Attracting FDI in the midst of Vietnam's 4th Covid-19 outbreak

|

| Dr. Le Xuan Sang, Deputy Director of the Vietnam Institute of Economics |

How has the 4th outbreak of Covid-19 in Vietnam since the end of April 2021 until now affected the attraction of FDI?

The results of attracting FDI amid the 4th outbreak in Vietnam have new characteristics, with advantages and disadvantages compared to the previous one. Favorable factors come from both outside and inside the country. For foreigners, in general, from May 2021, the economic situation and developments of the Covid-19 pandemic in Vietnam's investment partner countries (especially China, the US, the EU, Japan and South Korea) have improved.

In addition, the deeper and broader implementation of new-generation Free Trade Agreements such as EVFTA and CPTPP also promotes trade and investment demand between Vietnam and member countries.

Another advantage is that recently (May 2021) Vietnam is the only country in the world that has been upgraded by the world's leading credit rating agencies such as S&P, Fitch, and Moody's from Prospect to Positive since the outbreak of the Covid-19 pandemic.

In particular, the fact that the US Department of Finance has confirmed that Vietnam is not a currency manipulator and together with the State Bank of Vietnam announced a general agreement that the US will not impose rigid taxes on Vietnam and the SBV will allow prices to the value of the Vietnamese dong increases in line with Vietnam's strong economic foundation.

These are factors that increase the position and attractiveness of investment in Vietnam in the immediate future.

However, the adverse factors for attracting and implementing FDI projects are still quite large, especially the pandemic has become more severe and difficult to control. The restriction on movement makes it difficult for FDI enterprises to directly research markets and businesses, greatly hindering their ability to make investment decisions.

Moreover, on a regional and global scale, the serious infection of Covid-19 with no sign of being controlled in Vietnam has sharply reduced or even gradually lost its attractive advantages. FDI was created before - when Vietnam was a rare bright spot in pandemic control compared to other competitors.

Registered FDI as of July 20, 2021 decreased by 11.1% over the same period last year. Previously, registered FDI in 6 months decreased by 2.6%, in your opinion, will this trend continue?

The result of attracting FDI depends on many factors. If Vietnam can basically control the pandemic in a sustainable way and get a super large project, the total value of registered FDI can still increase.

However, in terms of both value and quantity, projects and if there is no mutation factor (super-project), FDI is unlikely to increase sharply in the remaining half of the year, or even decrease.

Furthermore, uncertainty remains high regarding the current Covid-19 variant (Delta) and the risk of new variant strains (e.g. Lambda), while the proportion of people vaccinated in the country is still relatively low.

In short, it is difficult to confirm with certainty the value of registered FDI in the rest of 2021.

Covid-19 has not been controlled, many provinces and cities are still implementing social distancing, will it affect FDI attraction in the near future?

The spread of the pandemic and tightening of the social distancing will affect investment decisions and FDI registration in Vietnam. Looking at the whole Asian region in the first quarter of 2021 and earlier, when the pandemic is basically under control, Vietnam continued to be an attractive investment choice in the region, especially when it comes to other areas.

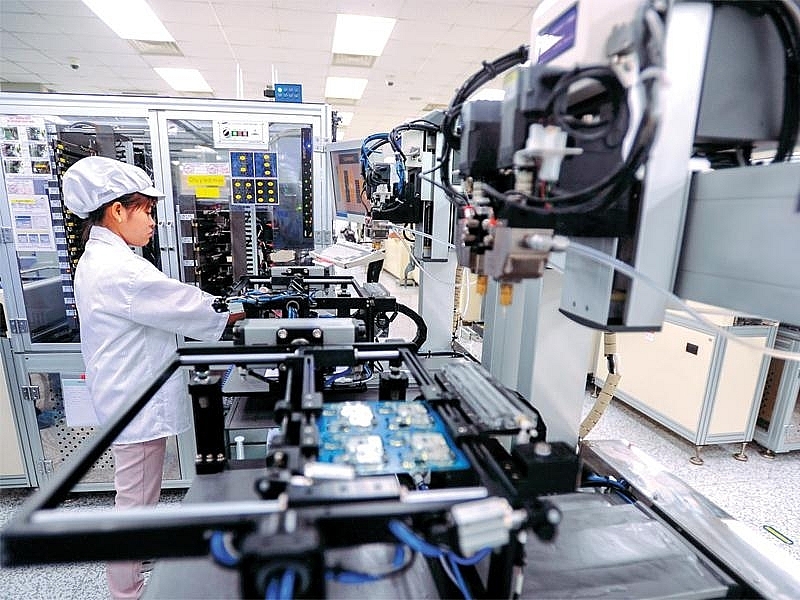

Capital flows "evacuate" from China, or "avoid" China due to the impacts of the US-China trade war, the strategy of diversifying risks (economic, political) and the South of East Asian countries (especially Japan, Korea and Taiwan), thanks to Vietnam's status as a "winner" in the Covid-19 pandemic.

Last year's strong increase in trade and investment was partly due to the fact that Samsung Electronics operated with little interruption in Korea and in Vietnam, but faced difficulties in production and investment in India due to the country's economic crisis during the pandemic.

In short, the success of Vietnam in attracting FDI depends a lot on the results of pandemic control.

|

| Disbursed foreign direct investment (FDI) reached US$10.5 billion, up 3.8%, considered a "bright spot" in the FDI picture in the past 7 months. |

There have been concerns that FDI does not enter Vietnam, even enter Vietnam and then move to other countries in the region, what is your opinion?

Whether FDI into Vietnam or withdraw to another country depends on many factors.

Excluding the internal factors of FDI, the domestic factors selected by FDI include the attractiveness/stability of the domestic market, business environment, quality of infrastructure, labor and other factors.

In the past few years, according to the survey results of Citi Group, besides China, Vietnam is one of the few developing countries targeted by FDI companies for investment, along with India and Indonesia.

Vietnam and these two countries have equally attractive business/investment environments.

For example, the ease of doing business index has fluctuated around 70th out of 190 countries in the last few years. Although Vietnam has a smaller population, it has more geo-economic and geopolitical advantages (next to China) as well as new advantages as the only country with a recent national credit rating and the US has dropped its designation as a currency manipulator.

Currently, both countries are also grappling with the pandemic. In general, Vietnam, in terms of potential, has an advantage in attracting FDI compared to the aforementioned competitors, with some aspects even better. Therefore, major concerns as well as large-scale, massive displacement are unlikely.

Increasing FDI in one country or withdrawing to another in the short and medium term depends a lot on the effectiveness of controlling the Covid-19 pandemic as well as efforts to improve the investment and business environment of each country.

Investment displacement, of course, still exists but will be based on FDI calculations on benefits and costs in (re)investment decisions, especially depending on their motivation to invest in a country, because efficiency, market, natural resource acquisition, strategic asset purchase or other purpose.

The pandemic is often seen as a temporary factor, so it is difficult for businesses that have invested in one country to "stop" and go to another country, especially when the business has "sunk" quite a lot and it is uncertain whether in the new market there is sustainable control of the pandemic and other more attractive factors.

In your opinion, what should Vietnam do to increase the efficiency of attracting FDI?

Vietnam has made efforts to attract FDI in recent years. However, in addition to gradually narrowing the traditional FDI attractions, it is also necessary to increase the attraction of 2.0 generation FDI projects, that is, to help bring Vietnam into the global value chain, spread more strongly with domestic enterprises, promote green growth, etc.

This requires a new, complex, and more tectonic way of doing things. With the traditional way, investment promotion activities lack the initiative and in the context of competition to attract foreign investment, if this continues, it will be less effective.

Therefore, in addition to increasing resources for FDI attraction/promotion, it is necessary to expand and strengthen other investment methods such as marketing.

The design of mechanisms and policies to attract FDI needs to take into account more than the commitments in the new generation FTAs, especially related to the origin of FDI, activities of FDI, market expansion, business development, etc.

The policy of attracting "FDI eagles to nest" is important, however, attracting the eagles goes hand in hand with encouraging to "create bait" for domestic enterprises, instead of for FDI.

It should be noted that attracting quality, new generation FDI can reduce the amount of FDI attracted in the initial stage. The results of FDI attraction in the first seven months of 2021 show that the implementation of Vietnam's selective investment attraction policy is a reason for the decrease in FDI capital. This is a fact that needs attention.

Related News

Enterprises focus on Tet care for employees

18:59 | 22/12/2024 Headlines

Numerous FDI enterprises face suspension of customs procedures due to tax debt

09:57 | 18/12/2024 Anti-Smuggling

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Latest News

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

More News

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export

Exporters urged to actively prepare for trade defence investigation risks when exporting to the UK

14:57 | 25/12/2024 Import-Export

Electronic imports exceed $100 billion

14:55 | 25/12/2024 Import-Export

Forestry exports set a record of $17.3 billion

14:49 | 25/12/2024 Import-Export

Hanoi: Maximum support for affiliating production and sustainable consumption of agricultural products

09:43 | 25/12/2024 Import-Export

Việt Nam boosts supporting industries with development programmes

13:56 | 24/12/2024 Import-Export

VN's wood industry sees chances and challenges from US new trade policies

13:54 | 24/12/2024 Import-Export

Vietnam's fruit, vegetable exports reach new milestone, topping 7 billion USD

13:49 | 24/12/2024 Import-Export

Aquatic exports hit 10 billion USD

13:45 | 24/12/2024 Import-Export

Your care

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export