Decree No. 65/2022/ND-CP will promote the corporate bond market

|

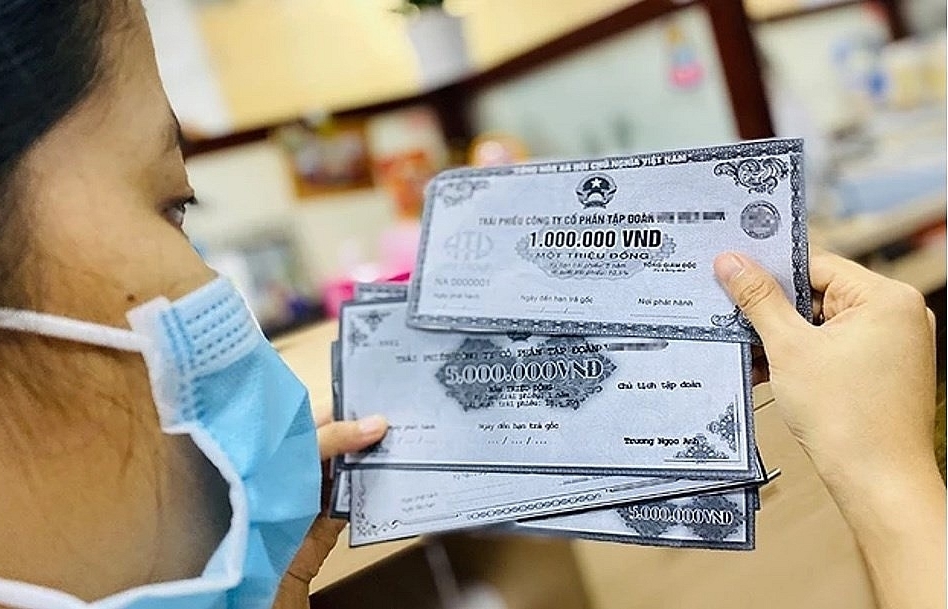

| The corporate bonds market is expected to open up capital after the issuance of Decree No. 65/2022/ND-CP. |

Enhance the transparency

With many new regulations, Decree 65/2022/ND-CP (referred to as Decree 65) is expected to solve difficulties for issuers and open up capital flows from this mobilisation channel for socio-economic activities. In addition, decree 65 has supplemented provisions to raise the standards of professional securities investors, enhance information transparency, and ensure the interests of investors.

Although it does not tighten the offering conditions, Decree 65 requires stricter requirements on offering documents, issuance methods and mandatory credit ratings in some cases. For example, the new decree has supplemented regulations to increase the professionalism of individual investors when buying privately placed corporate bonds, minimising individual investors from cheating on buying privately placed corporate bonds. Accordingly, identifying a professional securities investor by a securities portfolio must ensure that the portfolio holds an average value of at least VND2 billion within 180 days with the investor's assets, not including the loan.

Regarding issuance conditions and offering documents, the Decree supplements regulations on the bond offering documents, in which, in some cases of corporate bond issuance, it is required to have credit rating results following the circumstances and implementation roadmap as prescribed for bond offering to the public.

Another new regulation in Decree 65 that contributes to alleviating the market's worries is to allow businesses to issue bonds with restructuring debts. However, the offering documents and issuance methods are in higher demand. This regulation is considered a proper direction and in line with international bond practices. Along with that, to enhance information transparency and ensure the interests of investors, the decree has introduced strict regulations towards transparent and clear reporting and information disclosure.

For example, for the modification of capital use purposes, bondholders have the right to vote and the approval rate of at least 65% of the total outstanding bonds to help bondholders proactively capture information about the business and project in which they are investing.

Along with the above new points, the new decree also supplements provisions to enhance transparency and legal compliance of service providers, supplements regulations on establishing an organised trading market, and perfects regulations on management and supervision mechanism.

Unlocking capital channels for businesses

Assessing the impact of the promulgation of Decree 65/2022/ND-CP, Mr Do Bao Ngoc, Deputy General Director of Vietnam Construction Securities Joint Stock Company, said that, regarding the issuer, the issuance of Decree 65 has a legal nature to help businesses that meet the conditions under the new regulations to be able to issue new bonds. In addition, the State Securities Commission also has a legal basis to review and approve new issuance documents for regulatory agencies. Accordingly, the corporate bond market will be more open, and corporate bond issuance will increase again soon. Therefore, decree 65 also has a positive and massive impact on the corporate bond market, contributing to solving capital problems and promoting positive changes in businesses regarding transparency and investor risk reduction.

According to the credit rating agency Fiin Group, the issuance of Decree 65 will help to relieve the demand for bond issuance, and the issuance volume is expected to increase again. The new decree will remove the bottleneck of capital mobilisation through corporate bonds. Although the bank credit channel has also been expanded to a certain extent, it cannot meet the capital demand of enterprises, especially industries with medium and long-term capital demand, such as real estate and energy. The issuance of corporate bonds in these industries is very weak, even though there are months with only 1 or 2 issuances, so the issuance of Decree 65 will create an impetus for qualified issuers to build bond offering plans quickly.

Mr Nguyen Hoang Duong, Deputy Director of the Department of Banking and Financial Institutions (Ministry of Finance), said that the promulgation of Decree 65 would continue to create conditions for businesses to raise capital in the current period. Along with that, the Government has directed ministries and sectors to study and review relevant laws and specific corporate bond issuance regulations in the Law on Securities and the Law on Enterprises to submit to the National Assembly for amending regulations in that law in order to in line with the development of the market recently.

Regarding the requirement to have credit rating results for some bonds, Mr Nguyen Hoang Duong informed us that, currently, there are two licensed credit rating agencies on the market.

"In the future, according to the direction of the Prime Minister, we will continue to license three enterprises to provide credit rating services. According to the Decision of the Prime Minister, by 2030, five organisations will be providing services and credit ratings in the Vietnamese market. Currently, many reputable credit rating organisations in the world have shown their interest in the Vietnamese market and are studying Vietnamese market conditions to approach it," Duong said.

Related News

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

The corporate bond market will be more vibrant in the second half of the year

08:20 | 23/07/2024 Finance

The corporate bond market will enter new period of development

08:44 | 03/03/2024 Finance

Corporate bond market is expected to prosper soon

10:59 | 10/01/2024 Finance

Latest News

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

More News

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Your care

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance