Viet Capital may list in 3rd quarter

|

HSC said VCSC did not provide details on pricing, but the valuation of the listing may be US$200 million, making VCSC one of the three largest listed brokerage firms, along with Sai Gon Securities Inc (SSI) and HSC.

SSI has a current market capitalisation of VND10.4 trillion, while HSC has a market capitalisation of VND4 trillion.

“The main reason for the initial public offering (IPO) appears to be an attempt to make it easier for the company to raise new equity going forward,” HSC said.

Vietnam News contacted VCSC for comment on the listing plan. The broker neither confirmed nor denied it, saying the plan is confidential and information will be published in the near future.

According to HSC, VCSC is the third-largest securities company competing for leadership in the institutional and investment banking segments though “its retail business lags well behind SSI and HSC.”

But the HCM City-based broker has “a strong perigree” in terms of services for institutional customers and important investment banking deals.

In 2016, VCSC’s market share was 8.86 percent compared to 13.7 percent for SSI and 12.45 percent for HSC.

VCSC was the advisor for the sales of the retail chain operator Big C and the placements of Vietjet Aviation Joint Stock Company.

VCSC is said to “be advising on an upcoming IPO by Vietnam National Oil and Gas Group’s PV Oil unit along with other planned listings, such as Sài Gòn Trading Group (Satra) and CII Engineering and Construction JSC,” HSC said.

In 2016, VCSC had a net profit after tax and minority interests of 335 billion VND, a year-on-year increase of 41 percent from 2015’s figure.

The figure was driven by a rise of brokerage revenues of VND335 billion (a yearly rise of 6.5 percent), a net proprietary trading revenue of VND266 billion (a yearly increase of 82 percent), and an advisory income of VND83 billion (an annual jump of 92 percent).

However, the company’s total earnings were offset by a lower margin lending revenue of VND158 billion, which fell 1.8 percent from 2015 to an ending margin balance of 1.39 trillion VND.

Related News

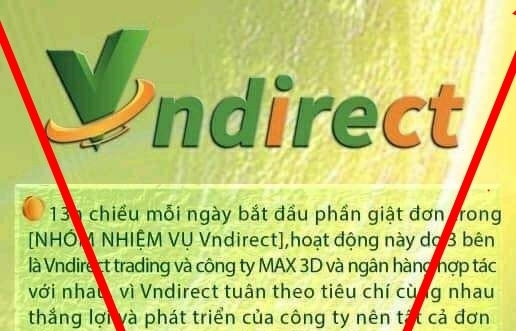

Many "tricks" employed to impersonate securities company

13:13 | 24/09/2021 Finance

Latest News

Banks strengthen information security systems

14:55 | 03/05/2024 Finance

“Opportune environment” for growth of insurance enterprises

10:15 | 03/05/2024 Finance

Closely monitoring fluctuations to calculate the appropriate time to adjust prices

15:35 | 02/05/2024 Finance

Strictly monitor market fluctuations to appropriately adjust prices

14:46 | 27/04/2024 Finance

More News

Closely monitoring market fluctuations to consider appropriate time to adjust prices

09:30 | 26/04/2024 Finance

How does the Land Development Fund work effectively?

09:19 | 26/04/2024 Finance

Vietnam seeks to remove obstacles in upgrade of securities market

13:50 | 25/04/2024 Finance

Price stability from supply increase and transparency in trading in gold market

09:42 | 25/04/2024 Finance

SBV takes more actions to stabilise foreign exchange rates

13:43 | 24/04/2024 Finance

Proposal to exclude criminal liability for tax officials when businesses provide false information to refund VAT

10:35 | 24/04/2024 Finance

Corporate bond maturity in 2024 remains high: MoF

13:51 | 23/04/2024 Finance

Support clearance procedures for imported gold for bidding

09:33 | 23/04/2024 Finance

The exchange rate will gradually cool down from the end of the second quarter of 2024, while interest rates will remain low

09:32 | 23/04/2024 Finance

Your care

Banks strengthen information security systems

14:55 | 03/05/2024 Finance

“Opportune environment” for growth of insurance enterprises

10:15 | 03/05/2024 Finance

Closely monitoring fluctuations to calculate the appropriate time to adjust prices

15:35 | 02/05/2024 Finance

Strictly monitor market fluctuations to appropriately adjust prices

14:46 | 27/04/2024 Finance

Closely monitoring market fluctuations to consider appropriate time to adjust prices

09:30 | 26/04/2024 Finance