Corporate bond market sees positive signs

| Payment of bonds by "barter agreement": is it difficult or easy? | |

| Corporate bonds worth 1.1 billion USD issued in March | |

| Handling bonded debt by real estate will speed up the settlement of bad debt |

|

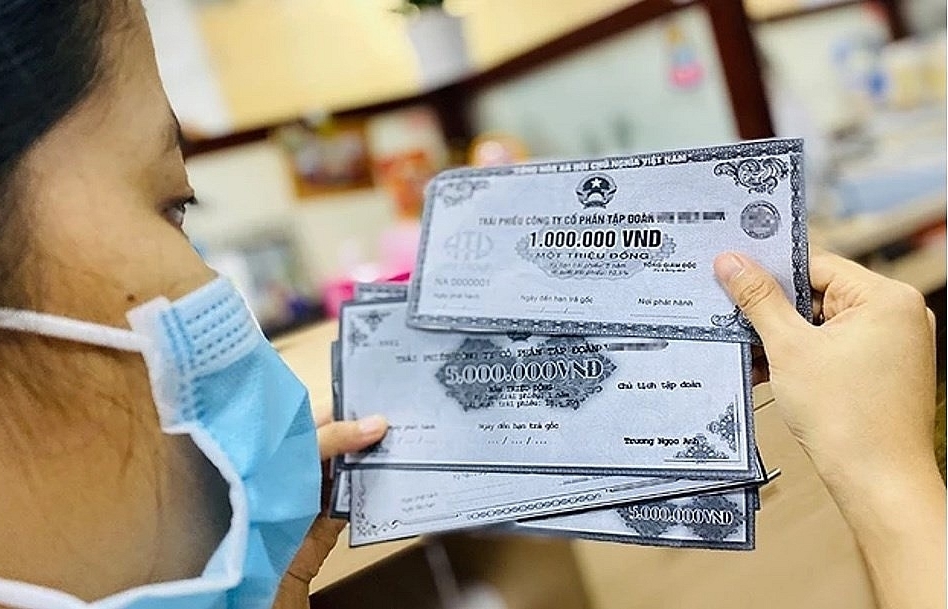

| The corporate bond market showed more positive signs after Decree 08/2023/ND-CP was issued. Photo: Internet |

The volume of placed bonds skyrockets after Decree 08 was issued

The placement of corporate bonds showed signs of recovery after Decree 08 was issued. According to the Vietnam Bond Market Association (VBMA) collected data from the Hanoi Stock Exchange (HNX) and the State Securities Commission of Vietnam (SSC), there were 11 placements of corporate bonds worth over VND26.42 trillion in March 2023.

A new private placement was announced in the last week of March with an issuance volume of VND600 billion by BAF Vietnam Agriculture Joint Stock Company.

These were 7-year-convertible bonds, without warrants and collateral, with an interest rate of 5.25 %/year. This is a positive figure compared with the only placement in January.

Data from the Ministry of Finance clarifies corporate bond issuance after Decree 08 was issued. Accordingly, a corporate bond worth VND 24,708 billion was issued in the first quarter, including the volume of corporate bonds valued at VND23,825 billion issued from March 6 when Decree 08 took effect, equivalent to 96% by volume. The average interest rate and issuance term are 7.75 %/year and 2.37 years. The real estate sector issued 98.2% of the corporate bond volume, and customers were mainly institutional investors, 99.99%, and banks accounted for 77%.

According to VNDIRECT Securities Company (VNDIRECT), in the first quarter of 2023, the primary corporate bond market had 14 placements. As a result, the total value of issued bonds reached over VND28.335 billion, up 59% compared to the fourth quarter of 2022 and down more than 60% year-on-year. According to VNDIRECT, all large private placements were implemented after Decree 08 was issued.

Masan Group issued the largest volume of 5-year corporate bonds in the first quarter with a total value of VND3,500 billion and floating interest rates. According to the VNDIRECT's experts, after Decree 08 was issued, the private placement showed a recovery when 9 out of 11 placements in the quarter were implemented. The total value of these 9 placements accounted for more than 97% of the total private placement value at the beginning of the year.

VNDIRECT's experts recommended that the large private placements in the quarter were all of the little-known enterprises; information about these enterprises is also very limited, even some companies have been established less than one year. "In the context that individual investors' confidence has not returned, the distribution rate of these bonds for individual investors is limited, buyers are mainly institutions, so these placements aim to restructure the internal debt of one or a few large organizations," said VNDIRECT's expert.

Regarding early redemption, according to VBMA's data compiled from HNX, the total value of bonds bought back before maturity in March 2023 was nearly VND14.3 trillion, up 137% month-on-month and 64% year-on-year. Construction and consumer goods are the two commodity groups that recorded the largest acquisition value in the month, reaching VND5 trillion (accounting for 35% of total acquisition value) and VND3.4 trillion (accounting for 24% of total acquisition value), respectively. Since the beginning of the year, the total value of bonds bought back by businesses has hit more than VND29.86 trillion (up 63% over the same period in 2022).

More drastic solutions need to be provided

Commenting on the corporate bond market prospect, the experts said that motivated by the loosening of regulations for the placement of Decree 08, shortly, there may be the issuance of the private placement of corporate bonds for restructuring internal debt as well the issuance of some enterprises at the end of March. However, to recover the market sustainably, it is necessary to have other comprehensive solutions to restore investor confidence and solve the market's illiquidity. Therefore, more drastic solutions need to be provided by businesses to strengthen investors' confidence in corporate bonds.

Real estate businesses should make great efforts to restructure their products to meet the market's real needs and take measures to handle inventory to get money to solve current difficulties in cash flow. In addition, the management agencies should speed up the settlement of legal procedures for real estate projects.

On the other hand, regulators should consider loosening conditions to allow large financial institutions such as banks to participate more deeply in the corporate bond market to create liquidity in the market and allow them to develop payment guarantees to restore investors' confidence gradually.

In addition, similar to the experience learned from handling the corporate bond crisis in regional countries such as Korea and China, the support for businesses to access capital, especially credit capital, to solve the short-term liquidity is very important", recommended by VNDIRECT's experts. However, the corporate bond market still awaits more positive signals from these solution groups.

The experts also said that the allowance of suspension of regulations on mandatory credit ratings and professional investors as per Decree 08 were factors that helped the private placement to recover during this period.

Mr Nguyen Hoang Duong, Deputy Director of the Department of Finance, Banking and Financial Institutions (Ministry of Finance), facing difficulties in cash flow after cases related to corporate bonds, and fluctuations in the international financial market, the Ministry of Finance has submitted to the Government to postpone the regulation on identification for professional investors until December 31, 2023, to help investors have more time to meet this regulation.

In addition, the Ministry of Finance reported to the Government to make a plan to control the market. Accordingly, the ministry has directed enforcement agencies to strengthen the management and supervision of the placement of corporate bonds and regularly give recommendations to issuers and services suppliers to comply with the law on consulting. Furthermore, the Ministry of Finance regularly recommends that individual investors assess risks when making investment decisions.

Related News

Significant changes ahead in the management of processing, export production, and export processing enterprises

13:47 | 28/11/2024 Customs

Over 300 Southern enterprises attend workshop to provide feedback to the General Department of Vietnam Customs

10:50 | 23/11/2024 Customs

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

The corporate bond market will be more vibrant in the second half of the year

08:20 | 23/07/2024 Finance

Latest News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

More News

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Your care

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance