Foreign exchange reserves: a solid foundation for exchange rate

| Vietnamese currency under bigger pressure in 2020 | |

| Some gets benefits and others get less profit because of exchange rate | |

| Foreign exchange market to be stable in 2018 |

|

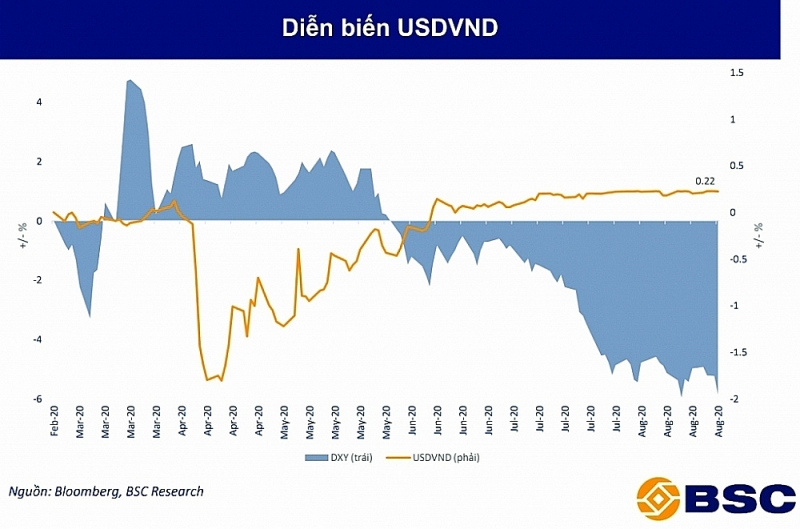

| Movements of the USD/VND exchange rate and USD index from the beginning of the year. Source: BSC |

The State Bank will buy about $8 billion

These days on the world money market, due to the influence of gold prices, the USD index (DXY), which measures the fluctuation of the USD compared to six other major currencies, continuously fluctuated in a downward direction. However, in the domestic market, since mid-June, although the world USD index has been continuously fluctuating due to the influence of the gold market, the domestic USD/VND exchange rate has been very stable. The central rate listed by the State Bank of Vietnam (SBV) still fluctuateseveryday, but the exchange rate at banks is stable. In general, over the past eight months, only a few sessions in March, May, and June had strong fluctuations, the rest were almost flat.

According to Bao Viet Securities Joint Stock Company (BVSC), the USD/VND exchange rate continued to be stable in recent weeks when the USD index (DXY) weakened. This is due to the fact that in the first eight months of the year, Vietnam saw an estimated trade surplus of $11.9 billion. In August, the trade surplus was about $4.4 billion. The total realized foreign direct investment capital as of August 20 also reached $11.4 billion, a decrease of 4.7% compared to the same period last year but still a relatively high level.

At the end of March, the State Bank said that Vietnam's foreign exchange reserves reached US$84 billion, so the recent figure of $92 billion announced by the Prime Minister showed a relatively rapid growth of foreign exchange reserves.

With the target of $100 billion by the end of the year, in the last months of the year, the State Bank may buy about $8 billion. Therefore, VnDirect forecasts that Vietnam will maintain a current account surplus at about 2.6% of GDP in 2020, plus Vietnam's foreign exchange reserves continue to increase, contributing to stabilize the exchange rate.

|

| Movements of the VND exchange rate against a number of other currencies in the region. Source: VnDirect |

With such stable developments in the monetary market, the State Bank always has a basis to send out a message to closely monitor market movements to actively manage the exchange rate flexibly and appropriately, helping the State Bank to continuously buy a large amount of foreign currency to supplement foreign exchange reserves, contributing to consolidating national monetary and financial security.

The State Bank said that with the available foreign currency potential, they are ready to intervene in the market when necessary, with the intervention selling rate lower than the current listed rate to stabilize the foreign currency market, contributing to macroeconomic stability. Not only that, according to experts, the stable exchange rate is also an important "buffer" to help the economy withstand external uncertainties, creating more confidence for investors.

There are many issues

VnDirect experts said that the USD/VND exchange rate will fluctuate in a relatively narrow range of about VND23,300 to VND23,500/USD in the remaining months of 2020. But from now to the end of the year, in the foreign currency market, it is not necessary to avoid all the changes.

In the future, the Covid-19 pandemic will continue to be unpredictable on a global scale, possibly pushing the world economy into a deep recession and having a heavy impact on the domestic economy in many ways when Vietnam has deeply integrated with the world and has high economic openness. Along with that, geopolitical and trade conflicts between many countries are still capable of causing exchange rates to fluctuate. In addition, the source of remittances to Vietnam is also forecast to decrease this year due to the impact of the pandemic.

The above issues show that foreign exchange reserves are very important in operating monetary policy of regulators. But in fact, the increase in foreign exchange reserves is not a simple matter but must consider many other variables such as national debt, external debt, international balance of payments.

Moreover, the one that has been warned for a long time when the State Bank can buy a large amount of foreign exchange reserves is the risk that Vietnam will be put on the US monetary manipulation list.

According to finance - banking expert Dr. Nguyen Tri Hieu, the move by the State Bank of Vietnam to continuously buy foreign currencies has made the US revision agency pay attention, but the State Bank is constantly buying and selling foreign currencies to adjust the forex market, which is not just one way of buying.

In addition, the move to buy foreign currencies is normal for developing countries, including Vietnam. Since these countries need to have foreign exchange reserves in accordance with international practice of three months of importation, so that if any problem occurs, there is enough money to pay the importer. Therefore, it is natural for Vietnam to increase its foreign exchange reserves to keep the nation's liquidity. Moreover, the current level of foreign exchange reserves of our country is not too high compared to many other countries.

However, experts said that, in order to avoid the risk that Vietnam is included on the list of US currency manipulation, it is likely that the State Bank will restrict net foreign currency buying activities, thereby making the VND stronger against the USD. Dr Nguyen Tri Hieu said that the important thing is Vietnam needs to create a more balanced trade with the US, to gradually reduce the level of trade surplus to this market.

Related News

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

Pressure on exchange rate plunges

18:02 | 01/09/2024 Finance

Inflationary pressure seen from monetary policy

09:47 | 21/07/2024 Finance

Determine tools, policy for inflation control

14:11 | 19/07/2024 Finance

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance