.

The second-highest profit growth was recorded by LPBank (Lien Viet Post Bank) with a pre-tax profit of 2,886 billion VND, up more than 84% year-on-year. In total net income from business activities, net service income accounted for 18.29%, up 2.6 times year-on-year in 2023. Foreign exchange business accounted for 3.31%. LPBank explained that Q1's business growth was due to the bank's strong push for credit growth from the beginning of the year. Additionally, the bank focused on promoting cross-selling of service products, especially foreign exchange, remittances, import-export products, etc.

At VPBank (Vietnam Prosperity Joint Stock Commercial Bank), consolidated pre-tax profit reached 4,182 billion VND, up 64% year-on-year. For the parent bank alone, Q1 pre-tax profit exceeded 4,900 billion VND, nearly doubling Q4 2023, with total operating income up 15% and net interest income up 25% year-on-year. In a recent shareholder meeting, Mr. Ngo Chi Dung, Chairman of VPBank's Board of Directors, said that the participation of strategic shareholder SMBC from Japan would help VPBank develop into a multifunctional bank, not just retail customers and SMEs, but also focusing on large corporate clients. However, a notable issue for this bank is that bad debt remains high, so Mr. Dung said VPBank aims to control bad debt below 3% in 2024. It is expected that in 2024, VPBank will allocate 13,500 billion VND for risk provisions (up 1,000 billion VND from the previous year), and recover 3,000 billion VND from bad debts. Therefore, bad debt is expected to gradually decrease in the last six months of the year and recover well from 2025.

Techcombank (Vietnam Technological and Commercial Joint Stock Bank) achieved a pre-tax profit of 7,802 billion VND in Q1 2024, up 38.7% year-on-year. Total operating income (TOI) increased by 32%, credit growth continued to be higher than the market, net interest margin (NIM) improved, and the CASA balance continued to increase by about 2% from the beginning of the year, on a high base at the end of 2023. According to Mr. Jens Lottner, CEO of Techcombank, in 2024, the bank has concretized growth goals through technology platform investment projects, resulting in unchanged staff numbers but increased value creation and significantly reduced operating costs. Additionally, Techcombank strives to diversify its credit portfolio, focusing on retail customers and SMEs. Currently, Techcombank has set four main pillars in its development strategy: 55% CASA, 20 billion USD capitalization, fee income accounting for 30% of total income, and 20% return on equity (ROE).

Many experts believe that the banking sector's profits for the entire year 2024 are more optimistic due to factors such as the economy's better recovery, which helps credit growth forecasted at 14-15% - higher than in 2023, as well as better revenue from other activities, improved NIM, etc. Banks with low capital costs and CASA advantages will have strong growth opportunities. However, the increasing pressure of bad debts will force banks to increase risk provisions, affecting profits. Additionally, many revenue sources that contributed significantly to profits in the previous period, such as cross-selling insurance and off-balance sheet debt collection, have not been able to recover quickly. This issue was reflected in Q1 business results of many banks. Several banks had negative profit growth, such as ABBank (down 71%), Vietbank (down 63%), SaigonBank (down 35%), PGBank (down 24%), MB (down 11%), and Vietcombank (down 4.5%).

Related News

Aiming for 16% credit growth and removing credit room allocation

09:17 | 14/02/2025 Import-Export

Hai Phong Customs implements solutions to facilitate trade

11:18 | 20/01/2025 Customs

Hai Phong Customs collects over VND87 billion from post-clearance audit

15:30 | 31/12/2024 Customs

Hai Phong Customs sets new record in revenue of VND70,000 billion

07:45 | 31/12/2024 Customs

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance