Corporate profits enter recovery cycle

|

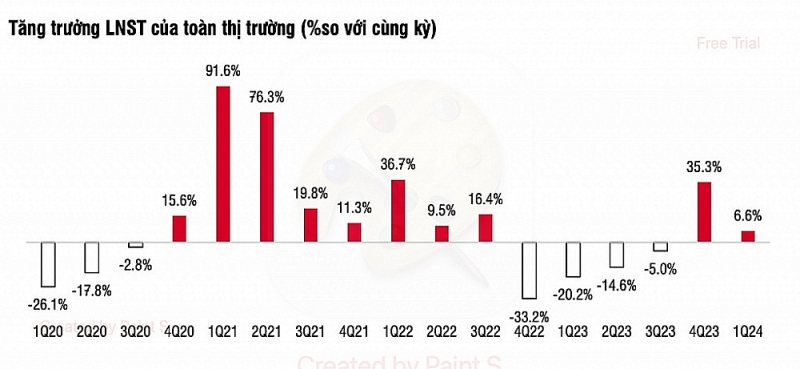

| After a period of significant volatility since the Covid-19 pandemic, profits are entering a phase of recovery and more stable growth. Source: SSI |

Many sectors see high growth

According to SSI's statistics as of May 6, the total post-tax profits of 1,059 enterprises increased by 6.6% year-on-year and 3.4% compared to the previous quarter, recording the highest profit in 7 quarters (only lower than the first two quarters of 2022). However, SSI pointed out that the growth rate in Q1 2024 significantly slowed compared to the 35.3% increase in Q4 2023 due to a higher comparison base. After a period of significant volatility since the Covid-19 pandemic, profits are entering a phase of recovery and more stable growth.

Among them, the post-tax profits of listed banks in Q1 2024 increased slightly by 9.6% year-on-year, accounting for 49.2% of the total market profits. The NIM (net interest margin) continued to face pressure (down 8 basis points from the previous quarter) due to weak credit growth. Meanwhile, asset quality continued to decline after improving in Q4 2023 due to seasonal factors. Specifically, the ratio of group 2 and bad debts to total outstanding loans were 2.23% (up 24 basis points from the previous quarter) and 1.94% (up 23 basis points from the previous quarter, close to the peak of 1.98% in Q3 2023). Income from foreign exchange business partially offset the sharp decline from insurance distribution and bad debt recovery activities. Additionally, good control of operating costs in Q1 2024 with a CIR (cost/income ratio) of 30.7% (compared to 31% in Q1 2023 and 36% in Q4 2023) was another factor supporting the business results of banks.

For the real estate sector, post-tax profits decreased sharply by 61.6% year-on-year, recording the lowest quarterly profit in 5 years. The sharp profit decline was due to a 44.9% year-on-year drop in revenue, a steep decline in gross profit margin from 21.9% to 16.2%, and an increase in both selling and administrative expenses.

SSI's statistics also show that the profits of the retail and tourism - entertainment sectors have returned to a growth trajectory. The retail sector grew strongly by 367% year-on-year, thanks to the impressive growth of two leading companies, MWG, which increased 41 times year-on-year and regained the highest profit level in 6 quarters, and FRT, which returned to profit after 3 consecutive quarters of losses with a 28-fold increase. The gross profit margin of the retail sector also improved significantly from 15.4% to 17.5%. Interest expenses also decreased from 6.6% of outstanding debt to 3.9% of outstanding debt.

The tourism and entertainment sector recovered strongly and returned to profitability after a long period of losses. HVN recorded record-high quarterly net revenue, up 19% year-on-year in Q1 2023 thanks to recovery in both market share and ticket prices, alongside a one-time income from debt cancellation of subsidiary Pacific Airlines. Other companies also recorded positive profit growth: VJC up 212%, ACV up 78%, SCS up 30%, AST up 46%.

Additionally, many other sectors also maintained positive profit growth. Specifically, the financial services sector continued to grow by 103%, bringing post-tax profits to the highest level since Q2 2022. The basic resources sector recorded a post-tax profit increase of up to 208% despite only a 5.8% increase in revenue. The telecommunications sector grew by 95%, mainly contributed by a strong 175% increase from VGI thanks to positive growth in foreign markets.

Operational efficiency improves

SSI's report also recorded many signals of improved performance. Specifically, the gross profit margin of the non-financial sector improved positively to 14.9% from 13.8% in Q4 2023 and 14.4% in Q1 2023. The average net profit margin also increased significantly to 5.9%, the highest level in 7 quarters. The sectors recording the best improvement were tourism and entertainment, telecommunications, food and beverages, retail, and automotive and parts.

The interest expense/total debt ratio (non-financial sector) sharply decreased to 5.8% from a peak of 7.8% in Q2 2023. Total interest expenses accordingly decreased from 19.7 trillion VND in Q2 2023 to 15.2 trillion VND in Q1 2024 despite a slight increase in the debt/equity ratio. The declining interest rates are gradually showing a positive impact, helping to reduce the interest burden on enterprises.

The interest coverage ratio increased positively, averaging 4.74 times in Q1 2024, compared to 3.21 times in Q4 2022. The debt/equity ratio remained stable compared to the previous quarter at 0.62 times, while increasing profits helped improve the financial health of enterprises. The ROE (return on equity) of the non-financial sector improved from 8.2% in Q1 2023 to 10.6% in Q1 2024.

Overall, SSI assessed that although some sectors such as real estate, electricity, water, petroleum, and gas are still in a downturn cycle, most other sectors are gradually recovering with improving financial health. This indicates that corporate profits may have overcome the most challenging period and entered a phase of more stable growth.

Related News

Enterprises focus on Tet care for employees

18:59 | 22/12/2024 Headlines

Numerous FDI enterprises face suspension of customs procedures due to tax debt

09:57 | 18/12/2024 Anti-Smuggling

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Latest News

VN faced with increasing trade defence investigations on rising protectionism

18:58 | 22/12/2024 Import-Export

Việt Nam expects to officially export passion fruit to the US next year

18:55 | 22/12/2024 Import-Export

UK’s carbon tax to affect VN exports

18:51 | 22/12/2024 Import-Export

Removing obstacles in granting certificates of exploited aquatic products

13:56 | 22/12/2024 Import-Export

More News

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export

Agricultural exports in 2024 to exceed 60 billion USD?

13:53 | 22/12/2024 Import-Export

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export

Binh Dinh province works to attract investment from Japan

15:44 | 19/12/2024 Import-Export

Agricultural, forestry and fishery exports “reach the target” early

15:20 | 19/12/2024 Import-Export

Your care

VN faced with increasing trade defence investigations on rising protectionism

18:58 | 22/12/2024 Import-Export

Việt Nam expects to officially export passion fruit to the US next year

18:55 | 22/12/2024 Import-Export

UK’s carbon tax to affect VN exports

18:51 | 22/12/2024 Import-Export

Removing obstacles in granting certificates of exploited aquatic products

13:56 | 22/12/2024 Import-Export

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export