Before the FED raises interest rates, the exchange rate is under great pressure

|

| The management agency is facing the problem of interest rate balance and exchange rate stability. Source: Internet. |

The domestic exchange rate continues to be tense

In the trading session on September 21, the State Bank of Vietnam (SBV) announced the central exchange rate between VND and USD at 23,301 VND/USD, unchanged from the previous session. But this rate has increased continuously, with an increase of up to 57 VND since the session on September 13.

Therefore, the foreign currency exchange rate at commercial banks is also high, increasing to nearly 100 VND in both directions compared to the first sessions of September. Specifically, the USD price at Vietcombank is 23,380-23,690 VND/USD; at BIDV is 23,390-23,670 VND/USD, Eximbank is 23,550-23,790 VND/USD (buy in - sell out).

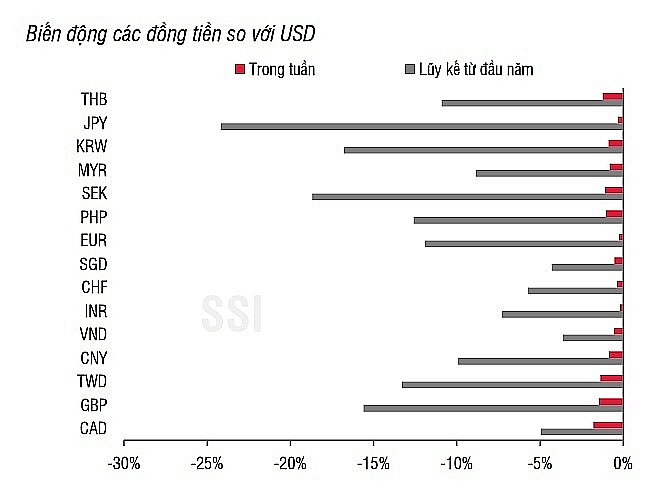

The strong increase in the domestic exchange rate came from developments in the international market. Currently, the USD Index has risen to 110.26 points, the highest increase since January 2002. While other major currencies all depreciated against USD such as British Pound (GBP) -1.46%; EURO -0.26%, Japanese Yen (JPY) -0.32%. The currencies of countries in the region also fell sharply such as New Taiwan Dollar (TWD) -1.37%, Thai Baht (THB) -1.24%, Philippine Peso (PHP) -1.03%, Malaysian Ringgit (MYR) - 0.83%.

According to experts, the foreign currency market fluctuates strongly because it is almost certain that the FED will decide to raise interest rates by 0.75% to control inflation, which is continuing to rise sharply in the US. The FED's interest rate hike is expected to cause further tension in the domestic exchange rate and may cause the SBV to increase the selling price of USD. Previously, on September 7, 2022, the USD selling price of the SBV's Transaction Office increased by 300 VND, to 23,700 VND/USD.

This shows that the pressure on the exchange rate is very intense from now until the end of the year. An economist said that since the beginning of the year, the exchange rate has increased by 3-4%, and if not careful, the VND will depreciate higher due to the loosening monetary policy of the FED and major central banks.

Moreover, the current deficit may continue, export growth will slow down, the financial balance will no longer have a surplus due to foreign investors' continuous net selling on the stock market, and the foreign exchange source has been somewhat "thinned".

Because it is estimated that from the beginning of the year until now, the State Bank has had to sell US$21 billion to increase liquidity to help stabilize the exchange rate.

|

| Movements of some currencies in the world. Source: SSI |

Devaluation of VND to support exports, only FDI enterprises will benefit

In this regard, Mr. Hoang Van Cuong, Vice President of National Economics University, said that the move of the FED will affect the money markets, including the VND. However, Vietnam has the advantage of being a multilateral export market, with good foreign currency reserves. In previous FED rate hikes, the SBV managed to keep the exchange rate flexible and stable.

Similarly, experts of SSI Securities Company also said that the volatility is still under control when the SBV has adjusted the selling price on the SBV's Exchange. At the end of the year, SSI expects the supply of foreign currency to be more positive due to seasonal factors, coming from import-export activities and remittances.

“In 2022, the pressure on the exchange rate will remain, but it is possible that the situation will ease at the end of the year when the FED's interest rate hike may come to an end and the economy's growth/inflation risks the world can be seen more clearly,” said SSI experts.

However, many suggest that the State Bank may increase the operating interest rate, because, in order to control inflation and keep the exchange rate, it is imperative to raise interest rates. But obviously, the interest rate problem in this context is very difficult if the economy is to recover after Covid-19.

Dr. Vu Dinh Anh, former deputy director of the Institute for Market and Price Research (Ministry of Finance), said that if the VND devaluation is to support exports, FDI enterprises will benefit due to their import and export proportions. FDI is quite balanced, while domestic enterprises suffer because most of the goods are imported. But if interest rates increase, domestic enterprises will also be severely affected because the main source of capital is bank loans. Therefore, the governing body must both stabilize the exchange rate and keep the interest rate level.

With such impacts, experts say, Vietnam must consistently keep the exchange rate but still be flexible with the market, and at the same time, it needs to operate monetary policy in sync with fiscal policy to control inflation, maintain macroeconomic stability, and promote reasonable imports and exports.

Related News

Numerous FDI enterprises face suspension of customs procedures due to tax debt

09:57 | 18/12/2024 Anti-Smuggling

The wood industry seizes opportunities amid changes in the export market

11:22 | 16/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export

Seafood exports increase competitiveness through quality

10:24 | 09/12/2024 Import-Export

Latest News

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

More News

Binh Dinh province works to attract investment from Japan

15:44 | 19/12/2024 Import-Export

Agricultural, forestry and fishery exports “reach the target” early

15:20 | 19/12/2024 Import-Export

Thailand remains Vietnam’s biggest trading partner in ASEAN

15:35 | 18/12/2024 Import-Export

Rubber value soars in 2024: VRA

15:33 | 18/12/2024 Import-Export

Vietnamese businesses struggle to access green finance

09:58 | 18/12/2024 Import-Export

E-commerce: a gateway to boost Vietnamese commodities in the UK market

16:55 | 17/12/2024 Import-Export

Agro-forestry-fisheries exports top 62 billion USD in 2024

16:51 | 17/12/2024 Import-Export

Removing “bottlenecks” for digital transformation in industrial production

10:00 | 17/12/2024 Import-Export

UKVFTA facilitates Việt Nam's tuna exports to UK market

13:56 | 16/12/2024 Import-Export

Your care

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export