Changing channels and preventing illegal goods at border gates

|

| Imported used slot machines are detected from channel change. Photo: L.T |

Declaring false information for exemption from inspection

On August 27, at Cat Lai port, the Import and Export Procedure Unit under Sai Gon port zone 1 Customs Department worked with the Southern Anti-smuggling Enforcement Unit (Unit 3) under the Anti-smuggling and Investigation Department, General Department of Customs to inspect an imported shipment from Australia to Vietnam by Sun World Logistics Co., Ltd., and discovered slot machines.

According to the customs declaration, the company said the imported shipment was MDF tables, which was classified into Yellow channel for dossier examination. Detecting suspicious signs, the Saigon port area 1 Customs Branch changed the channel and coordinated with Unit 3 to inspect the shipment. As a result, the container did not have working tables as declared but 37 used slot machines subject to list of goods banned from import.

According to Customs officers, companies deliberately misrepresented the name of the goods to be classified into Green or Yellow channels by the risk management system to be free from physical inspection. However, with a lot of management tools, as well as experience, through the study of import documents, the Customs agency saw suspicion in these shipments, so Customs agency changed channels to inspect and found illegal and prohibited goods.

Remarkably, there were shipments involved in tax fraud of billions of VND. Recently, in early August, through the control and information collection, Customs Supervision and Control Unit under Saigon port zone 1 Customs Branch detected and prevented an imported shipment involved in tax fraud of VND 1.3 billion. This shipment belonged to Tran Linh Trading and Services Co., Ltd and was declared as LED screen, Yestech brand, resolution of P4.8, used for data processing system, size 500x 500 mm, originated from China and subject to 0 percent import tax rate and 10 percent VAT. The company declared tax for the whole shipment was over VND 860 million. The shipment was classified into the Green channel.

When changing channel for physical inspection, the Customs Supervision and Control Unit and the Import and Export Procedure Unit under Saigon port area 1 Customs Branch detected all goods were display screens composed of many LEDs and ICs for outdoor use, this item has commodity code 82585910, corresponding to 12 percent import tax rate and 10 percent VAT. With these taxes, the total tax amount the company has to pay is nearly VND 2.2 billion. Thus, with the wrong declaration of codes, Tran Linh Trade and Services Co., Ltd. had a tax deficit of nearly VND 1.3 billion, equivalent to the value of the shipment of over VND 9 billion.

Tax fraud from exports

Recently, Customs agencies have discovered many suspect export shipments, so they changed channels to inspect and detected tax fraud of hundreds millions of VND.

On August 20, at Cat Lai port, the Southern Anti-smuggling Enforcement Unit (Unit 3) collaborated with Customs Information Collection and Analysis Division (Division 2), Online Supervision Division (Division 3) under the Anti-Smuggling and Investigation Department, General Department of Customs and Saigon port area 1 Customs Branch to inspect and discover five containers of exported goods with false customs declarations for tax fraud.

According to the case file, Duc Minh Import Export and Development Co., Ltd. (address: No. 297, Phuc Diem Street, Xuan Phuong Ward, Nam Tu Liem District, Hanoi) opened a customs export declaration of terracotta products, 100 percent new subject to 0 percent export tax rate and Green channel. Identifying suspicious signs, the customs agency invited the company to the customs office, but the company did not come. Inspecting the shipment, the customs agency found the five containers contained waste cans of beer and soft drinks, made into moulds and balls subject to 25 percent export tax rate. It is estimated that amount of tax fraud reaches hundreds of millions of VND.

Earlier, on April 17, Tin Tao Thanh Nghiep Co., Ltd registered a customs declaration at Saigon port area 4 Customs Branch to export horizontal and vertical laminated rubber timbers, which have been smoothed and dried used for pillars of stairs, tables, chairs, 100 percent new and subject to 0 percent export tax rate. The shipment was classified into Yellow channel. Through checking the customs dossier, Customs officers of the Import and Export Procedures Unit under Sai Gon port zone 4 Customs Branch discovered the suspicion, so proposed the Branch’s leaders change the channel for physical inspection. Accordingly, the unit found the export shipment was longitudinal lumber (suspected to be rubber wood), which has been smoothed with a thickness of over 40mm, subject to 25 percent export tax rate (other than 0 percent tax rate as declared by the company). Thus, Tin Tao Thanh Nghiep Trading & Service Co., Ltd misrepresented name, category, volume, commodity code, tax rate resulting in a lack of tax payable of 111 million VND.

| Extend clearance time at Kim Thanh international border gate VCN - Prime Minister Nguyen Xuan Phuc agreed to implement the pilot of extending clearance time from ... |

According to the Ho Chi Minh City Customs Department, some companies have taken advantage of the risk management mechanism to intentionally mislead names, categories, volumes, values, commodity codes and tax rates for tax fraud and evasion.

Related News

Goods trading, being seen from Lang Son border gate

13:45 | 28/11/2024 Customs

7 key export groups bring in US$234.5 billion

13:54 | 28/11/2024 Import-Export

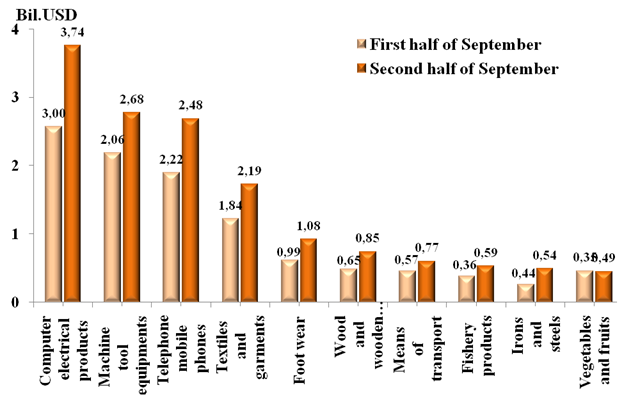

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Latest News

Drug trafficking ring busted: Synthetic drugs concealed in pickled bamboo containers

15:50 | 26/12/2024 Anti-Smuggling

High-risk of foreigners colluding with drug traffickers to produce drugs in Vietnam

11:08 | 26/12/2024 Anti-Smuggling

Exposing methods of hiding drugs and contraband goods through Cha Lo international border gate

09:00 | 24/12/2024 Anti-Smuggling

Prevent counterfeit goods on e-commerce platforms

13:54 | 22/12/2024 Anti-Smuggling

More News

Customs sector strengthens anti-smuggling for e-commerce products

19:09 | 21/12/2024 Anti-Smuggling

At the end of the year, there is concern of counterfeit and smuggled goods entering into Ho Chi Minh City

09:31 | 20/12/2024 Anti-Smuggling

Rise in e-commerce violations sparks concern

09:31 | 20/12/2024 Anti-Smuggling

Lang Son intensifies crackdown on smuggling and trade fraud

15:19 | 19/12/2024 Anti-Smuggling

Numerous FDI enterprises face suspension of customs procedures due to tax debt

09:57 | 18/12/2024 Anti-Smuggling

Concerns over counterfeit goods in e-commerce and express delivery

10:00 | 17/12/2024 Anti-Smuggling

Illegal transport of currency and gold tends to increase near Lunar New Year

19:29 | 14/12/2024 Anti-Smuggling

Smuggling forecast for the Lunar New Year 2025 will be complicated

10:24 | 13/12/2024 Anti-Smuggling

Tax authorities crack down on invoice fraud to legalize smuggled goods

09:41 | 12/12/2024 Anti-Smuggling

Your care

Drug trafficking ring busted: Synthetic drugs concealed in pickled bamboo containers

15:50 | 26/12/2024 Anti-Smuggling

High-risk of foreigners colluding with drug traffickers to produce drugs in Vietnam

11:08 | 26/12/2024 Anti-Smuggling

Exposing methods of hiding drugs and contraband goods through Cha Lo international border gate

09:00 | 24/12/2024 Anti-Smuggling

Prevent counterfeit goods on e-commerce platforms

13:54 | 22/12/2024 Anti-Smuggling

Customs sector strengthens anti-smuggling for e-commerce products

19:09 | 21/12/2024 Anti-Smuggling