How to regain investors' confidence in corporate bond market: experts

|

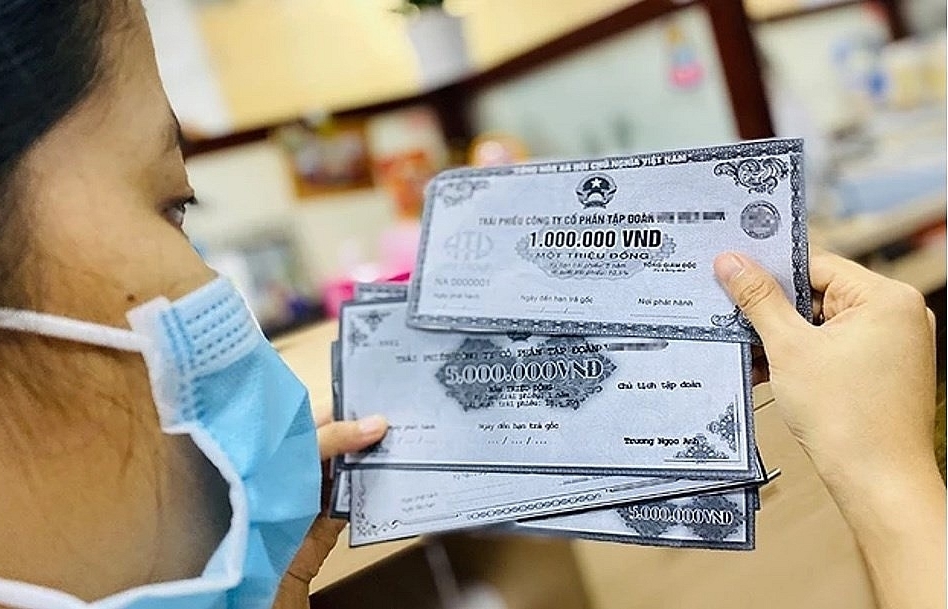

| Piles of Vietnamese banknotes. Photo vietnamplus.vn |

Investor confidence has decreased significantly as a result of the stock market's fluctuations and some scandals involving corporate bonds that have occurred since the beginning of the year.

According to Phạm Ngọc Hưng, head of Phạm Hưng Law Office, an important part of what causes investors to lose confidence in corporate bonds is that issuers publish false information, while there is a limited quality of collateral or no collateral.

Many units operate as bond brokers without being licensed by the competent authority, while some enterprises do not have approved bond issuance plans according to regulations and do not have financial statements for the year preceding the year of issuance audited by an auditing organisation.

Hưng said that the bond market in general still has many healthy businesses. Bonds with collateral still have a high level of safety. Therefore, investors need to learn information from reliable and transparent sources. And before making an investment, investors should observe the current state of the business and record information from official and trustworthy sources.

In fact, many investors listen to and believe rumours when making investments, putting themselves in jeopardy. Meanwhile, brokerage units such as commercial banks and securities companies need to be more transparent in the process of advising on bond issuance.

Financial expert Đinh Thế Hiển said that one of the signs that corporate bonds are safe is that the high interest rate is not 30 per cent higher than bank lending rates; the issuers are public joint stock companies listed or rated AAA by a reputable rating agency.

Investors should learn about well-known companies that are among the top 500 large enterprises on the stock exchange, Hiển suggested. These companies often issue bonds with interest rates in the middle of the lending rates of commercial banks or higher, up to 4 per cent, until now, the interest rates can be at 14 per cent or less. Thereby, this interest rate shows stability and is relatively safe, reducing the risk ratio for investors.

Concerning bond maturity pressures in the near future, Mã Thanh Danh, Chairman of International Consulting JSC (CIB), stated that enterprises must first calculate the possibility of their own inner strength. Businesses that are doing well but have bondholders who request a bond buyback can use cash to help relieve pressure.

If companies do not have enough money, they can borrow more or mortgage a part of the bond at a higher interest rate to borrow money to buy the rest. Besides, with a stable business situation, enterprises can negotiate directly with bondholders so that they can wait for maturity.

If the bondholder insists on a repurchase, the enterprise can negotiate a conversion of the bond into shares. For example, Citi Bank has recently agreed to convert Novaland (HoSE: NVL) bonds into NVL shares at the price of VNĐ85,000 a share (US$3.47 a share), while the NVL market price is just over VNĐ20,000 a share.

Particularly for businesses with insufficient finance or poor business performance, the requirement to buy back bonds is really a burden.

Therefore, "enterprises need to prepare a clear corporate restructuring plan to negotiate with bondholders. If not, the business is forced to sell its assets to pay the bondholders. It can be land, brand, distribution system... In addition, businesses can also find solutions outside the market," said Danh.

Official data from the Ministry of Finance showed that for the first ten months of the year, the market recorded 23 bond issuances to the public, worth nearly VNĐ10.6 trillion, which accounts for 4 per cent of the total issuance value, and 413 private placements, worth VNĐ240.7 trillion, accounting for 96 per cent of the total issued value. Compared to the same period last year, the value of bonds issued to the public decreased by 56 per cent and the value of private placements dipped 51 per cent.

Of which, finance and banking is the leading industry group in terms of issuance value in the first nine months of 2022, accounting for 57.7 per cent of the total issuance value, down 15.2 per cent over last year.

The real estate sector accounted for 21.5 per cent of the total issuance value, a sharp decrease of 67 per cent year-on-year.

Related News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Industrial real estate - "Magnet" attracting foreign capital

09:01 | 07/09/2024 Import-Export

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Transparent and stable legislation is needed to develop renewable energy

13:45 | 01/08/2024 Import-Export

Latest News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

More News

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

HCMC: Domestic revenue rises, revenue from import-export activities begins to increase

09:36 | 16/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance