Corporate bond market to continue to face headwinds in H2

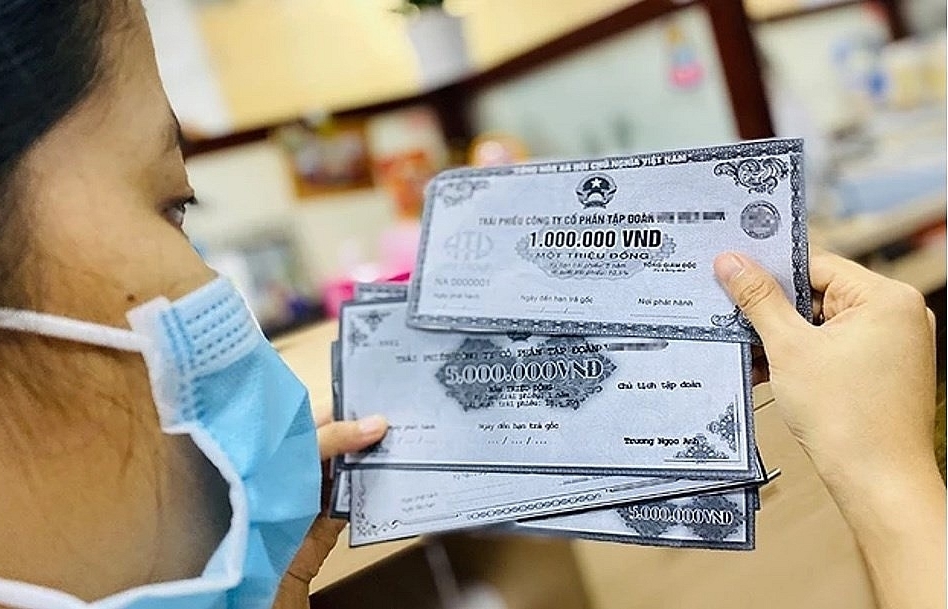

The corporate bond market continues to face headwinds in the second half of the year with billions of US dollars of bonds due this year. (Photo: VNA)

The corporate bond market will continue to face headwinds in the second half of the year, experts said.

Nguyen Ba Khuong, an analyst at stock brokerage VNDirect, has warned that a significant amount of corporate bonds are set to mature this year, leading to financial constraints for issuers and potential difficulties in meeting bond redemption obligations.

According to VNDirect, around 273 trillion VND (11.57 billion USD) worth of corporate bonds will be maturing this year, with the majority coming due in the last two quarters.

Many issuers, particularly property developers, have already struggled to meet their bond redemption obligations, which has eroded investor confidence in the market.

While more than 42 trillion VND worth of corporate bonds were rolled over in the second quarter, providing a short-term solution, this does not address the fundamental issues at hand, experts noted.

A decree issued in March allows issuers to roll over bond maturities by up to two years if investors agree. However, if investors do not agree, businesses must fulfill their bond redemption obligations.

Issuers also have the option to negotiate with bondholders to repay with other assets.

Transparency and disclosure key to restoring credibility

To restore credibility in the market, experts emphasised the need for a comprehensive approach. Transparency and disclosure are key factors in rebuilding trust, they said.

Companies issuing bonds must provide clear and comprehensive information about their financial health, business operations, and risk factors. This allows investors to assess the creditworthiness of the issuers and make informed decisions.

In addition, regulatory oversight and enforcement need to be strengthened.

Regulatory bodies should establish stringent guidelines for issuers, underwriters, and rating agencies, and ensure compliance with relevant regulations.

Any attempts to manipulate or misrepresent information should be met with severe penalties and legal consequences.

It’s also important to develop a well-functioning secondary market for corporate bonds, which would facilitate efficient bond-pricing mechanisms, providing investors with liquidity and enabling them to enter or exit positions as needed.

Enhancing investors' awareness of the fundamentals of bond investing, including credit risk, interest rate risk, and market liquidity, is also crucial.

Experts have proposed settling the various scandals involving bond issuances by major property developers and protecting investors as soon as possible to free up the frozen market.

The Ministry of Finance recently established a trading platform for privately placed corporate bonds (PPB).

Minister of Finance Ho Duc Phoc said the launch of the trading platform would give fresh impetus to the market, improve liquidity, and provide companies better access to capital.

He, however, pointed out that there is still a lot of work to do to build a fully-fledged market that is attractive to global investors.

Economist Dinh The Hien said the trading platform allows bond issuers to service their bonds that are coming due, and provides companies with good financial records better access to capital.

The corporate bond market experienced significant growth in 2020 and 2021, driven by increased capital demand from property developers and banks.

However, the collapse of the property market and the recent investigations into bond issuance and improper capital use by large firms have contributed to the current problems faced by the market.

The Government has established three committees to carry out reforms in liquidity and currency, the property market and corporate bonds.

Prime Minister Pham Minh Chinh has also instructed credit institutions to reduce costs to lower loan interest rates for businesses and support economic recovery./.

Related News

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

The corporate bond market will be more vibrant in the second half of the year

08:20 | 23/07/2024 Finance

The corporate bond market will enter new period of development

08:44 | 03/03/2024 Finance

Corporate bond market is expected to prosper soon

10:59 | 10/01/2024 Finance

Latest News

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

More News

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Your care

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance