Banks' bad debt reserve buffers continue to thin

| Another six months for debt restructuring but need to manage bad debt risks | |

| Bad debts kept rising in five months |

|

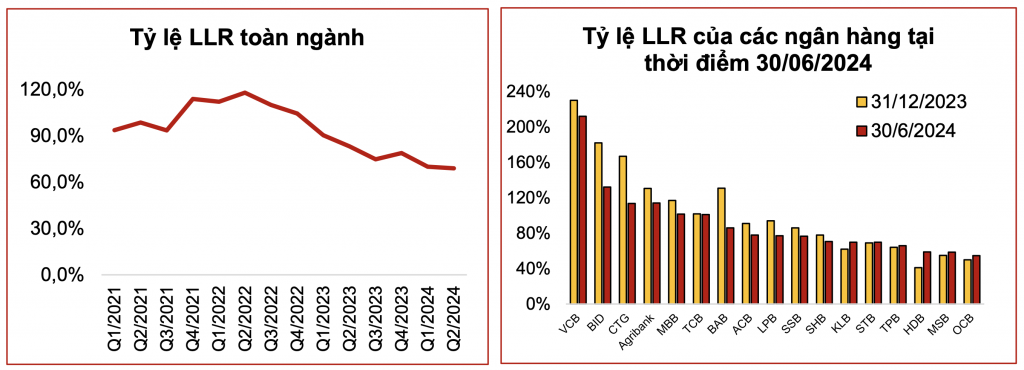

| The loan loss reserveso n bad debts (LLR) of the entire industry and some banks in the first 6 months of 2024 tends to decrease. Source: Agriseco |

24 of 29 banks increase bad debt ratio

Financial reports for the second quarter and the first six months of 2024 banks show that 24 of 29 banks recorded an increase in the ratio of bad debt per total outstanding debt compared to the end of 2023, pushing up the absolute bad debt balance of the banks increased by more than 20 percent compared to the end of last year.

Among them, BacABank is the bank that recorded the largest increase in bad debt in the system, increasing to 65.4 percent after just 6 months, reaching VND1,513 billion at the end of June. Accordingly, the ratio of bad debt to total outstanding loans increased 0.92 percent to 1.48 percent.

At VietABank, by the end of June 2024, total bad debt was VND1,675 billion, an increase of 52 percent compared to VND1,100 billion at the end of 2023. Notably, group 4 debt (doubtful debt) increased 11 times compared to the figure of VND22 billion by the end of last year. This pushed the bad debt ratio on VietABank's total outstanding loans from 1.6 percent to 2.3 percent.

In terms of absolute balance, VPBank is leading with total bad debt reaching VND31,712 billion at the end of the second quarter of 2024, an increase of 11.6 percent compared to the end of last year. VPBank's bad debt ratio on total outstanding debt continues to be above 5 percent, second only to NCB when this bank has a high bad debt ratio at two digits.

Along with that, compared to the end of last year, many banks have increased the ratio of bad debt to outstanding loans to over 3 percent such as MSB increased from 2.87 percent to 3.08 percent, OCB increased from 2.65 percent to 3.12 percent, ABBank increased from 2.91 percent to 3.6 percent, VietBank from 2.56 percent to 3.4 percent...

Bad debt is not only increasing in small and mid-range banks, in state-owned "big companies", bad debt is also increasing in both balance and ratio.

According to the financial report for the second quarter of 2024, as of June 30, Vietcombank's total bad debt is nearly VND16,446 billion, increased by 32 percent compared to the beginning of the year. Of which, potentially lossable debt increased by 27.7 percent, to VND10,017 billion, pushing the bad debt ratio to 1.2 percent of total outstanding debt.

VietinBank also recorded a 185 percent increase in group 4 bad debt compared to the beginning of the year. The bad debt ratio is currently at 1.6 percent of total outstanding loans.

BIDV has a total bad debt of VND28,687 billion, an increase of 28 percent compared to the beginning of the year; bad debt ratio increased from 1.26 percent to 1.52 percent.

According to a report by Agribank Securities Company (Agriseco), asset quality is differentiated between banks. Accordingly, the banking group with good asset quality will record bad debt and restructured debt controlled at a moderate level. Banking groups with a high proportion of corporate credit (including corporate bonds) and low bad debt coverage ratio may face bad debt risks and increased provisioning pressure in 2024- 2025.

The backup buffer continues to thin

According to FiinGroup's report, bad debt increased while provision costs remained moderate (thanks to the extension of Circular 02 on debt structure and extension of the State Bank), causing the provision buffer to continue to thin, limiting the ability to handle debt in the near future. The bad debt coverage ratio of the 27 surveyed banks decreased to 81.5 percent in the second quarter of 2024, the lowest level since Covid-19 pandemic and quite far from the peak (143.2 percent) in the third quarter 2022.

Calculation from banks' financial statements shows that currently there are only 6 banks with bad debt provisioning ratio above 100 percent such as Vietcombank (212 percent), BIDV (132 percent), Agribank (116 percent), MB (102 percent), Techcombank (101 percent).

At Vietcombank, despite having the highest level of bad debt coverage in the banking system, the level of credit risk provisioning in the first 6 months of the year decreased by 33 percent compared to the end of last year, from VND4,557 billion to VND3,021 billion.

Besides, there are some banks with reserve ratios from 50 percent to less than 100 percent such as: BacABank (86 percent); LPBank and SeABank are both at 77 percent; ACB (76 percent); SHB (71 percent); TPBank (66 percent); HDBank and MSB are both 59 percent...

Notably, many banks have a bad debt provision ratio below 50 percent even though the bad debt ratio is high, some banks even have a coverage ratio of only 5 percent. Furthermore, although some banks have increased their provisioning ratio, the increase is not commensurate with the increase in bad debt. For example, at VPBank, total bad debt on total loan balance is currently increasing by 11 percent but the increase in provisions is only over 9.3 percent, leading to a low bad debt coverage level of about 48 percent.

Profit results are being affected by slow credit growth, reduced profit margins, and non-credit business segments such as foreign exchange, insurance, securities, etc. are facing many difficulties. Therefore, many banks have to reduce risk provisions to "beautify" profit figures. Meanwhile, debt recovery and settlement are increasingly difficult in the context that the Resolution 42/2017/QH14 on pilot bad debt handling of the National Assembly has expired. Therefore, there is not a strong enough mechanism for debt recovery, business activities of enterprises still suffer many negative impacts, the real estate market is still not sustainable... while the Circular 02/2023/TT-NHNN on debt structure will expire at the end of 2024.

Therefore, experts believe that bad debt is an issue that banks must pay attention anhd strive to increase reserve buffers to avoid affecting the asset quality of banks in particular and the entire system in general.

| According to data from the State Bank, as of the end of May 2024, the bad debt ratio on the balance sheet of banks was at 4.94 percent, higher than 4.55 percent at the end of 2023. The bad debt ratio, including potential and restructured debt, has not changed much compared to the end of 2023, remaining at 6.9 percent. |

Related News

Hai Phong Customs’ revenue rises about VND 1,000 billion

14:52 | 14/02/2025 Customs

Import and export turnover reaches about US$29 billion in the second half of January 2025

14:52 | 14/02/2025 Import-Export

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Minister of Finance Nguyen Van Thang works with GDVC at the first working day after the Tet holiday

14:43 | 04/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance