E-tax payment service to be integrated on eTax mobile application

|

| ETax Mobile has been developed version 1.0 by the General Department of Taxation and officially launched on December 15, 2021. |

Link eTax Mobile App with banks

ETax Mobile has been developed version 1.0 by the General Department of Taxation and officially launched on December 15, 2021.

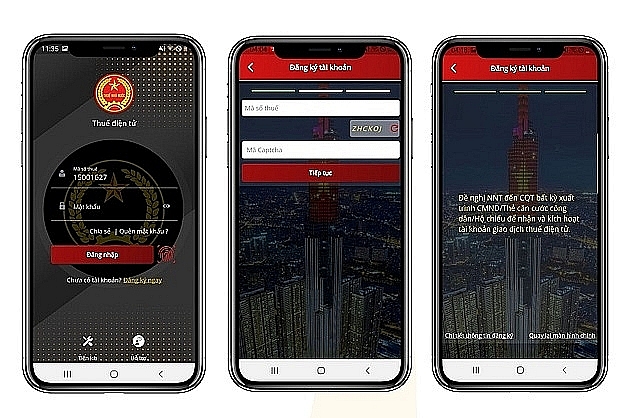

An electronic tax application for mobile devices (eTax Mobile) has been developed by the General Department of Taxation and officially launched on December 15, 2021. This version is helping taxpayers register accounts, look up tax liability, notices, file, manage accounts and other information such as looking up dependent information; taxpayer information; presumptive tax households; personal income tax calculator; the price list of registration fees for cars and motorbikes; and authorized collection banks; electronic tax payment banks; the tax office's address and news.

With the desire to improve satisfaction, modernize tax administrative procedures in parallel with promoting non-cash payments, the General Department of Taxation has implemented a two-phase plan to integrate the electronic tax payment service between commercial banks and the eTax Mobile application.

Specifically, in phase 1, the General Department of Taxation shall integrate the eTax Mobile App of the General Department of Taxation with the bank via an Internet Banking application.

Taxes from business activities of households and individuals, personal income tax, land use tax, vehicle registration fees and land fees will be paid online through the electronic tax application.

If the electronic tax payment function is implemented on the eTax Mobile application, it will bring great benefits to taxpayers such as convenient transactions 24/7, timely information, saving travel time and costs and limiting contact during the pandemic.

Many utilities

Currently, electronic tax payment is done through commercial banks. In addition to five commercial banks that have provided the service, there are two commercial banks (Orient Commercial Joint Stock Bank and Lien Viet Post Bank) that have registered to cooperate with the General Department of Taxation in providing the service.

Therefore, in order to create favorable conditions for people, the General Department of Taxation has asked the remaining commercial banks to coordinate with the General Department of Taxation to provide the service.

For commercial banks that have applied for service connection, the General Department of Taxation will coordinate with commercial banks to deploy in the first quarter of 2022.

According to the General Department of Taxation, the authentication function has now been implemented to support taxpayers.

At the same time, the E-tax mobile application is expanded to businesses.

| Preparing resources for implementing e-invoices VCN - The General Department of Taxation is preparing resources to be able to complete the "coverage" ... |

The General Department of Taxation confirms that the eTax Mobile service operates 24 hours a day and seven days a week, including weekends/holidays. Taxpayers can get support if they have problems using the eTax Mobile service.

| The eTax Mobile service is provided to customers who meet the following conditions: Firstly, the taxpayer is an individual who already has an account on the e-Tax system for individuals. Second, taxpayers have registered mobile phones in Vietnam's telecommunications network. In case taxpayers use eTax Mobile service on mobile device, the mobile device needs to have iOS operating system version 9.0 or higher or Android operating system version 4.0 or higher or other systems prescribed by the eTax app. |

Related News

Proposing the Tax Authority be flexible in applying tax debt enforcement measures simultaneously

09:40 | 19/11/2024 Regulations

Make good use of e-commerce data, create effective tax and customs management

10:02 | 16/06/2024 Customs

Warning about impersonating tax authorities to commit fraud during tax finalization month

10:22 | 27/03/2024 Finance

Customs strives to expand utilities in e-tax payment

08:56 | 25/02/2024 Customs

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

More News

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance